Disclaimer: This is not tax advice. Readers are advised to consult a tax professional for advice specific to their portfolio.

Long-Term Capital Gains Tax on Shares- Stock market investing can be a lucrative endeavour, but it’s important to understand the complexities of taxation, particularly as they relate to shares’ Long-Term Capital Gains (LTCG).

The desire to create long-term wealth as an investor frequently coexists with the necessity of understanding the tax ramifications of holding shares for a prolonged period of time.

Profits from the sale or transfer of assets, whether movable or immovable, are referred to as capital gains. We refer to these assets as capital.

Depending on how long a seller has held assets before a transaction occurs, capital assets might be split into two categories. They are capital assets with a long term and those with a short term.

In today’s blog, let us understand, Long Term Capital Gain Tax on Shares and how it is calculated-

Table of Contents

What is Long-Term Capital Gains (LTCG)?

Long-Term Capital Gains (LTCG) are the financial rewards for holding stocks and other investments for a longer period of time. Patience is not only a virtue in the world of financial markets, but it’s also a crucial factor in LTCG’s ability to unleash potential wealth.

Governments frequently provide LTCG tax rates at preferential levels to encourage long-term investment. This suggests that the tax burden on profits from long-term assets is frequently lower than that of short-term gains.

Tax Rates with Various Holding Periods

To demonstrate the tax ramifications depending on the holding term, let’s look at an example:

Situation:

- Shares are bought by an investor on January 1, 2024

- The shares will be sold on December 31, 2024

The investor’s gains will be considered short-term capital gains and subject to income tax at the appropriate income tax slab rates if they are sold before January 1, 2024, or within a year of the purchase.

If the investor sells the shares on or after January 1, 2024 (more than a year), the profits will be recognized as long-term capital gains and subject to the appropriate long-term capital gains tax rate.

Importance of Understanding LTCG Tax Implications

Making informed financial decisions requires an understanding of the Long-Term Capital Gains (LTCG) tax implications, which is critical for investors. This is the reason it’s really important:

1. Tax Effectiveness

Investors can strategically organize their investments to take advantage of favorable tax rates for long-term holdings by being aware of the LTCG tax rules. Over time, this may save a significant amount of money on taxes.

2. Planning for Strategic Investments

The choice of investment period is influenced by LTCG tax effects. By carefully organizing their portfolios, investors can match long-term investment opportunities with possible tax advantages with their financial objectives.

3. Confidence in Making Decisions

Investors can choose the best time to buy or sell assets by being aware of the LTCG tax. With this information, you can confidently time transactions to maximize your after-tax profits.

4. Preserving Wealth

Investors might plan to reduce their tax liability by considering the LTCG tax ramifications. Consequently, a greater percentage of gains are preserved, enhancing and maintaining their wealth over time.

5. Managing Risks

A thorough understanding of the LTCG tax consequences is essential to effective risk management. When assessing the risk and return characteristics of their investing plans, investors can take prospective tax responsibilities into account.

Long-Term Capital Gains Tax Rates in India

Long-term capital gains are typically subject to a 20% tax charge (plus any applicable surcharge and cess). However, in some exceptional circumstances, the taxpayer may elect to have the gain subject to a 10% tax charge (plus any applicable surcharge and cess). The following situations are the only ones where taxing long-term capital gains at 10% is advantageous:

1) Capital gains over Rs. 1,00,000 resulting from the sale of listed securities (Section 112A);

2) Capital gains over Rs. 1,00,000 resulting from the transfer of any of the following assets: a) Any security listed on an Indian stock exchange; b) Any unit of a mutual fund or UTI, regardless of listing ; and c) Zero coupon bonds

Calculation of Long-Term Capital Gains Tax on Shares

Here are the steps for calculating Long-Term Capital Gains Tax:

1. Establish the Holding Period: Ascertain how long the asset was held. The holding time must typically be more than a year in order to be eligible for long-term capital gains treatment.

2. Determine the Cost Basis: The asset’s initial purchase price is the cost basis. It comprises the purchase price as well as any other expenses related to the transaction, such commissions and brokerage fees.

3. Modify the Cost Basis: The cost basis may need to be modified. Adding transaction charges, making improvements to the asset, and depreciating real estate are examples of common modifications.

4. Establish the Selling Price: The amount that the asset was sold for is the selling price. This represents the total amount of money made from the sale.

5. Determine Any Capital Losses or Gains: To get the capital gain or loss, deduct the adjusted cost basis from the selling price= Gain or Loss on Capital = Selling Price − Adjusted Cost Basis

6. Use the Capital Gains Tax Rate: Generally speaking, long-term capital gains are subject to a lower tax rate than short-term gains. The kind of asset and the individual’s income determine the tax rate. For information on applicable rates, see a tax professional or the most recent tax laws.

7. Take into Account Exemptions and Deductions: Certain investments, like specific approved small business stock, can be eligible for tax breaks or exemptions. Gains can also be offset by deductions associated with the sale, such as capital losses.

Exemptions and Deductions

The basic exemption limit is the maximum income below which an individual is exempt from paying any taxes. The basic exemption limit that applies to an individual is as follows:

- The exemption cap for residents who are 80 years of age or above is Rs. 5,00,000.

- The exemption limit is Rs. 3,00,000 for residents who are 60 years of age or older but under 80.

- The exemption threshold for residents under 60 years of age is Rs. 2,50,000.

- The exemption limit for non-resident individuals is Rs. 2,50,000, regardless of the individual’s age.

- The exemption threshold for HUF is Rs. 2,50,000.

Tax Implications for Different Investment Vehicles

The tax consequences associated with long-term capital gains (LTCG) on various investment vehicles may fluctuate depending on the kind of asset and the current tax laws as below-

- Equity Shares: The holding period for LTCG is more than a year.

Tax Rate: LTCG on listed stock shares was subject to 10% tax as of my most recent update, with indexation excluded. But gains up to Rs. 1 lakh were free from taxation; only gains over this amount were subject to it.

- Equity Mutual Funds: The holding period for LTCG is more than a year.

Tax Rate: LTCG on equity-oriented mutual funds was taxed at 10% without the advantage of indexation, similar to equity shares, with gains up to Rs. 1 lakh being excluded.

- Debt mutual funds: The holding period for LTCG is more than three years.

Tax Rate: Debt mutual fund LTCG was subject to a 20% tax rate with the benefit

- Real Estate: Over two years is the holding period for LTCG.

Tax Rate: With indexation, the long-term capital gains (LTCG) on real estate sales is taxed at a rate of 20%.

- Gold: More than three years is the holding period for LTCG.

Tax Rate: 20% LTCG with indexation is applied to the sale of physical gold.

Comparison with Short-Term Capital Gains Tax

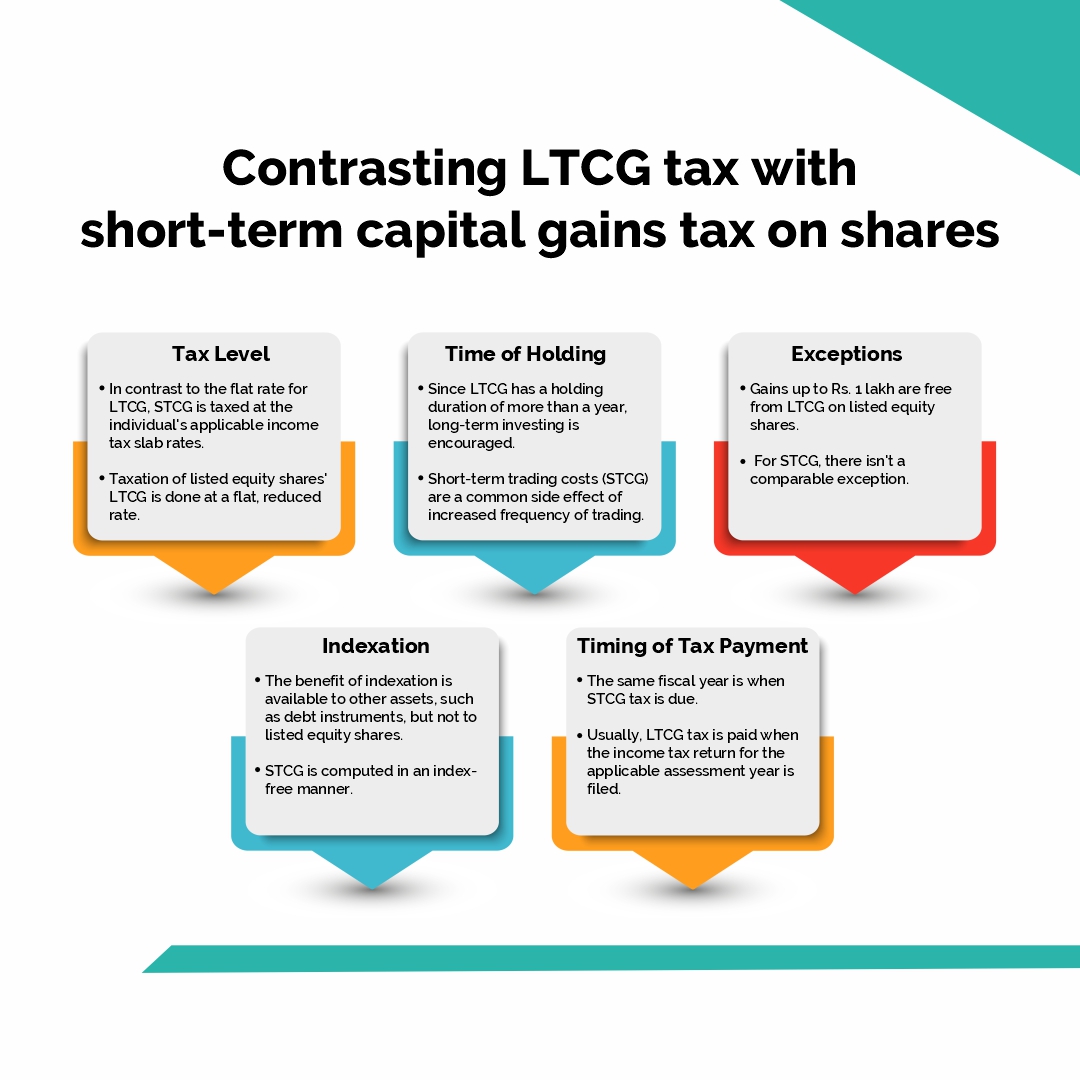

Contrasting LTCG tax with short-term capital gains tax on shares:

Tax Level

- In contrast to the flat rate for LTCG, STCG is taxed at the individual’s applicable income tax slab rates.

- Taxation of listed equity shares’ LTCG is done at a flat, reduced rate.

Time of Holding

- Since LTCG has a holding duration of more than a year, long-term investing is encouraged.

- Short-term trading costs (STCG) are a common side effect of increased frequency of trading.

Exceptions

- Gains up to Rs. 1 lakh are free from LTCG on listed equity shares.

- For STCG, there isn’t a comparable exception.

Indexation

- The benefit of indexation is available to other assets, such as debt instruments, but not to listed equity shares.

- STCG is computed in an index-free manner.

Timing of Tax Payment

- The same fiscal year is when the STCG tax is due.

- Usually, LTCG tax is paid when the income tax return for the applicable assessment year is filed.

Conclusion

Important to Indian investing is the Long-Term Capital Gains (LTCG) tax, which is levied on assets held for more than a year. It promotes long-term investment at a fixed 10% rate for listed equity shares with exemptions. In order to make the best financial decisions possible, investors need to understand the regulations, take exemptions into account, plan carefully, and consult experts.

Frequently Asked Questions (FAQs)

What is LTCG?

The profit from the sale of assets (such shares or real estate) held for more than a year is referred to as long-term capital gain (LTCG).

What is LTCG?

The profit from the sale of assets (such shares or real estate) held for more than a year is referred to as long-term capital gain (LTCG).

Are Indexation Benefits Applicable to LTCG on Shares?

No, LTCG on listed stock shares is not eligible for indexation advantages; however, other assets, such as debt instruments, may be.

Visit StockEdge for more Market Updates

I want to learn the best ways to earn money