Ever feel like your savings account is stuck, and it barely grows, even after years of saving?

We have a solution- mutual funds might be a way to grow it faster!

Investing in mutual funds can help us in building long-term wealth at a steady rate.

So, in today’s blog, let us discuss how, as a beginner, you can start investing in mutual funds:

Table of Contents

What are Mutual Funds?

A mutual fund is a pool of money managed by a professional Fund Manager.

These funds Invest in a variety of assets (stocks, bonds, etc.) to spread out the risk and aim to grow your money over time.

Let us understand mutual funds by an example:

Just like in a picnic, where everyone contributes a dish, similarly in mutual funds, everyone invests a little money in that fund.

These funds are overseen by professionals who invest in multiple financial assets, sectors, or companies to spread out risk.

Now that we know the basics of mutual funds, let us discuss how to invest in mutual funds:

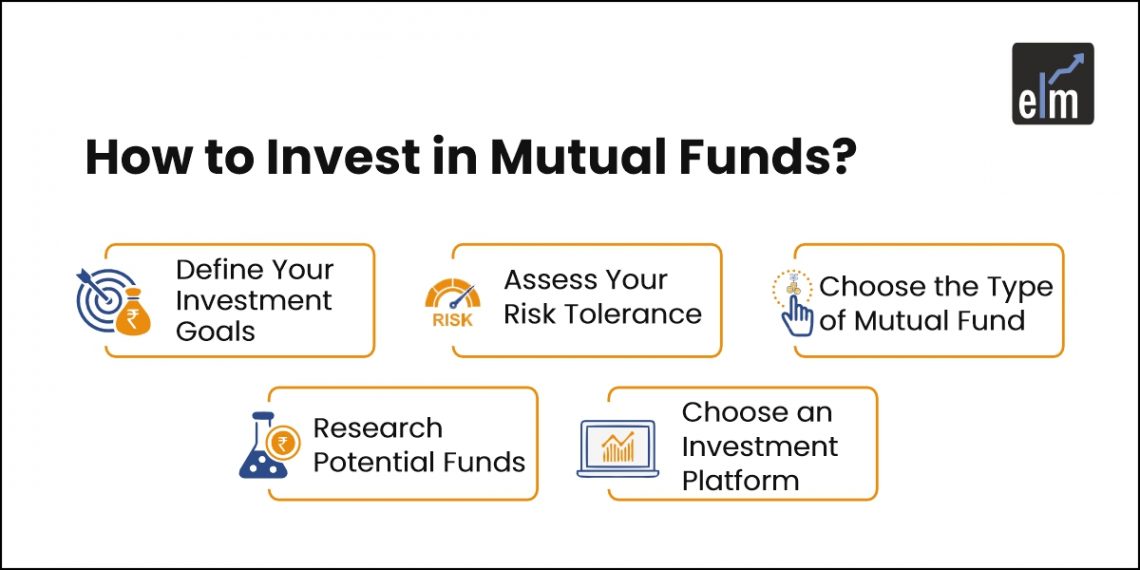

How to Invest in Mutual Funds: Step-by-Step Guide

Investing in mutual funds can be done with easy steps. Here’s a step-by-step guide to help you get started-

Let us take an example to demonstrate this. Suppose Devika’s age is 30 years old and wants to invest by SIP in mutual funds till retirement age.

Let us use the SIP Calculator to calculate how much she should invest every month-

1. Define Your Investment Goals

Before investing, determine why you want to invest.

Common goals include saving for retirement, building an emergency fund, or saving for a large purchase (e.g., a house or education).

Devika wants to save for her retirement in 30 years. She estimates she will need 1 crore by then.

2. Assess Your Risk Tolerance

Understand your risk tolerance to choose the right type of mutual funds.

Risk tolerance depends on factors like your investment horizon, financial situation, and personal comfort with risk.

Devika is 30 years old and has a moderate risk tolerance. She is willing to accept some volatility for higher long-term returns.

Also Read: Risk management strategies

3. Choose the Type of Mutual Fund

Mutual funds come in various types: equity funds, bond funds, balanced funds, index funds, and more.

Your choice should align with your risk tolerance and investment goals.

Given her long-term horizon and moderate risk tolerance, Devika decides to invest in a mix of equity funds and balanced funds.

Also Read: 15 Different Types of Mutual Funds in India

4. Research Potential Funds

Look for mutual funds that match your criteria.

Consider factors like past performance, fund manager reputation, expense ratios, and fund.

Devika researches funds using online resources and financial news. She finds that the ABC Growth Fund has a good track record and a reasonable expense ratio.

5. Choose an Investment Platform

Select a brokerage or investment platform where you can buy mutual funds.

Options include traditional brokerage firms, online brokers, and robo-advisors.

Devika chooses an online brokerage because of its user-friendly interface and low fees.

6. Open an Account

Open an investment account with your chosen platform.

This might be a regular brokerage account or another type of investment account, depending on your goals.

Devika opens an account with her online brokerage.

7. Fund Your Account

Deposit money into your investment account.

Most platforms allow you to link your bank account for easy transfers.

Devika transfers 5,000 from her savings account to her new account.

8. Purchase Mutual Funds

Once your account is funded, you can buy shares of your chosen mutual funds.

Decide how much you want to invest in each fund.

Devika decided to invest 3,000 in the “ABC Growth Fund” and 2,000 in a balanced fund called the “XYZ Balanced Fund.”

9. Set Up Automatic Contributions (Optional)

Consider setting up automatic contributions to invest regularly, which can help with dollars-cost averaging.

Devika sets up an automatic transfer of 200 per month from her bank account to her brokerage account

10. Monitor and Rebalance Your Portfolio

Regularly review your investments to ensure they are aligned with your goals.

Rebalance your portfolio as needed to maintain your desired asset allocation.

Devika reviews her portfolio annually. If her equity funds perform exceptionally well, she might rebalance by shifting some gains into bond funds to maintain her risk level.

Rebalancing your portfolio is also one of 5 great strategies to take advantage of market crashes.

How to Invest a Lump Sum in Mutual Fund Schemes?

By investing lump-sum in mutual funds, we invest a larger sum of money all at once, like paying the entire amount upfront.

This method is suitable for Investors with a substantial amount available for investment and a higher risk tolerance.

If you invest at a low point in the market, you could potentially see bigger returns when the market recovers.

Let us discuss how you can invest a Lump Sum in Mutual Fund Schemes.

Let us take Zerodh Coin account as an example:

Prerequisites:

- Existing Zerodha account with completed KYC (Know Your Customer) verification.

- Funds added to your Zerodha account balance using net banking, UPI, or debit card.

Steps:

- Explore Mutual Funds: Zerodha offers a wide range of mutual funds. You can browse through them based on various categories like asset type, investment objective, risk profile, etc

- Select Desired Mutual Fund: After considering your investment goals and risk tolerance, choose the target mutual fund scheme. Learn how to set financial goals for your future.

- Initiate Lump Sum Investment: Click on the “Buy” option for the chosen mutual fund scheme. This represents a lump sum investment.

- Enter Investment Amount: Specify the amount you wish to invest as a lump sum in the designated field.

- Review and Confirm: Double-check the investment details like fund name, amount, and any applicable charges. Once satisfied, proceed with the confirmation.

- Complete Payment: Choose your preferred payment method (UPI or net banking) to complete the investment process.

Also remember that market timing is difficult, and investing a lump sum at a market high could lead to lower returns initially.

How to Invest in Mutual Fund through SIP?

SIP allows you to invest a fixed amount of money in a chosen mutual fund scheme at regular intervals.

These intervals can be monthly, quarterly, or even weekly, depending on your preference and investment strategy.

SIP allows you to begin investing with a small amount, making it accessible to almost everyone.

Even with modest sums, consistent SIP contributions can lead to a significant corpus over the long term due to the power of compounding.

Steps:

After logging and selecting the mutual fund you wish to invest in, depending on your investment goals, risk tolerance and time duration, click on the SIP as shown below from your Zerodha account-

You will get a confirmation after clicking on “Create SIP”:

Points to Keep in Mind Before Investing in Mutual Funds

- What are you saving for? This could be anything from retirement planning, a child’s education, a down payment on a house,

- Knowing your investment goals will help you determine the type of mutual fund that is right for you and the investment time horizon.

- How much risk are you comfortable with? Mutual funds come in a variety of risk levels, from low-risk to high-risk.

- There are many different types of mutual funds available, each with its own investment objective. Some common types of mutual funds include equity funds, debt funds, hybrid funds, and index funds.

- Do your research to understand the different types of mutual funds and choose the ones that are right for you.

You can check Mutual Funds Analytics Using StockEdge

Frequently Asked Questions

How Much Should I Invest in Mutual Funds?

Your current financial status, investment horizon, risk tolerance, and financial aspirations all influence how much you should invest in mutual funds.

Can I Lose Money in Mutual Funds?

The chances of your mutual fund investment value going to zero are practically almost impossible as it would mean that all the assets in the fund’s portfolio will have to lose their entire value.

What Is the Best Time to Invest in Mutual Funds?

When it comes to mutual funds, the ideal time to invest is usually “as soon as possible,” depending on your financial readiness. The secret is to average out market volatility over time by investing consistently (dollar-cost averaging).

How to invest in mutual funds for tax saving purposes?

Consider tax-saving mutual funds such as Equity Linked Savings Schemes (ELSS) if you want to invest in mutual funds to save taxes. Under Section 80C of the Income Tax Act of India, ELSS funds provide tax benefits by enabling you to deduct expenses up to a predetermined amount.

How to buy mutual funds directly?

Direct mutual fund purchases can be made through Fund Houses and online brokerage platforms.

Are mutual funds tax-free?

Mutual funds are taxed according to the kind of mutual fund and the length of the holding period determine the tax treatment.

Conclusion

To sum up, mutual funds are an effective instrument for reaching your financial objectives and increasing your wealth. You can confidently traverse the mutual fund industry by maintaining a disciplined approach, comprehending the fundamental ideas, and keeping the previously mentioned things in mind. Recall that investing is a journey rather than a sprint. Begin investing now, hold onto your money for the long run, and profit from compound interest and expert management.

Enroll now in our Mutual Fund Course to master investment strategies and secure your financial future!