Hey Reader! We have a quick GK question for you.

Which is the richest country in the world in terms of per capita income?

Let us guess- Qatar? US? Switzerland?

Sorry to disappoint you!

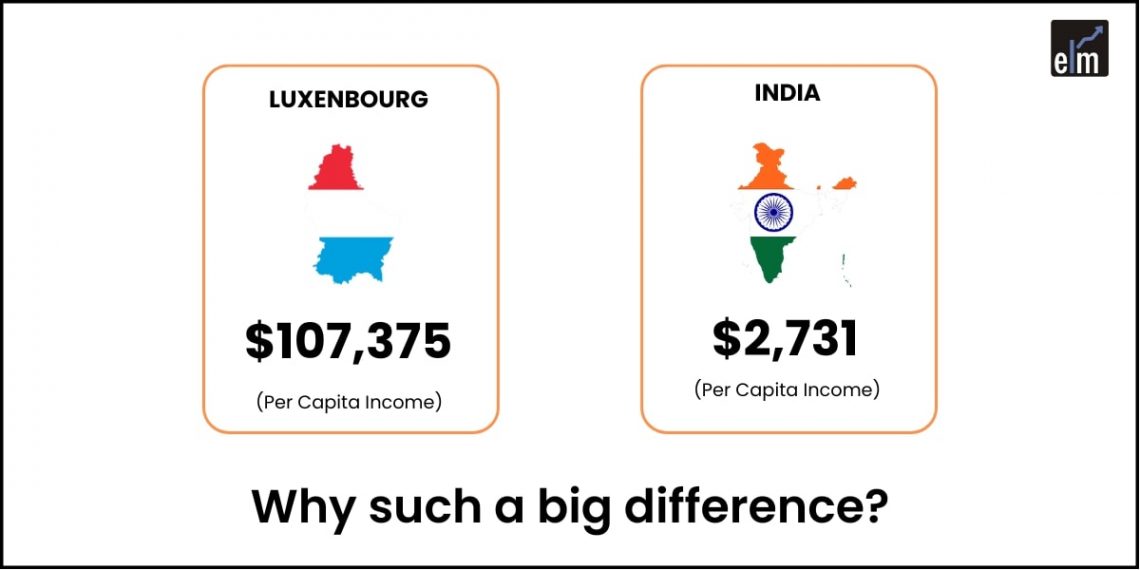

You are not the only one with such answers, as the majority don’t know about a tiny giant in Europe called Luxembourg, a country with a GDP (Gross Domestic Product) of around 85 Billion Dollars, a population of around 8 Lakhs and a GDP per capita projected to hit $107,375 by the end of 2024 compared to India’s estimated $2,731 in 2024.

But how did this happen?

A country that no one has heard of, beating giants like the US and Qatar?

Let’s understand it in detail about this Country With The Highest GDP per Capita –

Was Luxembourg always this rich?

The story of the Grand Duchy of Luxembourg starts in 1815, after Napoleon’s reign, when the leaders met in Vienna. They decided Luxembourg would be part of the Netherlands but with Prussian protection.

Later, Luxembourg became its own country, joining the German Confederation.

Before it, the country was highly dependent on agriculture with almost 75% of the population occupied in farming.

People had a tough and Laborious life.

Joining the Zollverein group (a group of German states that shared customs rules) after independence marked the beginning of a change that would become the most luxurious change in history.

Luxembourg’s industrial revolution kicked off around the middle of the 1800s when it became part of the Zollverein.

From here starts a love story- “Luxenberg and Steel.”

The Country found its Heart

Things started to turn around when steel came into the picture.

The Luxembourg steel industry saw a big change when Minette, a type of low-quality iron, was found in their mines. That’s when this rich love story of Luxembourg and steel began.

Post this, new steel mills were constructed and the early 20th century saw Luxembourg becoming a major steel producer around the world.

Countries in Europe started to purchase steel from Luxembourg instead of Russia or the US as they were comparatively expensive.

With the construction of new railway tracks and support to industries during the Zollverein reign, the steel industry benefited the most.

Occupation saw a shift from agriculture to mining and Industry.

Although this industry faced a lot of new competition, it kept restructuring itself to keep it’s stand upright throughout the time.

But this was not enough in the long term to make it big as mines would empty up in the long run.

So, the government planned to lure big companies and individuals through lucrative tax regimes.

It’s the Tax Haven on the Map

What attracted major companies and high networth individuals was the favorable tax regime here. Major companies jumped in to enjoy minimal taxes and hence generated major revenue for the government.

If we look at the current scenario-

In Luxembourg, companies pay a standard tax rate. If their taxable income is over 200,001 euros, it’s 17%. Below 175,000 euros, it’s 15%.

An SPF, or Private Wealth Management Company has been designed to handle an individual’s wealth.

As a pure holding company, it benefits from tax advantages, such as being exempt from corporate income tax, municipal business tax, wealth tax, and value-added tax.

Companies in Luxembourg also benefit from tax breaks on income from intellectual property and certain development costs.

Highly skilled workers in Luxembourg receive tax benefits, including reduced personal taxes and exemptions for moving expenses.

Companies holding shares in Luxembourg enjoy tax advantages, including reduced taxes on dividends and capital gains.

Startups and Giants loved Luxembourg because of this!

With such benefits, giants like Google and Amazon jumped in to set up their European headquarters in Luxembourg. Facebook, HSBC and other big players are also not behind this “Love Luxenberg club”.

Luxembourg has a unique organization called Luxinnovation which runs a well-known program called Fit 4 Start, which helps chosen startups by providing funding, coaching, and connecting them with experts and mentors.

Various important European bodies like the Court of Justice of the EU, European Investment Bank and European Investment Fund also exist here making it an important point of decision-making in Europe.

World War 2 gave Luxembourg an Advantage

Yes, you heard it right. When the world was bleeding, Luxembourg was getting extensively rich.

Countries like Germany, France and Poland started buying steel from them for the war.

This period saw the mines getting empty and the economy getting wealthy.

With all the revenue, they utilized this period and the country enhanced its medical and banking facilities.

With FDI’s already setting things up and also 150 investment banks hovering around, the country slowly started shifting from their steel dependence.

Because of this, even the empty mines could not affect them.

Rich Rich Rich…it’s fine.. but exactly how much?

Luxembourg’s Ministry of Finance oversees a budget of about 500 million euros. Beyond that, the country holds assets worth over 6 trillion euros, making it the top spot in the EU for billionaire residents, with 266 billionaires.

Luxembourg also hosts a whopping 16,777 investment funds, handling a vast 4.5 trillion euros.

This shows how it’s a major centre for finance and investment.

The average salary in Luxembourg is 48,000 Euros per year, significantly higher than the typical European average of 33,700 Euros per year.

Bright Tomorrow?

Luxembourg’s tourism sector is experiencing remarkable growth, and the country is proving itself to be a heaven for tourists.

With the safety provided, career growth is present, and Luxembourg is called the green heart of Europe. Luxembourg is the world’s destination of growth.

But will it always remain so?

Will it always remain the strong centre of Europe? Or will the business cycle play its part?

Currently, the government is doing excellently well in maintaining the ecosystem of growth and future planning.

According to Eco2050, by 2050, the market for “transition investments” is expected to reach around 1 billion Euros in Luxembourg, 1 trillion Euros in the European Union, and 10 trillion Euros globally.

Focusing on new technologies, sustainability, giant players, and demographics promises a strong future for the country if things continue to go with the same flow.

So now that you read about a mineral changing the course of a country-

What would have happened if all that Gold India had always stayed with us?

Stay glued to our blogs, and we will keep satisfying your curiosity about such topics!

Good one!