For any company, raising funds by going public is the best resort if it doesn’t want to cope with the burden of high interest costs.

But filing for IPOs can be a very tedious task.

Firstly the company needs to have a proven track record and a valid business model. Then it needs to meet a number of criteria set by the stock market regulator. To top it all off, companies prefer to go public during bull market conditions to get the most out of its valuations.

Read More : Are IPOs a Bull Market trap?

But one of the recent trends currently in the financial markets, which essentially is the solution to all such problems is a Special Purpose Acquisition Company (SPAC).

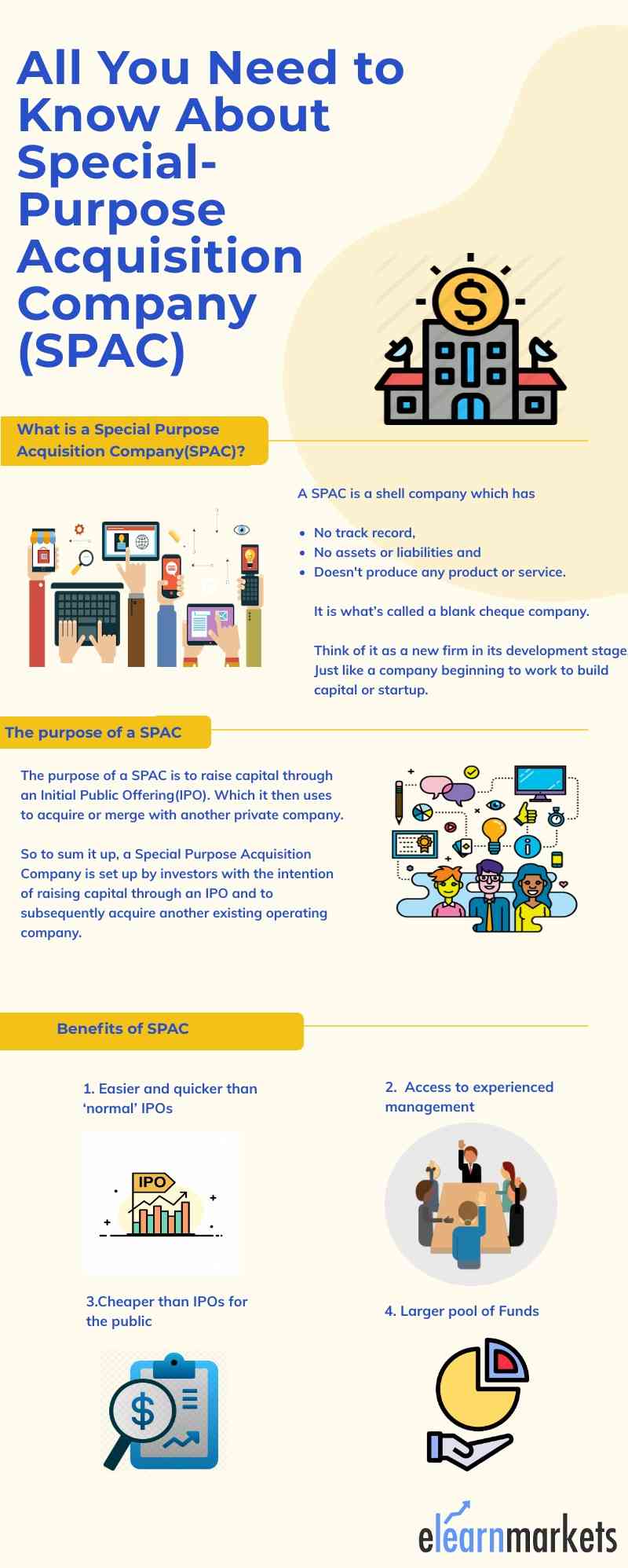

What is a Special Purpose Acquisition Company(SPAC)?

A SPAC is a shell company which has

- No track record,

- No assets or liabilities and

- Doesn’t produce any product or service.

It is what’s called a blank cheque company.

Think of it as a new firm in its development stage. Just like a company beginning to work to build capital or startup.

The purpose of a SPAC

The purpose of a Special Purpose Acquisition Companies is to raise capital through an Initial Public Offering(IPO). Which it then uses to acquire or merge with another private company.

So to sum it up, a Special Purpose Acquisition Company is set up by investors with the intention of raising capital through an IPO and to subsequently acquire another existing operating company.

This creates a win-win situation for the SPAC investors as well as the smaller firm it merges with.

The firm gets access to liquidity by getting listed and investors get to become shareholders of such firms which otherwise would have been difficult.

How does a SPAC merger work?

SPACs are formed or sponsored by financial market professionals or high profile investors with expertise in a sector, with the motive of acquiring at least one or more firms from that sector.

The firm which the Special Purpose Acquisition Companies targets to acquire is kept a secret to avoid regulatory scrutiny and disclosures during its IPO process.

The Special Purpose Acquisition Companies then seeks help from institutional investors and merchant bankers before ultimately offering shares to the public to subscribe via an IPO. The money raised through the IPO is held in a trust, similar to an ‘escrow account’.

The SPAC founders then need to identify and acquire a target firm within 2 years of its establishment. In case the acquisition does not go through, the SPAC investors are returned their funds after deducting brokerage and bank fees.

Let’s take a look at the 3 phases of a Special Purpose Acquisition Companies:

Phases of a SPAC:

1. SPAC Formation and IPO

Since a Special Purpose Acquisition Companies is a shell company, its sponsors and founders become the selling point for the public. The founders provide the seed capital which translates to around a 20% shareholding in the Special Purpose Acquisition Companies. The remainder 80% of the shares are issued to the public at $10 each via an IPO. This phase lasts around 8 weeks in its entirety.

2. Due Diligence and Negotiations with Target Company

Once the IPO goes through, the funds raised are then kept in a trust/escrow account. After this the SPAC directors and founders conduct a due diligence of the target company’s financials and researches in great detail about the company. After a Special Purpose Acquisition Companies settles on a target company, it begins its phase of negotiations for a merger or takeover and draws up its final financing figures. The complete process may take between 15-18 months to conclude.

3. Approval and SPAC merger

Finally if the negotiations and other formalities fall in line, the Special Purpose Acquisition Companies would announce its intention of either acquiring or merging with the target company. The Special Purpose Acquisition Companies public shareholders then have the option to either approve or disapprove against the merger by executing their voting rights. If approved, the merger will close and the target company becomes a publicly traded company. This phase may last between 3-5 months.

Since Special Purpose Acquisition Companies have been a hot trend and have managed to raise $91 billion so far in 2021, let’s understand its advantages.

Benefits of Special Purpose Acquisition Companies (SPAC)

- Easier and quicker than ‘normal’ IPOs : Small or growing companies may find it difficult to raise money through IPOs because of not having a proven track record, non- profitability or investor awareness. By merging with a SPAC, such companies get access to greater liquidity as SPACs find it easier to go public due to the rules they fall under.

- Access to experienced management : With SPAC sponsors and founders being highly experienced professionals in their respective fields, it allows the smaller firms access to their expertise. Likewise for investors, it adds to a SPACs credibility and allows for greater standards when it comes to returns and investor confidence.

- Cheaper than IPOs for the public : Special Purpose Acquisition Companies price their IPOs at a fixed $10 a share which can be much cheaper when compared to IPOs. So this allows for a wider range of public investors to invest in the IPO of a SPAC.

- A larger pool of Funds : Special Purpose Acquisition Companies allow target companies to negotiate and determine the price of their stock. Unlike traditional IPOs where the company has to fix a price which is neither too high nor too low. It reduces the valuation risks for the target company.

With that in mind, let’s take a look at a few successful companies which went public by merging with Special Purpose Acquisition Companies.

Read our latest article on Understanding Bond Yields

Examples of companies that went public through SPACs in 2020

In the year 2020, 248 SPAC deals took place which were able to raise over $83 billion.

In India, ReNew Power, a renewable energy producer became the first Indian company to be involved in a SPAC merger. It’s merger with RMG Acquisition resulted in the Indian company’s listing on NASDAQ which helped it raise $1.2 billion.

One of the most notable SPAC deals was involving Richard Branson’s space company Virgin Galactic. Where prominent investor from Wall Street, Chamath Palihapitiya’s SPAC Social Capital Hedosophia Holdings bought a 49% stake for a $800 million deal.

A few SPACs lined up for 2021 include Bill Gates backed start-up Butterfly Network. There are also talks of digital media companies such as BuzzFeed and Vice media to go public using a Special Purpose Acquisition Companies

There are also rumours about Indian online grocery platform Grofers to go public via a Special Purpose Acquisition Companies deal.

Bottomline

In India, the market regulator, Securities and Exchange Board of India(SEBI) has reportedly formed a group of experts to understand the prospects of launching SPACs here. However, this would deem to be a lengthy process because the Companies Act of 2013 does not allow the creation of blank cheque companies in India.

Besides many analysts and financial advisors have raised concerns over the interests of ‘retail investors’ who participate in SPACs.

After a study of 47 SPAC mergers which took place between 2019 and 2020, the average returns considering 6 months and 12 months returns were a poor -23% and a whopping -65% respectively.3.

To know more about IPO visit web.stockedge.com