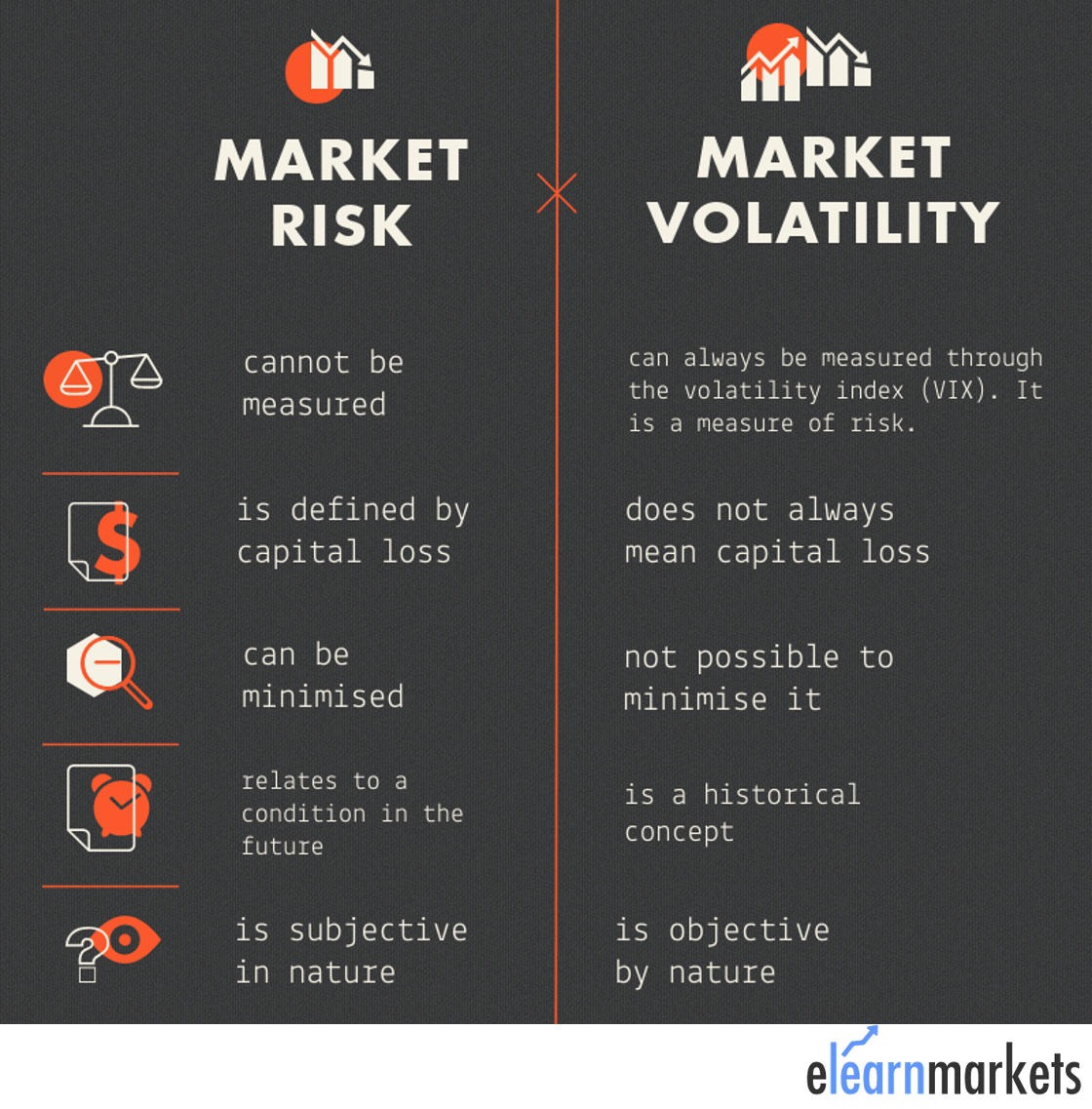

Today, in the financial world, market volatility is always considered risky. People don’t understand the thin line of difference between the two. Market volatility and market risk are heavy fear-inducing terms to an investor.

Risk refers to uncertainty and the likelihood of suffering loss due to elements that impact the overall market performance, whereas, volatility is the variation in the value of a security and the risk of high degrees of dispersion in the magnitude of securities.

| Table of Contents |

|---|

| Market Risk is not equivalent to Market volatility |

| Types of Market Risk |

| Market Volatility is not Market risk |

| How to Optimize market volatility? |

| Conclusion |

These two terms are used synonymously and may often lead to trading mistakes, that will not only cost you money in the short-run but also financial stability in the long-run.

Market Risk is not equivalent to Market volatility:

Volatility makes up the market. Being up one day and down the other is in the DNA of the market. But a risk is just an element in the market. It is so much more than just volatility. Risk is primarily the possibility of not getting expected returns. One can take steps to minimize risk or prevent negative outcomes, but not eliminate it.

Types of Market Risk

Interest Rate Risk: It means fluctuations in interest rate caused by a change in fundamental factors, like monetary policy.

Currency Risk: It refers to a loss of money due to change in the price of a currency. It usually occurs for investors involved in international trade and investment.

Equity Risk: It is the risk arising due to change in stock prices of a company. It is considered to have high market volatility.

Commodity Risk: This occurs due to variations in prices of commodities, such as crude oil and metal that indirectly has an impact on equity.

Current Scenario Risk: This includes the impact of a change in company’s position due to political situations, and emergency.

Certain volatile conditions comprise of just a small part of risk, which brings down the market and increases the possibility of losses. It is important to acknowledge that even stocks with low market volatility, may face a sudden decline due to unexpected circumstances, like unexpected litigation or bankruptcy filing, and prove to be a risky investment.

The most common misconception is that investments, which are highly volatile, would always bear losses. What people fail to understand is that it is more about the timing and perspective.

Learn Profitable Options Strategies for Volatile and Steady Stocks in just 2 hours by Market Experts

One can neither be sure that high market volatility would slide the prices nor that low market volatility is reliable. A recent Morgan Stanley report said that equity has delivered the best returns in India over 5-year periods, in comparison to gold, real estate, and fixed deposits, among others.

Over a 20-year period, returns from equity were 12.9%, gold 8.4%, bank fixed deposits 5.5% and property 6.2%. This proves, while being highly volatile, it may not necessarily be risky. There is more to risk than just market volatility.

Market Volatility is not Market risk

As per Warren Buffett “Volatility is far from synonymous with risk.”

While they are closely related, it’s important to not confuse market risk with market volatility. They are not identical. Nobody makes an extra effort to recognize the underlying difference; hence they are substituted for one another.

Warren Buffett clarified the conception of market volatility and risk in his 2014 annual letter to his shareholders. “Stock prices will always be far more volatile than cash-equivalent holdings. Over the long term, however, currency-denominated instruments are riskier investments—far riskier—than widely diversified stock portfolios that are bought over time and that are owned in a manner invoking only token fees and commissions. That lesson has not customarily been taught in business schools, where volatility is almost universally used as a proxy for risk. Though this pedagogic assumption makes for easy teaching, it is dead wrong: Volatility is far from synonymous with risk.”

While market volatility may result in a permanent loss, and add on to risk, but it gives investors a chance to book their profits and stop their losses in time. It is only one source of loss, but its ease of measurability makes it the heart of risk management method.

To clearly elucidate, we will take an example:

Stock XYZ goes up by 0-0.5% every fourth day, down 0-0.5% every fourth day, and up or down more than 0.5% every fourth day. Whereas, Stock ABC goes up 0.5% every other day, again up 1-6% every third day, and up again, closely, 12% every sixth day on average.

While Stock ABC is clearly more volatile, Stock XYZ is riskier as one would be more afraid to invest in a stock that goes down every fourth day. This displays the difference between the two.

It’s high time to avoid such mistakes of investors that they do while trading. They should start reading between the lines instead of focusing on, simply, the black and white.

How to Optimize market volatility?

Market volatility is seen as a security’s tendency to noticeably spiral up and down within a short period of time. But this movement may not always have a downside. Once people stop seeing this phenomenon as detrimental, they will see it as opportunistic. Short-term fears cloud an investor’s judgment and strategizing ability. Market volatility is inevitable and one needs to find a way around it.

When a storm hits, it does not call for an exit strategy. It’s vital to understand the potential advantage of investment opportunities that arise from market volatility. Below are two strategies to help in leveraging volatility for one’s own benefit

Focus on Long-Term until market volatility clears

One way to capitalize on market volatility is to stay put during the course of it, despite the chaos in the market. This would, in the least, prevent unnecessary losses in the short-run that could arise in attempting to estimate the correct market timing. It’s impossible to time your exit (at a market high) or entry (at a market low) perfectly. This bad timing can moreover boost losses during market volatility.

When Prices are low, take advantage

Market volatility, if one looks at it the other way, can also create advantageous opportunities for an investor. It can provide points of entry for someone whose investment strategy and time horizon is long-term. For bullish investors, who believe markets will perform better in the long-run, downward market volatility provides the opportunity to buy more shares at relatively lower prices. By increasing investment in securities at a discount, one would lower the average cost per share and increase returns over time.

The stage of market volatility proves to be a good time to invest extra additional funds and liquidate/redeploy underperforming assets, keeping in mind your tolerance for risk and long-term goals. A way to do so is to invest in mutual funds, designed for this.

Suggested Read : Why should we invest in Systematic Investment Plans

Having a plan that outlines your objectives and accounts for your timely needs, and regularly reviewing it ensures that you’re sorted for all market conditions. This would pilot you through phases of uncertainty when there are chaos and panic and people just act in fear. It is not always bad, not when one is prepared to cash in on its exclusive prospects and opportunities.

Warren Buffett says, “ Be fearful when others are greedy, and greedy when others are fearful.”

Also read : 10 Habits of Highly Successful Investors

Conclusion:

Volatility, though unavoidable, can be beneficial if one knows how to go about it. Risk, on the other hand, can be minimized if one tries. One way to do so would be hedging which is basically an insurance policy for your stock portfolio diversification.

For a retail investor, it is suggested that they stay away from short-term market volatility, especially if they don’t understand market movements. High market volatility proves to be good entry points for long-term investors.

In spite of their differences, both are vital for an investment to be successful and have increased emphasis on analysis and a systematic and professional style of approach. One must know how to take advantage of an unfortunate situation and be prepared for the worst.

In order to get the latest updates on Stockedge