Nifty close:

The index corrected more than 350 points from its record high last week and remained under pressure for the third consecutive session on Wednesday.

Hourly Technical:

In the Hourly chart, the selling pressure continued in today’s session but the correction got deeper in the second half.

The probable support in the hourly chart comes at Lower Bollinger line (presently at approx.10097.9).

On the upside, Nifty may face resistance at 5 Hour High EMA (presently at approx.10143.6) and 20 Hour Moving average (presently at approx.10187.2).

Hourly Stochastic, RSI and CCI are in the oversold zone. ADX is consistently going up indicating strength in downside momentum.

Overall Nifty remains bearish in the Hourly chart.

Figure: Nifty Hourly Chart

Daily Technical:

In the daily chart, Nifty opened marginally lower and the selling pressure continued in today’s session.

The index found support from 50 DMA and Lower Bollinger line.

The probable support in the Daily chart comes at Lower Bollinger line (presently at approx. 10101.1) and 100 DMA (presently at approx. 9979).

On the upside, Nifty may face resistance at 5 Day Low EMA (presently at approx. 10166.1) and 100 DMA (presently at approx.9979).

Daily Stochastic and CCI are in the oversold zone while RSI is the normal zone. Overall Nifty remains bearish in the daily chart.

Learn technical analysis in NSE Academy Certified Technical Analysis course on Elearnmarkets.

Figure: Nifty Daily Chart

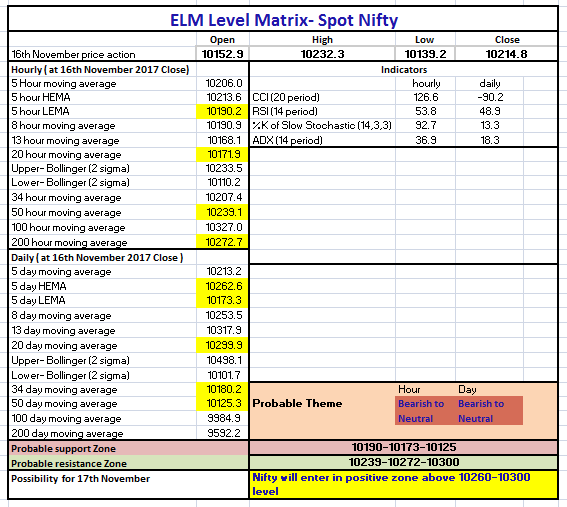

Figure: Nifty Tech Table

To know more about this table watch the video below: