Have you ever wondered where to park your cash for a short while to earn a little extra return but still have easy access to it when you need it?

That’s where money market funds come in!

They offer a way to potentially squeeze some extra yield out of your uninvested cash while keeping it highly liquid and relatively low-risk.

In today’s blog, let us discuss what mutual funds are, their types and whether they are safe for investing:

Table of Contents

What Are Money Market Funds?

Money market funds are a type of mutual fund that invests in short-term, highly liquid debt instruments.

Their goal is to offer investors a low-risk, secure way to store their money, with the possibility of earning a little return, all while keeping it easily accessible.

Their usual investments are cash equivalents, such as commercial paper, Treasury bills, and certificates of deposit (CDs) with shorter maturities than a year.

Because these assets are issued by governments or high-worthy businesses, they are regarded as being quite safe.

How Money Market Funds work?

Let’s say you have some extra money in your savings account that you won’t need for at least a few months.

For you, a money market fund might be a wise choice.

This is how it could function:

- Rs.10,000 is invested in a money market fund by you.

- Your money is invested by the fund in a variety of short-term debt products.

- You choose to utilize the funds for buying something you want to after a few months.

- You get your 10,000 back when you redeem your shares in the money market fund, along with any interest you made while you were investing.

Types of Money Market Funds

Money market funds provide investors with a low-risk method to park their money. And make a little return by investing in short-term, highly liquid debt products.

Here are some types of money market Funds:

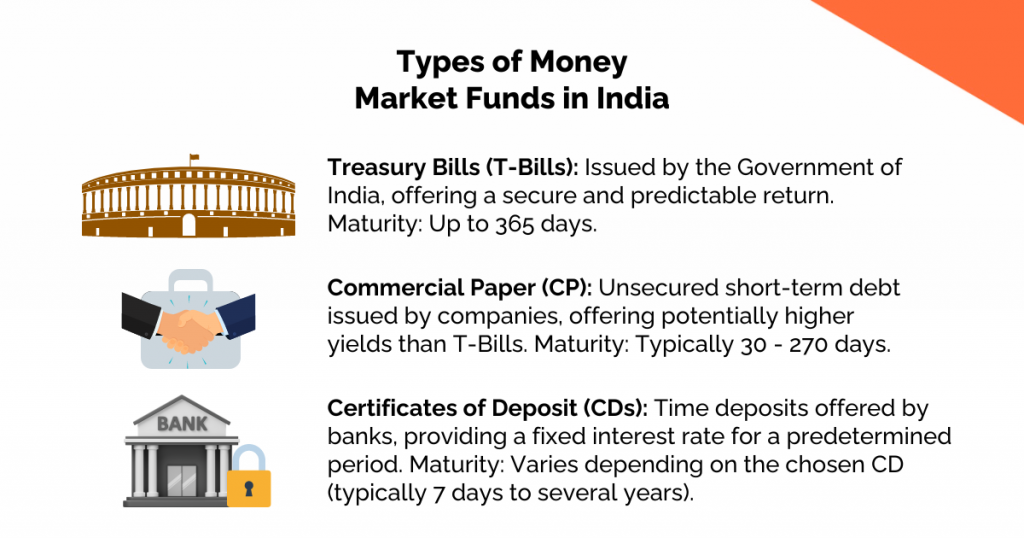

1. Treasury Bills (T-Bills)

Issued by the Government of India, T-Bills are considered the safest option among money market instruments.

They are essentially short-term debt obligations backed by the government’s creditworthiness.

T-Bills come in various maturities, ranging from a few days to one year (365 days).

Example: ICICI Prudential Money Market Fund invests a portion of its assets in T-Bills issued by the Government of India.

2. Commercial Paper (CP)

These are short-term unsecured debt instruments issued by large and creditworthy companies to meet their working capital needs.

CPs generally offer higher yields than T-Bills due to slightly higher risk.

Maturities for CPs typically range from 30 to 270 days.

Example: Franklin India Money Market Fund may invest in CPs issued by reputable Indian companies.

3. Certificates of Deposit (CDs)

Similar to fixed deposits offered by banks, CDs are time deposits issued by banks and financial institutions.

They offer a fixed interest rate for a predetermined period, making them suitable for investors seeking a predictable return.

Maturity: CDs can have varying maturities ranging from a few days to several years, depending on the specific offering.

Example: Some money market funds might hold CDs issued by nationalized banks like SBI or private banks like HDFC Bank. However, it’s less common compared to T-Bills and CPs due to their longer maturities.

How to Choose a Money Market Fund?

Here are steps that will help you in selecting money market fund for investment”

1. Define Your Investment Goals

Short-Term Needs: Are you saving for a down payment in a few months or building an emergency fund? Prioritize liquidity and capital preservation.

Return Expectations: Money market funds offer low returns, but consider if even a slight difference matters for your goals.

2. Evaluate Key Factors

- Yield: Compare the net asset value (NAV) and expense ratio of different funds to understand the effective yield you’ll receive.

- Fees: Look beyond the expense ratio and consider any entry/exit loads the fund might have.

- Fund Management: Research the reputation and track record of the fund manager.

- Investment Objectives: Ensure the fund’s investment strategy aligns with your risk tolerance and goals.

3. Research and Analyse

- Fund Ratings: Reputable financial institutions like CRISIL or ICRA rate money market funds. Look for funds with high safety ratings.

- Historical Performance: Past performance is not a guarantee of future results, but it can provide some insight into the fund’s consistency.

- Prospectus: Read the fund prospectus carefully to understand the fund’s investment strategy, risk profile, and fees in detail.

- Portfolio Composition: While specific holdings might change, understanding the types of securities (T-Bills, CPs, CDs) the fund invests in can help assess risk.

Example:

Imagine you’re saving for a down payment on a house in 6 months. Liquidity and capital preservation are your top priorities.

Here’s how you might choose a money market fund:

You compare several money market funds and find two options:

- Fund A: Higher expense ratio but slightly higher historical yield.

- Fund B: Lower expense ratio and a consistently stable NAV.

Based on your goals, you choose Fund B.

Lower fees and a stable NAV ensure you get your money back when needed, even if the overall return is slightly lower than Fund A.

Are Money Market Funds Safe?

Money market funds are generally considered safe investments.

Money market funds often make investments in highly rated short-term financial instruments such as certificates of deposit, Treasury bills, and commercial paper from creditworthy issuers.

Unlike stocks or bonds of obscure companies, these investments have a lower default rate.

Because these securities typically have maturities of less than a year, there is less chance that changes in interest rates will materially affect the value of the fund.

Consider investing in a money market fund that has Treasury bills with a ninety-day maturity period. The fund will still earn the predetermined return on its T-Bills when they mature, even if interest rates marginally increase during the next three months.

Frequently Asked Questions (FAQs)

Are Money Market Funds taxes as capital gains?

Yes, money market funds can be taxed as capital gains if held for less than a year (short-term) in India.

Which Money Market Funds are tax-exempt?

Directly invested money market funds in India are not tax-exempt. However, some tax-saving mutual funds might invest a portion of their assets in money market instruments, but the overall return won’t be entirely tax-free.

Conclusion

Money market funds are a smart place to put your money because they prioritize capital preservation by investing in low-risk, short-term debt securities.

The advantage of liquidity You can instantly access your money when you need it by simply redeeming your shares. They are therefore perfect for emergency savings or short-term objectives.

Lower returns, when compared to stocks or bonds, are the converse of safety. They can even fail to keep up with inflation.

Aggressive investing tactics or long-term wealth growth are not appropriate uses for money market funds.