To adopt a suitable strategy for yourself as an investor, the first step is to understand the basics of the markets, inside out. To understand the market in a more comprehensive manner, you may want to have a look at this course: Advanced Equity Research & Technical Analysis

“Buy Low, Sell High” is considered to be a passive investment strategy in the trading world these days. It looks at upside or downside movement of the market as an advantage. Those who have been following the markets would have noticed that they tend to increase over a period of time. If someone wants to buy shares of a company like Unilever and hold it for 5 years, they will be adhering to the “Buy Low, Sell High” strategy.

For traders and market participants, “buy low and sell high” is challenging to implement in the short run. It’s easy to understand the highs or lows in retrospect, but at the moment, when the near future is uncertain, it becomes overwhelmingly difficult. This idea goes against our psychological biases and instincts. When stocks fall, we fear the loss of money, and when stocks rise, we fear the loss of opportunity. They often use technical analysis tools to make informed decisions, like moving averages and they also consider the business cycles.

Why is it particularly difficult?

One of the main reasons why “buy low and sell high” is so difficult is because one may not be able to predict when the market is high or low enough; at which price it’s overbought or oversold. For a bull trader, the market price is always low and for a bear, it’s always high. Determining the intrinsic value of the stock, sure, isn’t easy. We never know when the market shoots and drops.

Also adding to the difficulty is the procyclical nature of cash flows. This relates to a more severe downturn in the market. Due to economic distress, cash flows tend to dry up and buying when the market is low is not always possible.

It is totally natural to be scared when one deals in financial markets because they’re partly real and partly fictitious and no one wholly understands it. When market goes down, people do become pessimistic, it’s in their nature to choose flight over fight. Most people assume the worst and want to avoid risk. And vice versa for an upturn in the market. Who would want to sell and get out when they think the market is booming?

Learn the strategy of “Buying Low and Selling High” in our workshops in a major city near you.

Does it hold much relevance for investors?

Everyone would agree that this is a good approach. But what they end up doing is, buy high and sell even higher. But is this what traders want today?

These 5 rules may help you implement this strategy:

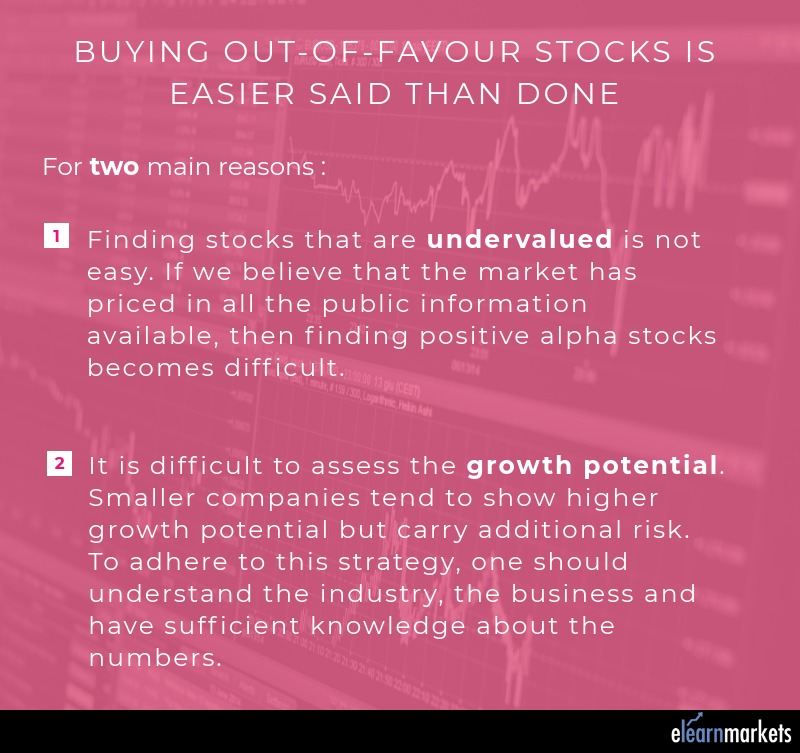

Buy Out-Of-Favour Stocks

Every investor wants to pick out positive alpha stocks i.e. stocks that have a higher intrinsic value than the price that they are trading at.

Investors want to buy stocks of companies that show a potential for growth and will create shareholder value. They would want to buy such a position at a discounted price to maximize returns. Out-of-favor stocks are sold for a reason; people don’t like it at that point. A stock may be down due to macroeconomic incidents, company adversities or industry-specific recessions and thus, the stock may have an ugly future and will be priced cheaply.

Sell In-Favour Stocks

Investors want to sell the stocks when they are on the upside. For example, if we know a company is going to announce positive quarterly performance, the right time to buy maybe before they announce it. Once the results are announced, it will be priced in and we’d have to buy at a higher rate. In-favour stocks imply that investors believe that the future of the company is bright. The key to generating alpha returns in this scenario is to know when to exit from a particular buy position (i.e. when to sell). Market timing is important and it is here where the investor’s judgment comes to question.

However, there exist behavioral biases that make the execution of this strategy difficult. When the price is increasing, investor holds the stock and waits for the right time to sell, just to get an extra buck. They’re caught in chasing trends, and thus, they have to sell when prices normalize or fall, or hold it till it goes back to where it was.

Another bias is the fear of regret, that after they sell, the momentum will continue. This even makes them buy at higher prices. This may reap returns in some cases, but more often than not, it’s not advisable to buy when the prices are increasing or at their peak.

Don’t Rely On Sell-Side Analysts

A sell-side analyst analyses a stock and it’s future earnings growth and other investment parameters, to sell a report of their analysis to the clients and buyers and make buy-sell-hold recommendations. They usually form their estimates on the basis of industry research, market analysis, and experience.

The problem with sell-side analysis is that:

- They always try to play safe. They fear the risk of being different. It’s human instinct to want to fit in, and thus an out-of-favor buy and an in-favor sell would be an unpopular recommendation. For them, it is okay to be wrong when everyone else is!

- They don’t want to shut the doors to insightful information from companies, so they rarely recommend selling a stock of the company they cover. No one wants to put his/her job on the line for an unpopular call!

One must be careful of the points above. It’s important to use plenty of reports from different institutions before making a decision, but one must know not to get swayed away by target prices. We must get access to as many research reports and also analyze how many companies the analyst covers. If there are too many of them on the list, it’s easy to miss a few crucial points.

One must build their own financial models to test the market assumptions. They must not blindly trust their suggestions before thinking for themselves.

Get Past Your Emotions

Investing doesn’t come naturally to people. We are our biggest enemy. It’s in our nature to follow emotional instincts that make us panic in danger and ecstatic in improved situations. This makes us terrible investment decision-makers and messes up the timing to buy and sell. We feel everything is great when stocks are high and buy a lot. When stocks fall, we give in to the chaos and sell. We follow the herd and that’s what holds us back from success.

Read more: 10 Habits of Highly Successful Investors

Once we learn to overcome these instincts and think through the pros of waiting it out, we will outperform every other member of the herd. We must consciously make an effort to think before we do.

Don’t Neglect Fundamental Data

In order to do away with ambiguity and uncertainty, we must use fundamental data. To calculate a company’s value, we should use their financial statements – current and historical. Focusing on actual data rather than expected returns and positive rumors removes the presence of emotion in the evaluation of an investment.

Ignoring past price levels, and future expectations of it are necessary to prevent the occurrence of an anchoring bias. Investors predict the future stock prices based on the past levels and not on the present performance. Don’t we see a flaw here? That will obviously make us make decisions that don’t reflect the current scenarios.

Getting caught in this trap is maddening. They are always in the hope and desire for the price to go back to where it was, once they’ve already come past it.

Also read: Why Fundamental Analysis is Important

Bottom Line

“Buy Low and Sell High” strategy is really simple but we’re not able to follow it. The nature of the market and our own instincts don’t allow us to do something like this, something we know is unnatural and against everyone else.

We always face a point in our life when we know the right thing to do but it’s just too difficult. Investing brings us to such points almost all the time. We must know how to approach such a situation. It’s all about being prepared to tackle something that the others are not.

In order to get the latest updates on Financial Markets visit Stockedge

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.