Nifty close 10440.5: The benchmark index ended today’s session on a strong note and closed over 10400 for the first time ever. Nifty zooms over 100 points and eyeing 10500 mark.

Hourly Technical:

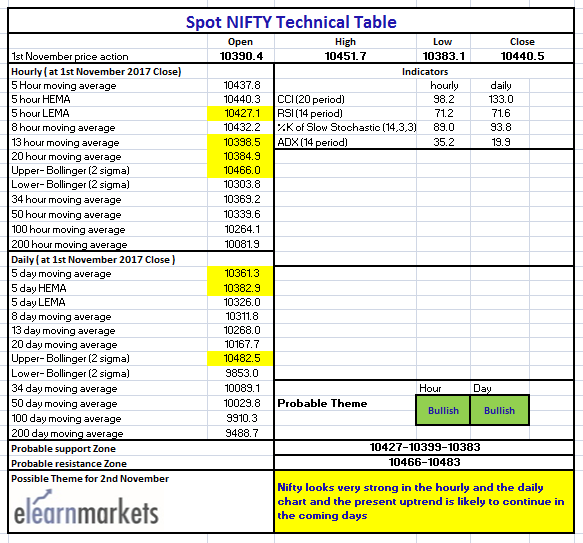

In Hourly chart, Nifty opened gap up of over 50 points and gradually moved higher in today’s session. The probable support in the hourly chart comes at 5 Hour Low EMA (presently at approx. 10427.1), 13 Hour moving average (presently at approx. 10398.5) and 20 Hour moving average (presently at approx. 10384.9).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10466).

Hourly Stochastic and RSI are in the overbought zone while CCI is very close to the lower bound. Moreover ADX is steadily going up suggesting gain of momentum in the hourly chart. Overall Nifty remains bullish in the Hourly chart.

Figure: Hourly Chart

Daily Technical:

In the daily chart, Nifty closed above 5 Day high EMA and most short term moving averages indicating positive bias. The probable support in the daily chart comes at 5 Day High EMA (presently at approx. 10382.9) and 5 DMA (presently at approx. 10361.3).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10482.5).

Figure: Daily Chart

Daily Stochastic, RSI and CCI are in the overbought zone. Moreover, ADX is also upward sloping indicating gain in momentum. Overall Nifty remains very bullish in the daily chart.

Figure: Tech Table