Inflation-Indexed bonds-Bonds tied to inflation are special financial instruments used to guard against inflation. The rate at which prices for goods and services are generally rising is known as inflation.

Over time, it reduces the purchasing power of money, which may have a detrimental effect on fixed-income assets.

Investors can make better decisions regarding their portfolios by being aware of inflation.

Bonds that have their principal and interest payments modified for inflation are known as inflation-linked bonds. As a result, the bond’s value rises in line with inflation, acting as a buffer against the depressing impacts of growing costs.

These bonds, which are issued by businesses and governments, may be a desirable choice for investors looking to hedge against the risk of inflation. Inflation-linked bonds are primarily designed to assist investors in maintaining their purchasing power.

Because of their propensity to show little association with other asset classes, they are a vital instrument for investing portfolio diversification.

They also have a significant impact on the financial sector since they enable businesses and governments to borrow money at cheaper interest rates when there is inflation.

In today’s blog let us discuss inflation-indexed bonds-

Table of Contents

What are Inflation-Indexed Bonds?

Bonds with fixed income that are indexed to inflation are known as inflation-linked bonds. These assets, which are often provided by federal governments, are inflation-indexed. This implies that they are indexed to inflation, meaning that the interest component and the principal investment fluctuate in tandem with the rate of inflation.

They are frequently linked to the consumer goods and services price index. The US government, for example, is linked to the Consumer Price Index.

How Inflation-Indexed Bonds Work?

Inflation-linked bonds are tied to the costs of consumer goods as measured by an inflation index, such as the consumer price index (CPI). Each country has its own method of calculating those costs on a regular basis.

In addition, each nation has its own agency responsible for issuing inflation-linked bonds. For example- In the US, Treasury the U.S. Treasury sells inflation-indexed savings bonds (I bonds) and inflation-protected securities (TIPS), which are based on the value of the country’s CPI.

The U.K. Debt Management Office issues inflation-linked gilts in the United Kingdom that are correlated with the retail price index (RPI) of that nation. Real return bonds issued in Canada are issued by the Bank of Canada.

The Reserve Bank of India (RBI) is the entity that issues inflation-indexed bonds for India.

For inflation-linked bonds, the bond’s outstanding principal typically increases when inflation increases. Therefore, when inflation happens, the bond’s face value, or par value, increases. In contrast, the value of other kinds of assets frequently declines when inflation increases.

Inflation-linked bonds also modify the interest rate they pay out. Inflation-linked bonds can mitigate the actual effects of inflation on bondholders by offering these advantages.

Types of Inflation-Indexed Bonds

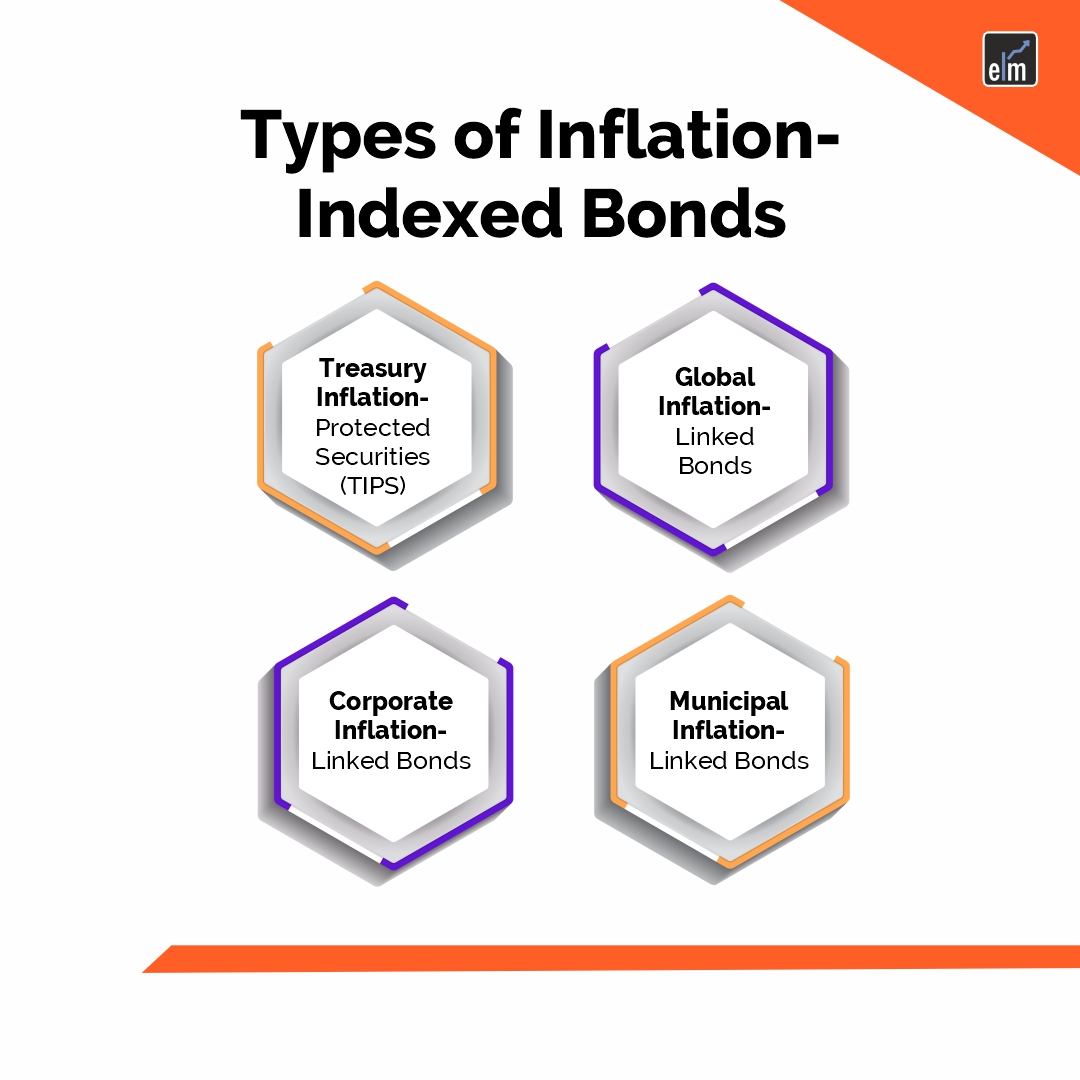

Treasury Inflation-Protected Securities (TIPS), global inflation-linked bonds, corporate inflation-linked bonds, and municipal inflation-linked bonds are among the various varieties of inflation-linked bonds–

1. Treasury Inflation-Protected Securities (TIPS)

TIPS are the most well-known kind of inflation-linked bond, and they are issued by the US Department of Treasury.

As determined by the CPI, they offer investors protection against inflation. Because TIPS are guaranteed by the full faith and credit of the United States government, they are regarded as low-risk investments.

2. Global Inflation-Linked Bonds

Governments all across the world issue global inflation-linked bonds, which give investors the chance to diversify their portfolios regionally.

These bonds are comparable to TIPS, but depending on the country of issuance, they might be correlated with various inflation indices. Global inflation-linked bonds that are well-known include French OATi bonds and UK Index-Linked Gilts.

3. Corporate Inflation-Linked Bonds

Private corporations issue corporate inflation-linked bonds, which have the potential to yield greater than government-issued bonds because of the higher risk attached to corporate issuers.

These bonds are appropriate for investors looking for higher returns with an inflation hedge because they expose them to both credit risk and inflation protection.

4. Municipal Inflation-Linked Bonds

Municipalities and local governments offer municipal inflation-linked bonds to finance public works initiatives. Due to the interest income’s typical exemption from federal income taxes and, occasionally, state and municipal taxes, these bonds provide tax advantages.

They contribute to portfolio diversity and offer inflation protection, just like other inflation-linked bonds.

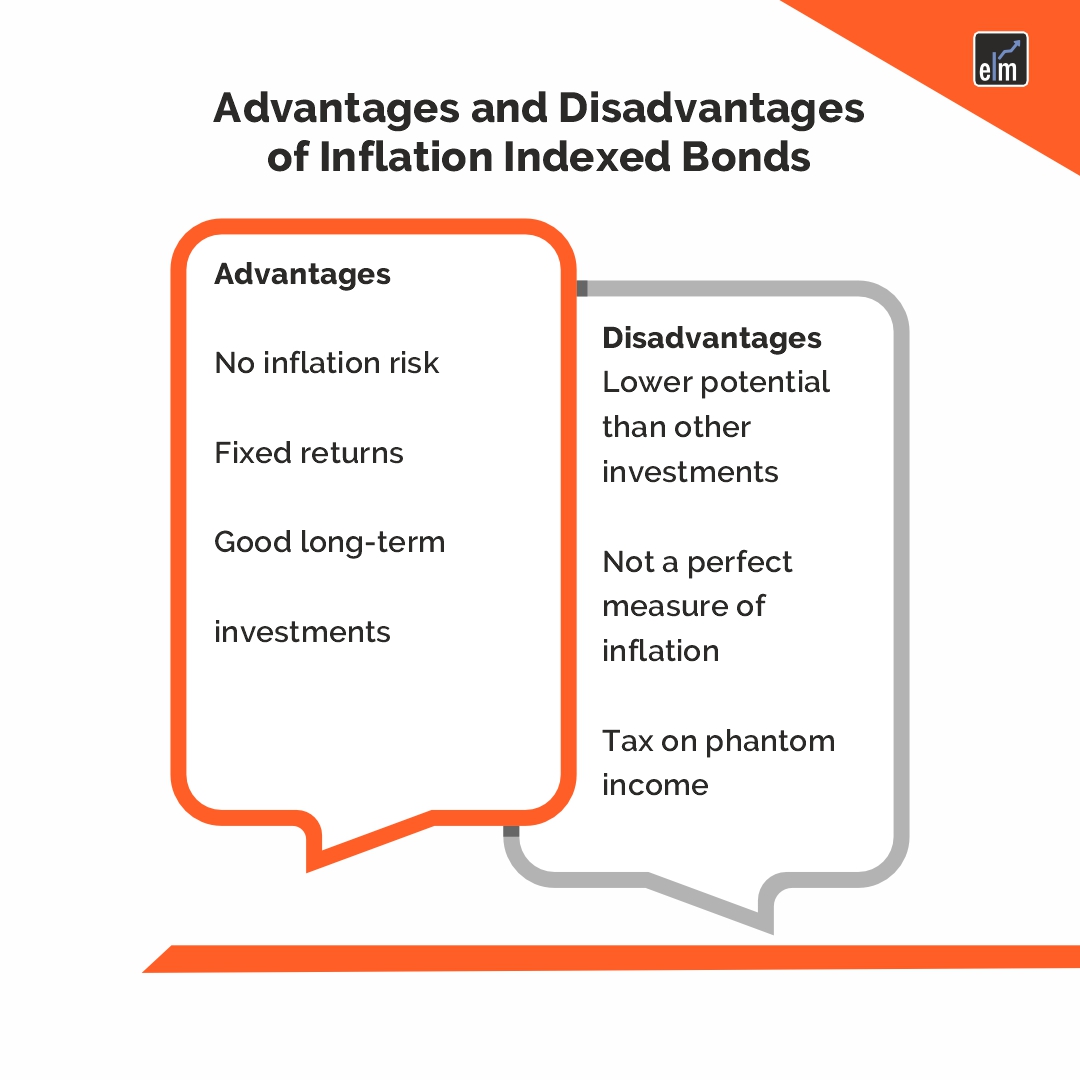

Benefits

Investors can profit from inflation-linked bonds in a number of ways, such as reduced volatility, portfolio diversification, preservation of real return, and protection against inflation risk.

1. Protection Against Inflation Risk

The ability of inflation-linked bonds to protect investors’ portfolios from the depletion caused by inflation is their main advantage. These bonds contribute to maintaining the buying power of the invested capital by modifying principal and coupon payments to reflect changes in inflation.

2. Diversification

Because of their generally low correlation with other asset classes like equities and conventional bonds, inflation-linked bonds are a useful tool for diversification. Investors can lower the overall risk in their portfolios and increase potential rewards by adding inflation-linked bonds.

3. Real Return Preservation

Inflation-linked bonds give yields that are adjusted for inflation, in contrast to nominal bonds, which have fixed interest payments that might not keep up with inflation. This guarantees the preservation of the real return on investment, or the return after taking inflation into account, during the duration of the bond.

4. Lower Volatility

Because their cash flows are adjusted for inflation, inflation-linked bonds often have less price volatility than other fixed-income products. They may be a desirable alternative for investors looking for more reliable investment options because of this feature.

Disadvantages

Below are disadvantages-

1. Less potential than other investments

Compared to other assets like shares or mutual funds, these bonds have less potential. They are unable to provide exceptionally large profits while the market is bullish.

2. Not the ideal inflation gauge

These bonds are correlated with the CPI, which is a measure of inflation. Still, the CPI is far from a perfect inflation measure. Therefore, it is challenging to determine whether these bonds are genuinely providing yields that beat inflation.

3. Phantom income tax

The principal amount of the bond is increased for inflation, but the investor does not get any money until the bond matures. For taxation purposes, the inflation-adjusted amount is frequently seen as gains. Investors will, therefore, be required to pay tax on this “phantom income,” or money they make but haven’t yet received.

Risks

Inflation-linked bonds have advantages, but they can have drawbacks, including interest rate risk, liquidity risk, deflation risk, and tax implications.

1. Interest Rate Risk

Interest rate risk affects inflation-linked bonds just like it does all fixed-income investments. Bond prices typically decrease in response to increases in interest rates, which could mean capital losses for holders of bonds that are sold before they mature.

2. Liquidity

It could be harder to buy or sell some inflation-linked bonds in the secondary market if they are less liquid than their nominal counterparts. Increased price volatility and broader bid-ask spreads may follow from this.

3. Deflation

If certain inflation-linked bonds have lower liquidity than their nominal counterparts, it could be more difficult to buy or sell them in the secondary market. This could lead to wider bid-ask spreads and higher price volatility.

Bottomline

When it comes to long-term investing strategy, inflation-linked bonds can be very important because they offer portfolio diversity and inflation protection. It is imperative to assess their appropriateness based on the unique requirements and risk tolerance of each investor, though.

Investors should carefully examine their financial goals, risk tolerance, and investment horizon before making an investment in inflation-linked bonds. The proper distribution of inflation-linked bonds within a diversified portfolio will be determined in part by these considerations.

Frequently Asked Questions (FAQs)

Are inflation-indexed bonds a good investment?

The purchasing power of investors can be severely reduced by inflation, but ILBs may be able to shield investors from these consequences. ILBs might potentially provide extra advantages in a setting with a larger portfolio. Bonds: A type of debt that a business or government issues to raise money.

What is an inflation-linked bond?

Securities known as inflation-linked bonds, or ILBs, are made to help shield investors against inflation. Inflation-indexed note (ILB) principle and interest payments fluctuate in tandem with the rate of inflation, primarily issued by sovereign governments like the United States and the United Kingdom.

For more Market Insights, visit StockEdge