Nifty (Close 10298.8): Nifty remained range bound during the day and closed with positive notes for the day

Hourly Technicals:

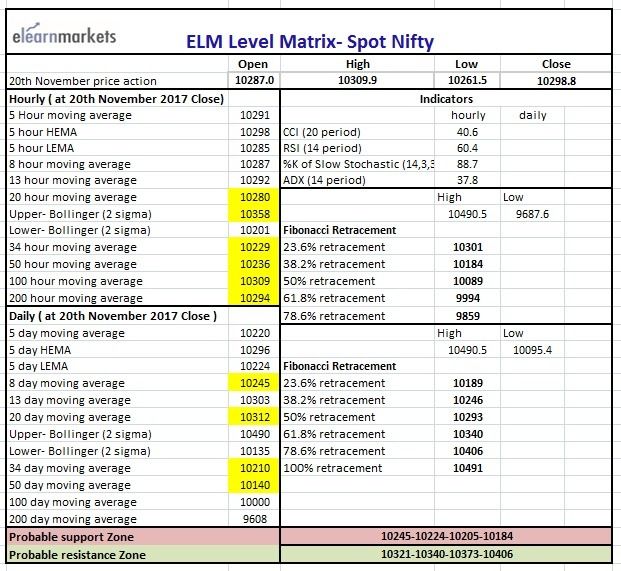

Nifty closed just below the 100 hour sma, presently at 10309. However, a close above 20 hour sma, presently at 10280, indicates short term bullish probability. On the upside Nifty may find resistances near 100 hour sma, the upper Bollinger line (10358) and then the earlier important level of 10410.

On the downside, Nifty may find support near 20 hour sma (presently at 10280), 34 hour sma (presently at 10229) and 50 hour sma (presently at 10236)

Hourly CCI, RSI, slow stochastic are close to the mid-point of their normal range, indicating directionless-ness. The hourly ADX is also showing lack of momentum.

Figure: Nifty Hourly Chart

Nifty hourly chart

Daily Technicals: In daily chart, nifty closed near the 20 day moving average. On the upside, 20 day moving average (presently at 10312) can be one significant resistance. Also, 10340, which is 61.8% retracement of the fall from 10491 to 10094, is likely to be another important resistance on the upside. On the downside, 8 day simple moving average (presently at approx. 10245), and 34 dma, (presently at approximately 10210) are likely to act as important supports.

The daily, CCI, RSI, Slow Stochastic are close to middle of the range, indicating lack of direction. The tepid ADX is also indicating lack of momentum.

Figure: Nifty Daily Chart

Figure: Nifty Tech Table