Nifty close 10370.3: Nifty ended the session on a negative note and closes below the psychological 10400 mark. As mentioned in yesterday’s Tech table, 10359 acted as a good support area for the indices in today’s session.

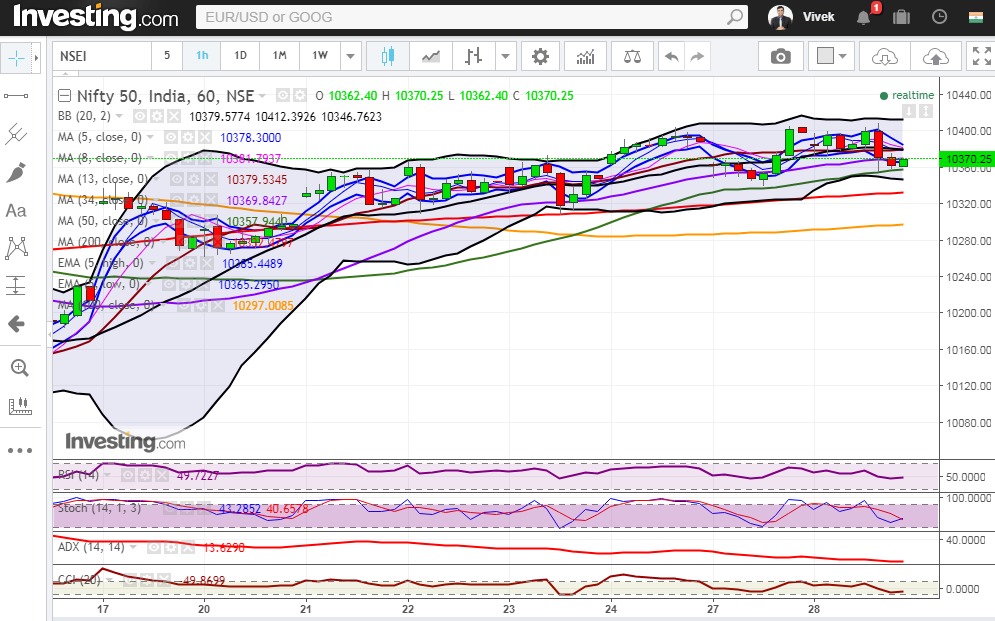

Hourly Technical:

In the hourly chart, Nifty opened marginally lower and found support at 34 Hourly moving average. The probable support in the hourly chart comes at 50 Hour moving average (presently at approx.10357.9), lower Bollinger line (presently at approx.10346.8) and 200 Hour moving average (presently at approx.10332.5).

On the upside, Nifty may face resistance at 5 Hour High EMA (presently at approx. 10385.4) and Upper Bollinger line (presently at approx.10412.4).

Hourly Stochastic and CCI are in the normal range of their respective zone. Moreover ADX is downward sloping suggesting loss in downside momentum. Overall Nifty remained neutral in Hourly time frame.

Figure: Nifty Hourly Chart

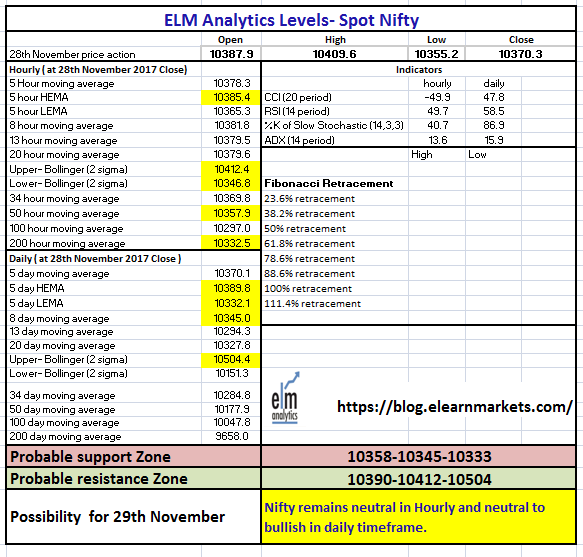

Daily Technical:

In the daily chart, Nifty consolidates at 10400 mark for the last 3 consecutive sessions and close above 10420 may take Nifty to lifetime high area. The probable support in the daily chart comes at 8 DMA (presently at approx. 10345) and 5 Day Low EMA (presently at approx. 10332.1).

On the upside, Nifty may face resistance at 5 Day High EMA (presently at approx. 10389.8) and Upper Bollinger line (presently at approx. 10504.4).

Daily Stochastic has entered the overbought zone while RSI and CCI are still in the normal zone but inching towards the overbought area. Overall, Nifty remained neutral to bullish in the daily timeframe.

Figure: Nifty Daily Chart

Figure: Nifty Tech Table