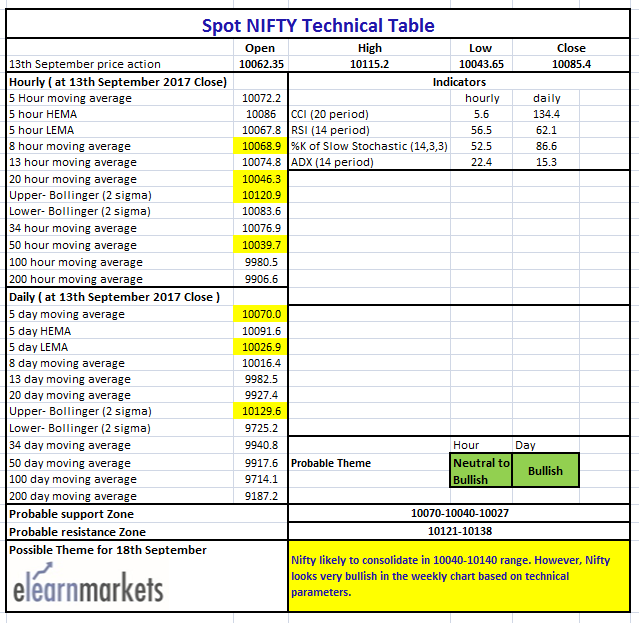

Nifty close 10085.4: Nifty ends volatile session flat amid North Korea tensions. Nifty is likely to consolidate near its lifetime high for sometime before it will resume its next leg of up move.

As mentioned in last day’s report, Nifty took support from 5 DMA (at approx. 10040) in today’s session.

Hourly Technical:

Nifty recovered from its low in the second half of the trading day, however , this is the third time in the last three days, it faced resistance near its lifetime high.

The probable support in the hourly chart comes at 8 Hour moving average (presently at approx. 10068.9) and 50 Hour moving average (presently at approx. 10039.7).

On the upside, Nifty may face resistance at upper Bollinger line (presently at approx.10120.9).

Hourly CCI, RSI, Stochastic are in the normal zone.

Moreover, ADX indicates loss of momentum.

Overall Nifty remains Bullish to neutral in the Hourly timeframe.

Hourly CCI, RSI, Stochastic are in the normal zone.

Moreover, ADX indicates loss of momentum.

Overall Nifty remains neutral to bullish in the Hourly timeframe.

Figure: Hourly chart

Daily Technical:

In the daily chart, Nifty closed above most short-term moving averages but consolidating at the top.

The probable support in the daily chart comes at 5 DMA (presently at approx. 10070) and 5 Day Low EMA (presently at approx. 10026.9).

On the upside, Nifty may face resistance at upper Bollinger line (presently at approx. 10129.6).

Daily Stochastic and CCI are in the overbought zone and RSI is close to the upper bound of the normal zone.

Daily ADX has finally turned up thus indicating a gain in momentum, but this strength will increase once it goes above 20 levels.

Overall Nifty remains Bullish in the Daily timeframe.

Become a technical analysis expert by joining: NSE Academy Certified Technical Analysis course on Elearnmarkets.

We will include about MSCI Emerging market index from this week.

Figure: Daily Chart

iShares MSCI Emerging Markets(Close, approx. 45.59): The MSCI Emerging market index looks bullish at present in daily chart. Based on Fibonacci projections

It can go up to 46.26, which is close to 1.8% higher from present close.

Figure: ishare MSCI Emerging Markets Daily Chart

Weekly Technical:

In the weekly chart, the bearish view due to the presence of long red candle in the first week of August has been totally negated in the last one month. The close above 5 Week High EMA (presently at approx. 10026.2) signals that bulls are strong in the weekly chart.

Weekly stochastic is close to the upper bound of the normal zone while CCI and RSI are already in the overbought zone. Overall Nifty remains firmly bullish in the weekly timeframe.

Figure: Weekly Chart

However, the weekly chart looks very interesting.

It is at a very crucial resistance level and the index got resistance between 43.60-45.90 since 2012.

A decisive move beyond 45.90 will open up strong bullish follow-up a possibility.

Figure: ishare MSCI Emerging Markets Weekly Chart

Figure: Tech Table

Watch the video below to interpret the above table: