Nifty close: Nifty saw some profit booking in the second half of today’s trading session. There was a heavy selling by FII on Friday’s session at the top so it’s better to be cautious.

Hourly Technical:

In the hourly chart, Nifty moved higher in the first hour but later on gave away the gains in the second half.

The probable support in the hourly chart comes at 34 Hour moving average (presently at approx.10434.4), lower Bollinger line (presently at approx.10418.3) and 50 Hour moving average (presently at approx.104090).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10470.1).

Hourly Stochastic, CCI and RSI are in the normal zone. ADX is still down suggesting some loss of momentum and some profit booking near the lifetime high area.

Overall Nifty remains neutral bullish in the Hourly chart.

Figure: Nifty Hourly Chart

Daily Technical:

In the daily chart, Nifty is still above 5 Day High EMA and also above all short-term moving averages indicating a positive bias.

The probable support in the daily chart comes at 5 DMA (presently at approx.10420.8), 8 DMA (presently at approx.10391.8) and 5 Day Low EMA (presently at approx.10384.4).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx. 10537).

Stochastic, CCI and RSI are in the overbought zone and ADX is still up indicating a gain in upside momentum.

Overall Nifty remains bullish in the daily chart.

Figure: Nifty Daily Chart

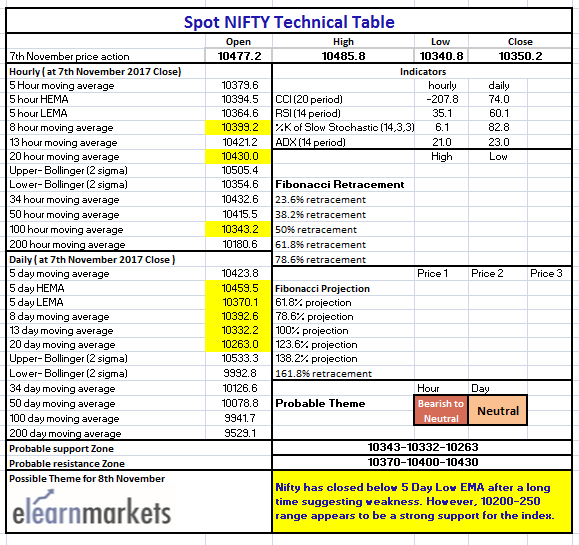

Want to know how to analyze the below table?Watch the video below:

Figure: Nifty Tech Table

Bottomline:

You can read the related blogs here

Happy Reading!!