Bank Nifty opened above its 5 Day High EMA at (25026 approx) ahead of the all important FOMC meet . The Index traded in a range of 109 points throughout the day and closed at 25042 approx.

Hourly Technicals:

In the Hourly Chart, Bank Nifty has closed marginally below its 5 Hour High EMA of (25063 approx).The Index is likely to face immediate resistance around (25105 approx) mark. Bank-Nifty has to trade above 25200 convincingly to see a fresh rally.

Hourly RSI stands midway between the normal range while the CCI is remained subdued. The ADX is indicating that volatility is on the cards.

Figure: Bank-Nifty Hourly Chart

Daily Technicals:

The daily chart indicates that Bank Nifty has closed 60 points short of the upper Bollinger Band (25103 approx). If Index trades and closes above the 25105 mark,it will face the next wave of resistance around 25200. On the downside however, if Bank-Nifty breaks and closes below its previous days low of 24941, it could find support at the 8 DMA area(24791 approx).

The daily RSI and CCI indicator has closed near the upper end of the normal range.The ADX however indicates lack of momentum.

Figure: Bank-Nifty Daily Chart

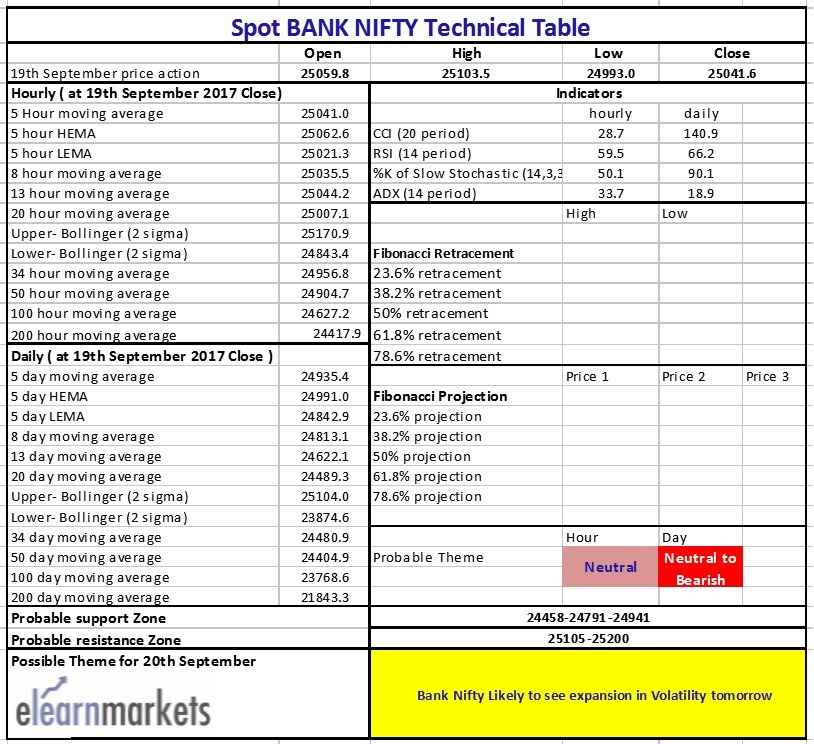

Figure: Bank-Nifty Tech Table