In Business risk analysis and leverage, we learned about the types of business risks and also, about leverage as a decision-making tool. Want to learn more about corporate finance decision-making tools? Enroll in the NSE Academy Certified Finance for Non-Finance People course on Elearnmarkets.

In this blog, we will further understand other concepts related to the decision-making tools.

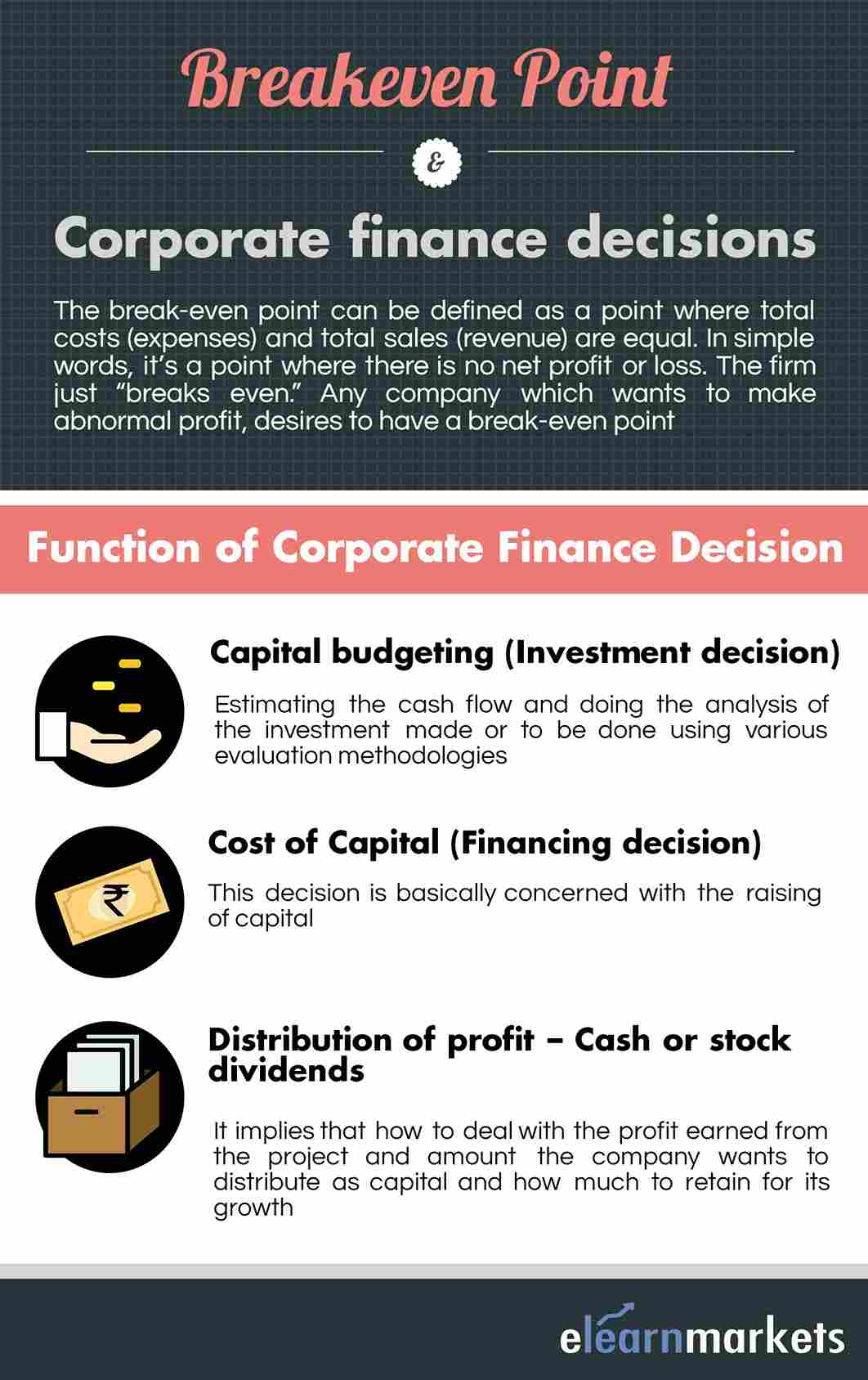

Break even point

Break-even point is a no profit no loss situation.

This implies the number of units produced by the company, wherein the company’s net income is zero.

After this, whatever revenue is earned it will lead to the profit because you have already covered all your costs.

After covering the fixed costs, whatever contributing the company earns, it will directly contribute to the EBIT because the company has already covered the fixed costs and is at the break-even.

Thus, wherever earning is made post fixed costs that contribute to the Earning before interest and tax (EBIT).

In the above figure, you will see that the revenue and the total cost intersect at a particular time.

This intersection is termed as the Break-even points (in units).

Break-even (Units) = Total fixed costs/ Contribution per unit.

Function of Corporate Finance Division

In this topic, we will discuss the broad categories of decisions taken by the company:

Capital Budgeting (Investment decision)

Estimating the cash flow and doing the analysis of the investment made or to be done using various evaluation methodologies.

Also Read: Time Value of Money

Cost of Capital (Financing decision)

This decision is basically concerned with the raising of capital.

Once you have found out a particular profitable project, you will also require sourcing that project with the funds.

This is where the corporate decision comes to play its role of selecting as to what kind of borrowing it will make.

Whether it will be in terms of equity or whether it will be debt. Basically, this decision will be based on the cost of equity or cost of debt.

Generally, the cost of debt is cheaper the cost of debt because the equity bit is riskier and carries more returns.

To get a more clear idea of the other corporate decision-making tools, watch the video below:

You cannot keep on pouring lot of debt in the company; you may need equity as well.

In this case, the corporate finance team will come forward to take a decision of raising capital so as to maintain a balance between the equity and the debt.

It also helps to keep the cost of capital at the minimum.

Distribution of profit – Cash or stock dividends

Once the company has decided on the profitable project and the source of capital, now the decision to be taken is on the profit earned.

This implies that how to deal with the profit earned from the project.

Now the company has two options to deal with the profit of the company:

- Distributed as dividend: The company has the option to either distribute the profits earned as a dividend to the shareholders, or

- Retention of profits: The company can keep the profits for the business development in the form of retained earnings. This amount can be utilised for further expansion of the business.

Now, suppose the company decides to give the dividend, then there are two types of dividends.

One is a stock dividend and other is cash dividend.

Cash dividend is received as the proportion to the number of shares held.

Suppose you arc a shareholder of a company which has announced a dividend of Rs. 1 per share and you hold 500 shares of that company.

So the dividend amount earned by you will be Rs. 500.

Stock dividend is basically the bonus shares.

A bonus shares is also the form of distribution of profit, but in case of bonus shares, cash is not given instead the company gives the shares in proportion to the shares held by the shareholder.

For example: The company declares bonus shares in the ratio of 1:1.

The market value of the company is Rs. 10,00,000. No of shares = 10, 000. Now after the bonus issue, the number of shares will be = 20, 000.

And the price per share will become Rs. 50 instead of Rs. 100, before the bonus issue.

When a company declares the bonus shares, they transfer the retained earnings to the shareholder.

So though there is no cash disbursement to the shareholder, the company has transferred profits to the shareholders through the share capital.

This is also know as capitalisation of profits.

In this way, it benefits the shareholder.

Bottomline:

We hoped that this article has helped you to get a clear idea of the basics of different types of decisions being undertaken by the corporate finance division of a company.

Follow our blog page to read on related topics.

To watch our videos on related topics, please click on the elearnmarkets youtube channel.

Feel free to give your feedback by writing to us by using the comment box below.

Happy Learning!!