Key Takeaways:

- Accounts Receivable is the amount which the company will receive from its customers who have purchased its goods and services on credit.

- It forms a major part of the company’s assets and shows in the balance sheet as current assets.

- A higher or increasing accounts receivables shows that a company is poor in collection procedures and faces problem in converting its sales into cash. Rising Cash crunch makes business operations difficult.

- A lower or decreasing one shows that a company can collect cash easily from its customer and can use this cash for continuous operations. It helps the company to increase its liquidity, efficiency and cash flow.

- A continuous rise in Accounts receivable increases the chances of Short term capital requirement and thus increases the short term borrowing leading to high-Interest burden and low profitability.

What is Accounts Receivable?

Company’s while doing businesses mostly need to do it in credit, where some businesses demand more credit and some get away with very few days of credit. Let’s understand what this credit is.

Companies generally sell goods and services to its customer on credit.

That is, they deliver the goods and services immediately, send an invoice, and then get paid later.

They keep track of all the money their customers owe them using an accounting entry in their books called accounts receivable.

It is also known as trade receivable which is the accounting term used to refer to the money that the Company should receive from its customers for the goods or services it provided on credit.

Accounts Receivable Example

Suppose you have a company named XYZ Ltd. which manufactures fans.

A customer gives you an order of Rs. 50,000 for 50 fans. Now, when the invoice is generated for that amount, the sale is recorded, but for making the payment you allow and extend the credit period for 30 days to the customer.

Your company will record an account receivable of Rs. 50,000 when it delivers fans to the customer. So from the date of delivery, until the company receives the money, the company will have an account receivable where it will record this amount of Rs 50,000.

(Note:- After selling the goods, the inventories of the company reduce, and in turn, company needs an asset to balance the financial statements. Either that assets are cash-in-hand or Accounts receivables in case of credit sales).

Gain comprehensive knowledge of company assets with Company Valuation Course by Market Experts

Once the payment is completed by the customer, the cash segment in the balance sheet will increase by Rs. 50,000 and the accounts receivable will decrease by the same amount.

Where do I find Accounts Receivable?

They are classified as an asset because it provides value to the company. You can find it under the ‘current assets’ section in the balance sheet.

Why Account Receivable is important?

Accounts Receivable forms a major part of the company’s assets. It generates cash inflow in the books of the company. It is very important because it affects the company’s future cash flow.

The company generally provides credit facility to the customers to ease the process of the transaction and establish a strong credit relation. This sometimes helps in providing better deals for the company.

An investor can use accounts Receivable days to check the collection efficiency of the company.

What are Accounts Receivable days ?

It shows the number of days a company takes to collect cash from its credit sales. It shows how well a company is in collecting cash from its customers and whether the company is efficient or not in keeping the number of days in check.

An Inflated Accounts Receivable for many years can spell disaster for a company and some may eventually become Non performing Assets (NPA) if not controlled.

Formula:

This is calculated by dividing the Average accounts receivable by the total sales for the period and multiplying it by 365 days. Most often this ratio is calculated at year-end when Annual Reports are available.

Accounts Receivable days:- Average Accounts Receivable / Total sales *100

Average Accounts Receivable:– Previous year Accounts Receivable + Current Year Accounts Receivable /2

Higher days show that a company is poor in collection procedures. It shows customers are unable or unwilling to pay for their purchases. These companies are normally unable to convert their sales into cash.

Let us understand this with an example:

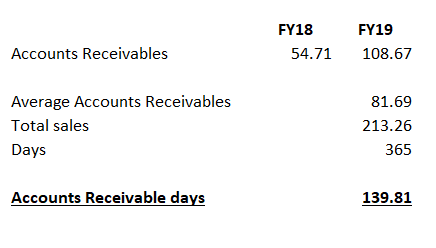

Company:- Jiya Eco Products Ltd.

As of March FY2019. Under total Assets, current assets are Rs. 122.58 Crs out of which Accounts receivable is Rs. 108.67 Crs. This results in high receivable days of around 140 days. This means the company takes 140 days to collect cash from its customer.

Thus it means that the cash does not come back to the company before 140 days.

Impact:

So for continuous business operations, the company might have to borrow short-term loans. This puts an extra burden and increases the expenses of the company and thus puts pressure on its Cash from operations.

This eventually impacts the bottom line due to the high-Interest burden on the short-term loan so taken and thus decreases the profit of the company.

On the other hand, lower days are good for the company. It shows the company can collect cash earlier from its customer and can use this cash for continuous operations.

It also shows that the accounts receivable are good and won’t be written off as bad debt. (Bad debt- When accounts receivable won’t get paid, the company has to write it off as bad debt).

Let us understand this with an example

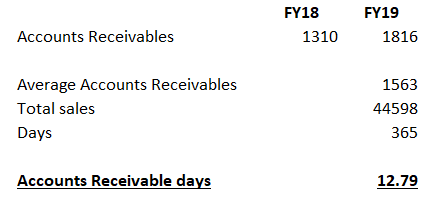

Company:- Hindustan Unilever Ltd.

The company takes approximately 13 days to collect cash from its customer on an average basis. It means the company is receiving its payment/or getting cash faster before it has to make any payment to its suppliers.

Because low receivable days, make the company’s cash from operation positive without any requirement of short-term borrowing. Good control over receivable days increases the efficiency and cash flow of the company.

Accounts Receivable is the amount which the company will receive from its customers who have purchased its goods and services on credit.

Suggested Read – How Investors evaluate a company?

It forms a major part of the company’s assets and shown in the balance sheet as current assets.

A higher or increasing Accounts receivables shows that a company is poor in collection procedures and faces problems in converting its sales into cash. The rising Cash crunch makes business operations difficult.

A lower or decreasing Account receivable shows that a company can collect cash easily from its customer and can use this cash for continuous operations. It helps the company increase its liquidity, efficiency, and cash flow.

A continuous rise in Accounts receivable increases the chances of Short term capital requirement and thus increases the short-term borrowing leading to a high-Interest burden and low profitability.

In order to get the latest updates on Financial Markets visit https://stockedge.com/

Happy Learning!