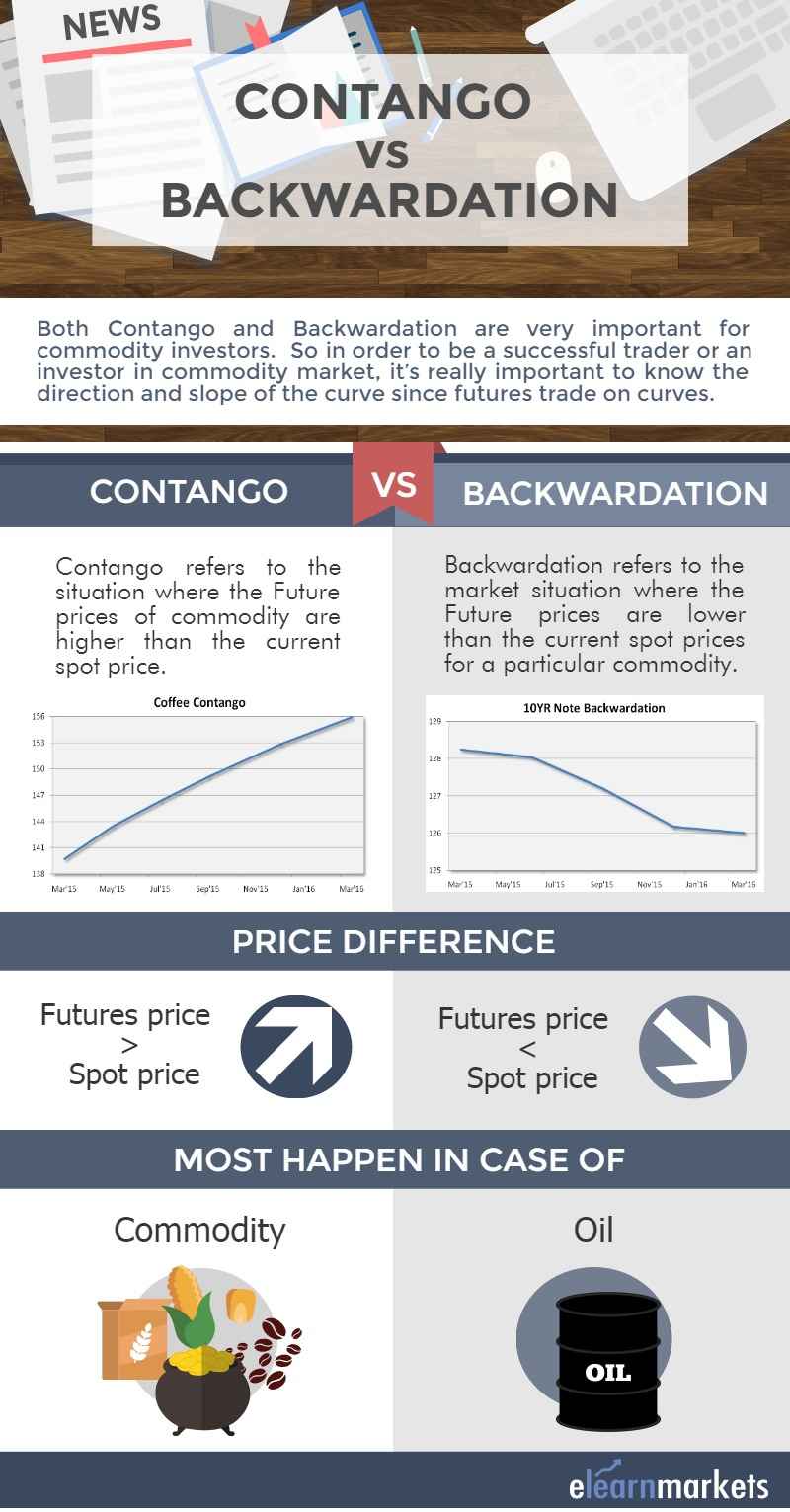

The terms Contango vs Backwardation might seem irrelevant for equity investors, but these concepts are very important for commodity investors. To learn more about the basics of commodities, join our course to gain a Certification in Online Currency and Commodities with Elearnmarkets.

So in order to be a successful trader or investor in a commodity market, it’s really important to know the direction and slope of the curve since futures trade on curves.

They can be used in tracking individual commodities like gold, oil or energy and it can be plotted on the curve to get an idea about the shape of the curve.

A normal futures curve will be upward sloping indicating the rising price in the commodity with time.

On the other hand, the inverted curve will show the fall in the price of the commodity over time.

Before getting deep into the concept of contango and backwardation, let’s understand some important terms which would help us understand both the concepts in a better way.

1. Commodity

Commodities which are traded in the markets are often of two types- hard commodities and soft commodities.

Hard commodities often include natural resources like rubber, gold, oil, etc while soft commodities include agricultural products like sugar, sugar, coffee etc.

2. Derivative market

It is a contract between two parties which derives its value from an underlying asset. The most common types of derivatives are forwards, futures, options, and swaps.

3. Spot price

It refers to the current market price where security can be bought/ sold for immediate payment and delivery.

4. Futures price

It is the price at which the counterparties agree to buy or sell a commodity at a price agreed today for delivery and payment at a future date.

5. Premium

This is the amount to be paid in case of entering into an options contract.

Also Read: Guide to Options – To hedge the investment position

Contango vs Backwardation

Both the terms are often used in energy and commodity markets to understand the shape of the forward curve. Let’s understand both the terms-

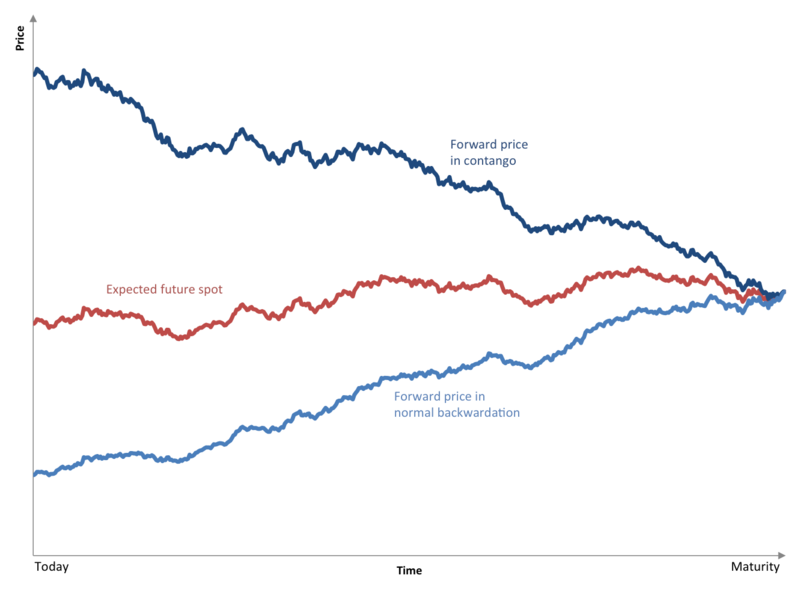

Contango refers to a situation where forward prices exceed spot prices and the forward curve is upward sloping.

While Backwardation is essentially the opposite of contango where spot price is higher than the forward prices and the forward curve is downward sloping.

Example- Say if a price of crude oil contract stands at $150 per barrel but the futures price for delivery after six months stands at $170 per barrel, the market is said to be in a contango since futures price is higher than the spot price.

On the other hand, if crude oil is trading at $150 per barrel for delivery today, and the six-month contract is trading at $120 per barrel, then that market would be said to be in backwardation.

Help identify demand-supply situation

Both contango and backwardation are very important especially in the commodity market as it helps to identify the demand-supply scenario of a particular commodity.

Let’s take an example to understand the above concepts in more detail-

The contango in crude oil indicates immediate supply while if crude oil is in backwardation, it may show an immediate shortage in the commodity.

The factors which threaten the supply of oil in the world like a breakout of war may lead the oil market into backwardation.

Some reasons for this kind of market structure could be geopolitical situations, shortages and weather conditions.

Say extreme dry weather hits the region during wheat growing season, such condition may lead to a spike in the spot price of the wheat crop while the future delivery price remains stable or do not rise much.

Bottomline

A simple approach to understand contango and backwardation is that contango takes place when the futures price is expected to be more expensive than the spot price while backwardation occurs when the futures price is expected to be less expensive than the spot price.

Contango and backwardation are simply curve structures which are visible in the futures market and it can be due to a number of factors.

However, it’s important to know that as contract expiration nears, the gap between the spot price and futures price will eventually converge..

Loved the concept? Then learn derivatives trading as well from our platform and become skilled at it.