The Indian stock market is a thriving marketplace where investors look for ways to increase their wealth and stabilize their financial situation. However, in the ever-changing world of investments, one vital component is sometimes disregarded: knowing the tax ramifications.

Understanding the complexities of tax rules in the stock market is not only advisable for investors in India but also necessary since taxation policies can have a substantial impact on investing outcomes.

One cannot stress how crucial it is to comprehend the tax ramifications of the Indian stock market. It acts as the cornerstone around which well-informed investment decisions are built, allowing investors to maximize their profits while navigating the complexity of taxation. Furthermore, keeping up with tax legislation is crucial in an ever-changing regulatory landscape to guarantee compliance and minimize risks.

In today’s blog, let us discuss stock market taxes of the Indian Stock Market and also some strategies to reduce taxes.

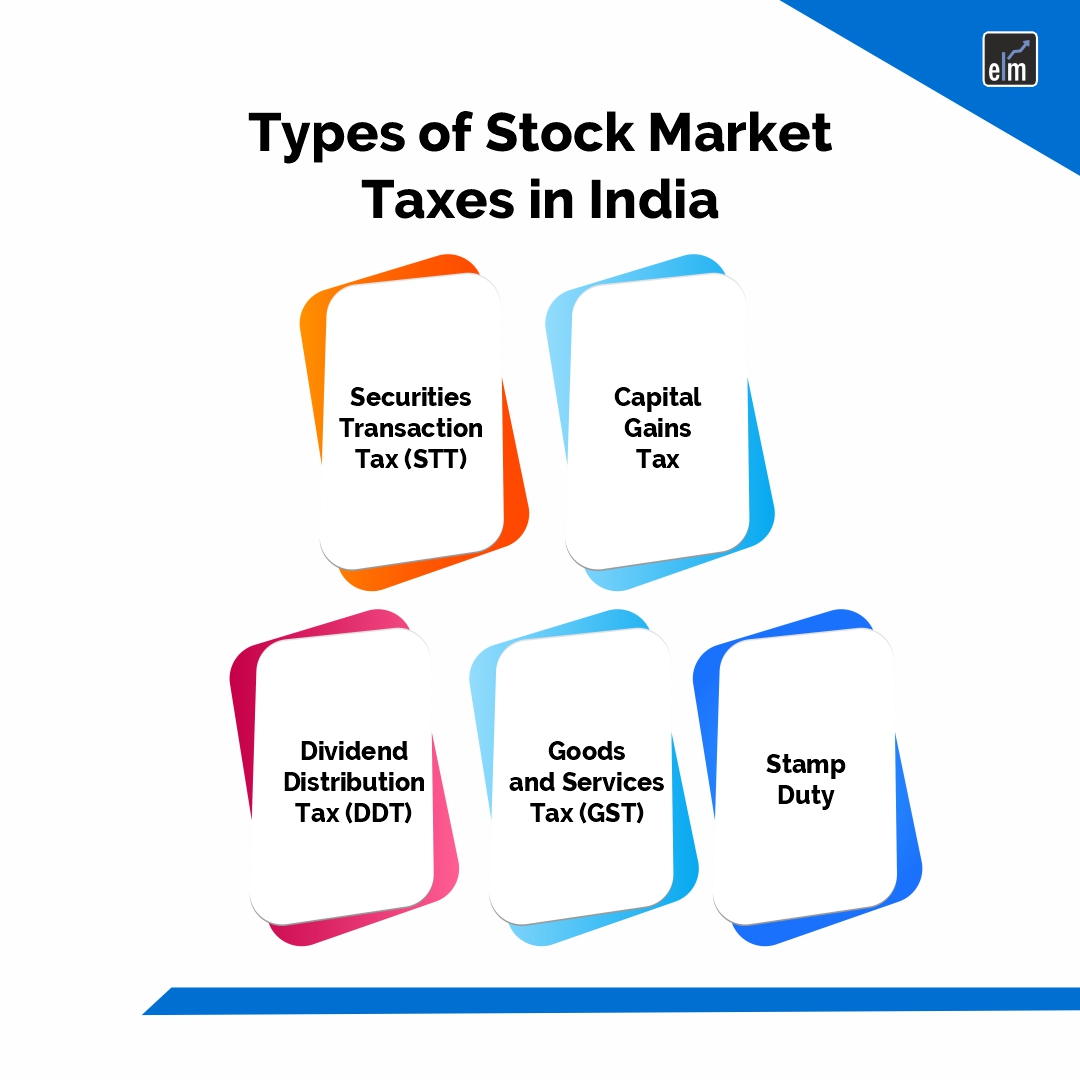

Types of Stock Market Taxes

1. Securities Transaction Tax (STT)

STT is a tax that is applied to the buying and selling of securities that are listed on reputable Indian stock exchanges. It applies to transactions involving both derivatives and equities, such as stocks. Equity delivery, equity intraday, equities futures, equity options, and so on all have different rates.

Stock exchanges receive STT from trading members for each transaction completed through them. The government receives the STT collected from the exchanges.

Certain types of transactions, like those involving government securities, off-market transactions, and other specifically designated transactions, are not subject to the STT.

STT raises the cost of transactions in stock market trading. Therefore, traders and investors must take STT into account when determining their profits and losses.

The government reserves the right to periodically modify the STT rates and regulations. It is important for traders and investors to be informed about any changes to STT exemptions or rates.

The kind of transaction determines the STT rates. The following are the current STT rates for various transaction categories:

- 0.1% is the equity delivery percentage for both the purchase and sell sides.

- Intraday Equity: 0.025% on the sale side (buy and sell on the same day).

- Equity Futures: On the selling side, 0.01%.

- Equity Options: 0.05 percent (on premium) on the sell side.

- Commodity derivatives futures: 0.01% sold side.

- On the sell side, options on commodity derivatives are worth 0.05%.

2. Capital Gains Tax

Profits from the selling of securities are subject to capital gains tax. Capital gains tax in India is divided into two categories:

Short-Term Capital Gains (STCG): Gains on most equities that are held for less than a year are regarded as short-term capital gains and are subject to a certain rate of taxation.

Short-term capital gains are subject to taxation at the taxpayer’s applicable slab rates. The gains are taxed in accordance with the taxpayer’s overall income.

Gains on securities held for a period longer than a year are referred to as long-term capital gains (LTCG). In the past, LTCG on listed securities was free from taxes; however, based on government laws, there might be taxes that apply.

Depending on the kind of asset, different tax rates apply to long-term capital gains.

When it comes to listed securities, like equities and mutual funds focused on equity, any LTCG above Rs. 1 lakh is subject to 10% taxation without the advantage of indexation.

With indexation, long-term capital gains (LTCG) are taxed at a rate of 20% on assets other than real estate and gold.

3. Dividend Distribution Tax (DDT)

DDT was created to tax the corporation that distributes dividends rather than the shareholders who receive them. It was a tax on the company’s dividend profits. DDT did not apply to mutual funds, but it did apply to local businesses, including international corporations’ Indian subsidiaries.

Dividend Distribution Tax (DDT) is a tax that domestic companies in India that distribute dividends to their shareholders are required to pay on the gross dividend amount. The corporation that declares the dividend is required to pay DDT. The Finance Act of 1997 instituted DDT, which is applied at a 15% rate. DDT had an effective rate of 17.65% when surcharge and cess were subtracted. The Income Tax Act’s Section 2(22)(e) applies to dividends, and the tax rate is 30%.

The firm paying out dividends had to subtract DDT before distributing them to shareholders. The business had a deadline for paying the government for the DDT.

3. Goods and Services Tax (GST)

Certain financial services, such as stockbroker brokerage services, may be subject to GST. The specific service may have an impact on the GST rate.

4. Wealth Tax

In India, the wealth tax was eliminated in 2015. On the other hand, people must pay income tax on any income derived from their assets, including stock market investments.

5. Stamp Duty

State-by-state variations in stamp duty rates apply to the transfer of shares and securities.

Let us discuss some tax-efficient investing strategies-

Tax-Efficient Investing Strategies

Here are some Tax-Efficient Investing Strategies that can help you in reducing stock market taxes-

1. Tax-Loss Harvesting Strategy

To maximize returns while lowering tax responsibilities, investing strategies that minimize taxes are crucial. Tax-loss harvesting is a useful tactic that investors can use in the Indian setting to maximize their tax positions. The following explains the significance of tax-loss harvesting and its potential advantages in the Indian setting:

- Offsetting Capital Gains: Profits from the sale of capital assets, including stocks, mutual funds, and real estate, are subject to capital gains tax in India. Investors might balance out capital gains made elsewhere in their portfolio by selling investments that have lost money. This lowers the total amount of tax due.

- Using Losses for Tax Planning: By achieving losses in certain investments to offset gains and lower taxable income, tax-loss harvesting enables investors to proactively manage their tax obligations. It gives investors a tool for optimizing and planning their taxes.

- Long-Term and Short-Term Capital Gains: Depending on how long an asset is held, capital gains in India are classified as either long-term or short-term. Compared to long-term capital gains, short-term capital gains are subject to higher tax rates. Harvesting tax losses can be especially helpful in offsetting capital gains that are made during the short term and are subject to higher tax rates.

- Portfolio Management Flexibility: Tax-loss harvesting gives investors the freedom to rearrange their holdings while taking the tax implications into account. It enables investors to deliberately sell underperforming assets without sacrificing their long-term financial objectives.

Strategies for Tax-Loss Harvesting in India

- Finding Losses: Keep a close eye on your investment portfolio to spot any stocks or other assets that have suffered losses. Concentrate on assets that are out of line with your investing goals or are unlikely to make a quick recovery.

- Selling Losing Investments Strategically: Sell losing investments in order to offset gains on other investments. Keep in mind the appropriate holding times and long- and short-term capital gains tax rates.

- Preserving Portfolio Diversification: To preserve portfolio diversification while harvesting losses, reinvest the money from sold investments into new opportunities that meet the same criteria. Make sure your investment plan and risk tolerance are in line with the new investments.

2. Systematic Withdrawal Plans (SWP) to Manage Tax Liabilities

For investors looking to maximize tax efficiency and reduce tax liabilities, SWP should be incorporated into a more comprehensive tax planning strategy.

- Strategic SWP structuring can reduce the tax impact on withdrawals. Investors have the option to arrange their withdrawals to best utilize the capital gains tax treatment.

- Making Use of Long-Term Capital Gains Tax Benefits: Long-term capital gains from equity mutual funds in India are now tax-exempt up to a specified amount (provided the holding period exceeds a year). To take advantage of this tax exemption, investors might use SWP to methodically remove money from their long-term equity mutual fund investments.

- Optimizing Tax Brackets: With the help of SWP, investors may efficiently manage their income levels and tax brackets. Investors may be able to minimize their overall tax obligation by maintaining their taxable income within lower tax bands by spacing out their withdrawals across a number of financial years.

3. Tax-Saving Investment Options

Here are some tax-saving investment options that traders to use reduce their stock market taxes:

1. Equity-Linked Savings (ELSS)

ELSS mutual funds may yield higher returns than conventional tax-saving vehicles because they predominantly invest in equity and equity-related products.

Under Section 80C of the Income Tax Act, investments made in ELSS are eligible for tax deductions up to a total of Rs. 1.5 lakh every fiscal year.

2. Public Provident Fund

PPF is a long-term investment plan with tax advantages and guaranteed returns supported by the Indian government.

Public Provident Fund contributions are tax deductible under Section 80C, while withdrawals and interest are tax-free.

3. Pension Plan for Employees (EPF)

EPF is a retirement savings plan that is required for paid workers and to which both employers and employees contribute.

Subject to the total cap, Section 80C allows for tax deductions on EPF contributions.

4. National Pension System

The Pension Fund Regulatory and Development Authority oversees NPS, a voluntary retirement savings plan (PFRDA).

Section 80CCD(1) allows for tax deductions for contributions made to NPS, and Section 80CCD(1B) allows for further deductions for self-contributions.

5. Fixed Deposits (FDs)

Numerous financial institutions provide five-year tax-saving fixed deposits that guarantee returns while also offering tax advantages.

Subject to the total cap, Section 80C allows tax deductions for investments made in tax-saving mutual funds (FDs).

6. Certificate of National Savings (NSC)

The Indian government offers the National Savings Certificate (NSC) as a fixed-income investment plan via post offices.

Section 80C allows for tax deductions for NSC investments. Interest is accumulated annually but is considered reinvested for tax purposes.

7. Samriddhi Yojana Sukanya (SSY)

A government-backed savings program called SSY is designed to help girls with their financial demands, such as those related to marriage and education.

Section 80C allows for tax deductions for contributions made to the Social Security Trust (SSY), and the scheme permits tax-free withdrawals and returns.

Learn Proven Strategies to Legally Reduce Your Capital Gains Burden with Our Stock Market Courses

Conclusion

Investors can improve long-term wealth building, make well-informed decisions, and maximize their investment portfolios by clearing up the confusion around share market taxes in the Indian stock market. In order to match their investment strategies with their financial goals and tax planning objectives, investors must stay informed about changes in tax laws and regulations and seek professional guidance when needed.

In conclusion, having a thorough awareness of taxes in the Indian stock market enables investors to successfully navigate the investment environment, take advantage of opportunities, and reduce risks all while pursuing financial success.

Dive into understanding Indian stock market taxes! Enhance your skills with our Currency Trading Course today

Visit StockEdge for more Market Updates

Frequently Asked Questions (FAQs)

1. What is Securities Transaction Tax (STT), and how does it affect stock market transactions?

STT is a tax that is applied to stocks bought and sold on the Indian stock exchange. Depending on the kind of transaction, it affects the total cost of the transaction.

2. How are capital gains taxed in India, and what are the implications for stock market investors?

What is Securities Transaction Tax (STT), and how does it affect stock market transactions?

STT is a tax that is applied to stocks bought and sold on the Indian stock exchange. Depending on the kind of transaction, it affects the total cost of the transaction.

3. What was Dividend Distribution Tax (DDT), and how has it changed in recent years?

DDT was a tax that was removed from firms that distributed dividends. Shareholders now owe taxes on their dividends, which affects their total tax obligations.

4. What are tax-efficient investing strategies, and how can investors implement them in the Indian stock market?

The goal of tax-efficient investing strategies is to maximize investment returns while minimizing tax obligations. To efficiently manage their taxes, investors might use strategies such as systematic withdrawal plans (SWP) and tax-loss harvesting.