The 2023-2024 Budget has been announced, along with some major announcements such as revised income tax slabs, an increase in rebate under the new scheme, and the highest-ever allocation to the Indian Railways.

When presenting the Budget in the Lok Sabha on Wednesday, Finance Minister Nirmala Sitharaman stated that she hopes to build on the foundation of the previous Budget and the blueprint for India@100.

Sitharaman added that this is the first Budget in Amrit Kaal. Union Finance Minister Nirmala Sitharaman revealed the seven priorities governing the Union Budget for 2023 in her Budget speech.

These seven prioritized elements include facets like:

- Green Growth

- Youth Power

- Inclusive Development

- Reaching the Last Mile

- Infrastructure and Investment

- Unleashing the potential

- Launch of Digital Platforms

Let’s discuss the Budget 2023-2024 in detail and also how the Indian stock markets reacted to the budget:

- Important Highlights

- 1. India @100

- 2. Rural Focus

- 3. Focus on macro stability

- 4. First Budget in Amrit Kaal

- 5. Green Growth

- 6. Jet fuel prices hiked by 4% in line with firming international oil prices

- 7. Hub for Sri Ann or Millets

- 8. Agritech Startups

- 9. New program for pharma research

- 10. Big jump in capex

- 11. Long-term loans to states for capex

- 12. PM Awaas Yojana allocation increased

- 13. Cheer for Auto Sector

- 14. The revamped credit guarantee scheme

- 15. Personal finance proposals

- 16. Fiscal deficit pegged at 5.9% of GDP

- 17. DigiLocker expansion for fintech companies

- 18. Calamity cess on cigarettes

- 19. Boost for Tourism Sector

- 20. FY24 nominal GDP growth assumed at 10.5%

- 21. Changes in Tax Regime

- How the Indian Stock Market Reacted to the Budget?

- Bottomline

Important Highlights

Below are some of the important highlights from the budget as presented by our financial minister-

1. India @100

Finance Minister Nirmala Sitharaman maintains her forecast for the current fiscal year growth of 7%. According to experts, India is off to a promising start in the global economy. As such, the budget will hope to build on the previous budget’s foundation and the blueprint for India@100.

2. Rural Focus

The Finance Minister gets to the point, focusing on rural India at the start of his speech. The government announces that the government will spend Rs 2 lakh crore on free food grains for all priority households under the PM Garib Kalyan Yojana.

3. Focus on macro stability

The Finance Minister’s emphasis on strengthening macroeconomic stability will calm the bond and currency markets. The external sector of India has emerged as a source of concern in 2022, and the going may be tough this year as the global economy slows.

Experts, including those within the government, have advocated for fiscal consolidation and bringing the current account deficit back within the red line of 2.5-3 percent of GDP.

4. First Budget in Amrit Kaal

According to FM Nirmala Sitharaman, our vision for the Amrit Kaal includes a technology-driven and knowledge-based economy with strong public finances and a robust financial sector. To achieve this ‘janbhagidari,”sabka saath, sabka prayaas’ is required.

5. Green Growth

Finance Minister Nirmala Sitharaman stated that “green growth” would be one of the budget’s priorities. “Many programmes for green growth are being implemented across various economic sectors… “They will contribute to lowering carbon intensity and creating green jobs,” the FM stated.

6. Jet fuel prices hiked by 4% in line with firming international oil prices

On Wednesday, jet fuel prices were raised by 4% to reflect rising international oil prices, but petrol and diesel prices remained frozen for a record 10th month. According to a price notification from state-owned fuel retailers, the price of aviation turbine fuel (ATF) in the national capital has increased by Rs 4,218 per kilolitre, or 3.9%, to Rs 1,12,356.77 per kl. The increase comes after three rounds of cuts since November.

7. Hub for Sri Ann or Millets

According to the budget, India will become a global hub for Sri Ann or Millets. India is already the world’s largest producer and second largest exporter of millets, and maintaining a focus on domestic production, consumption, and export potential will not only earn us dollars, but will also strengthen India’s soft power.

8. Agritech Startups

The government announced digital public infrastructure for agriculture, which will enable inclusive farmer-centric services relevant for crop protection, providing a boost to the country’s agritech startups.

Agritech startups defied the 2022 funding slowdown by raising large sums from investors, but India has yet to produce its first agritech unicorn.

With the government constructing digital public infrastructure for agriculture, will agritech startups receive more funding and grow faster this year?

9. New program for pharma research

Incentives to encourage R&D investments have been requested by the pharmaceutical industry. According to the FM, a new pharmaceutical research programme will be developed, and the industry will be encouraged to invest in research. Details are pending. If these include significant tax or other incentives, pharma stocks may benefit.

10. Big jump in capex

The Centre’s capex target for 2023-24 is Rs 10 lakh crore, which is 33% higher than the budget estimate of Rs 7.5 lakh crore for 2022-23. The government’s emphasis on capital expenditure to boost economic growth cannot be denied. What really matters, however, is the resumption of the private investment cycle.

For the private sector, the question is which came first: the chicken or the egg? When capacity utilization exceeds 80%, and demand is expected to increase, investments are made. With India’s GDP growth expected to slow in 2023-24 and global growth expected to slow, reducing India’s exports, the private sector has remained on the sidelines.

11. Long-term loans to states for capex

The 50-year, interest-free loan to states for capital expenditure has been increased to Rs 1.3 lakh crore, which is 30% more than the amount allocated for 2022-23. The finance ministry has previously stated that there is a high demand from states for these interest-free loans.

The interest-free loan to states will be part of the Centre’s capital expenditure. While budgetary support for capex is set at Rs 10 lakh crore, the government’s effective capital expenditure for 2023-24 is estimated at Rs 13.7 lakh crore. In comparison, the effective capital expenditure for 2022-23, as estimated by the budget, was Rs 10.68 lakh crore.

12. PM Awaas Yojana allocation increased

The 64 percent increase in allocation for the PM Awaas Yojana to Rs 79,000 crore will benefit commercial vehicles and tractors transporting construction materials.

13. Cheer for Auto Sector

Replacing old government vehicles will boost the economy. It would result in growing orderbooks for automakers, increased output, and job creation. This was last done on a large scale in India around 2008, following the collapse of Lehman Brothers.

14. The revamped credit guarantee scheme

According to the FM, the revamped credit guarantee scheme for MSMEs will go into effect on April 1, 2023, with an infusion of Rs 9000 crore into the corpus. This will allow for an additional collateral-free credit guarantee of Rs 2 lakh crore rupees, lowering the cost of credit by 1%. Good news for MSMEs still reeling from the effects of the pandemic

15. Personal finance proposals

A one-time, two-year savings scheme for women with a 7.5 percent interest rate and partial withdrawal option.

The maximum deposit limit for senior citizens will range from 15 lakh to 30 lakh. The investment limit in small savings schemes such as Senior Citizen Saving Schemes (SCSS) has been raised to Rs 30 lakh from Rs 15 lakh previously.

The investment limit in the Monthly Income Scheme (MIS) has been raised to Rs 9 lakh for a single account, up from Rs 4.5 lakh previously. The limit for joint accounts has been increased from Rs 9 lakh to Rs 15 lakh.

16. Fiscal deficit pegged at 5.9% of GDP

The fiscal deficit target for 2023-24 has been set at 5.9 percent of GDP in the Union Budget. This would be a 50 basis point reduction from this year’s fiscal deficit target of 6.4 percent, which Finance Minister Nirmala Sitharaman has stated will be met.

According to data released on January 31, the fiscal deficit for the first nine months of 2022-23 was 59.8 percent of the full-year target.

The target for next year is in line with economists’ expectations of 5.9 percent. However, some concerns have been raised, particularly by global rating agencies such as Moody’s Investors Service and Fitch Ratings, about how the 4.5 percent medium-term target will be met by 2025-26.

17. DigiLocker expansion for fintech companies

Finance Minister Nirmala Sitharaman has announced the expansion of the Government’s Digilocker services for the fintech sector. This is good news for fintech startups because the DPI has previously only allowed individuals to store and share certificates such as academic records, driving licences, and PAN cards.

“The availability of documentation will be the focus of the DigitLocker expansion for the fintech sector,” Sitharaman said. “The fintech sector has been facilitated by digital services, PM Jan Dhan Yojana, Indian Stack, and UPI.”

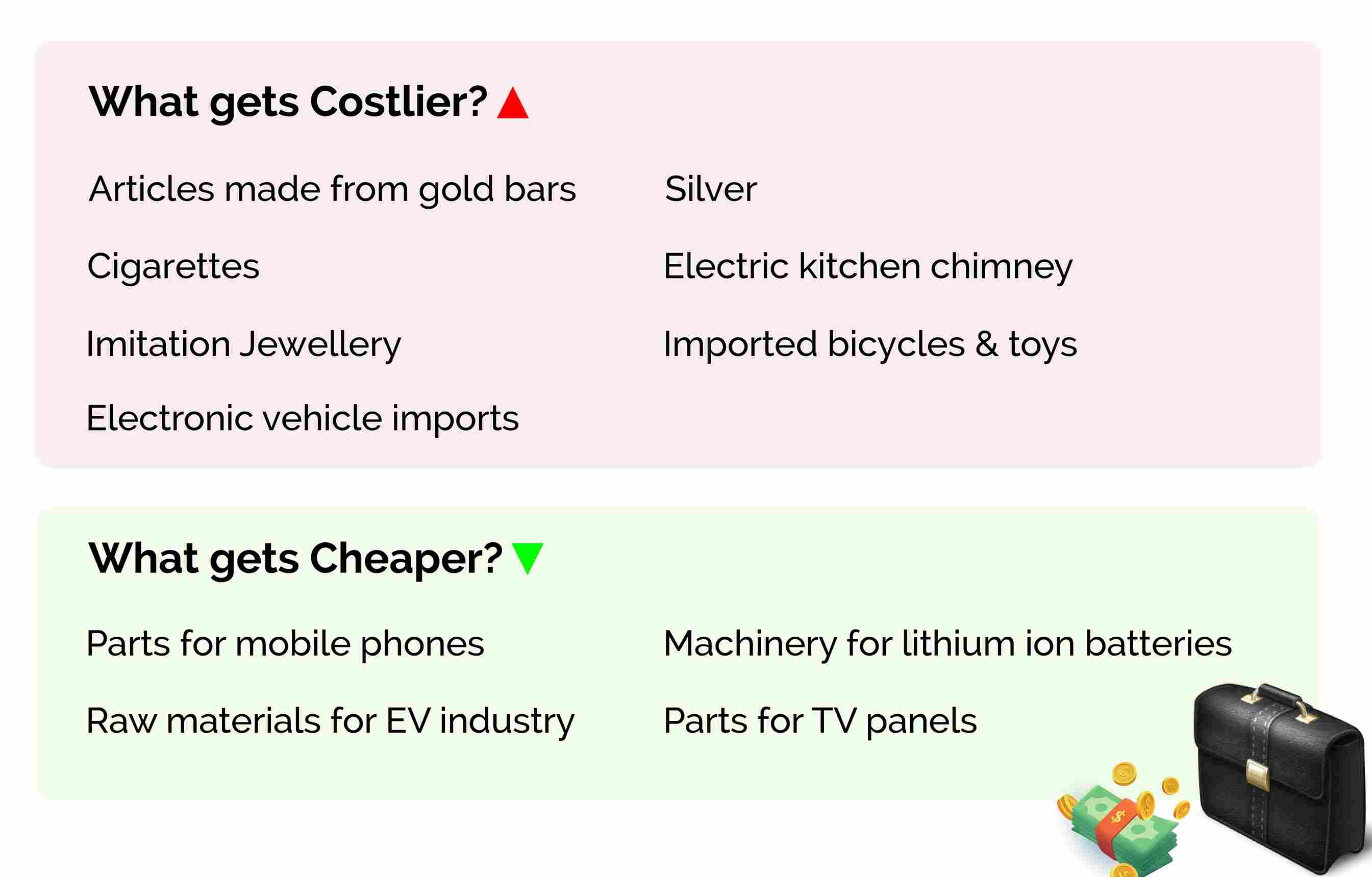

18. Calamity cess on cigarettes

Cigarettes are subjected to a 16 percent increase in the calamity cess. Cigarette prices will rise as a result, potentially slowing volume growth in the short term. ITC will be impacted, but so will other tobacco companies.

19. Boost for Tourism Sector

Investors cheered Finance Minister Nirmala Sitharaman’s push for the tourism industry in the Budget 2023, which boosted hotel stocks. Sitharaman emphasised the tourism sector’s enormous potential for job creation and entrepreneurship. “Tourism promotion will be undertaken on a mission basis, with the active participation of states’ convergence of government programmes and public-private partnership,” Sitharaman said in her budget speech.

You can also join our course on Online NSE Academy Certified Capital Market Professional (E-NCCMP)

20. FY24 nominal GDP growth assumed at 10.5%

The government has assumed a nominal GDP growth rate of 10.5 percent for 2023-24, according to Finance Minister Nirmala Sitharaman’s Budget 2023. The nominal GDP growth assumption of 10.5 percent is in line with economists’ expectations.

21. Changes in Tax Regime

Below are the changes in the tax regime-

- Change in LTCG Tax

In the Budget 2023, a limit of Rs 10 crore has been proposed on the maximum deduction that can be claimed under sections 54 and 54F of the Income-tax Act of 1961 on long-term capital gains reinvested in a residential property.

- Capital Gains on Electronic Goods

According to Budget 2023, the conversion of physical gold into electronic gold receipts and vice versa by a SEBI-registered Vault manager is not considered a capital gains transfer.

- LTCG tax on market-linked debentures

Gains on the transfer, redemption, or maturity of market-linked debentures will be taxed as short-term capital gains under the Income-tax Act of 1961 Section 50AA.

- Tax rule for online gaming

Budget 2023 proposed TDS and taxability on net winnings at the time of withdrawal or at the end of the fiscal year for online games. Furthermore, TDS would be exempt from the Rs 10,000 threshold. The Rs 10,000 TDS threshold limit for lottery, crossword puzzles, and other games will remain in place, but it will only apply to aggregate winnings during a fiscal year.

- Income Tax Changes

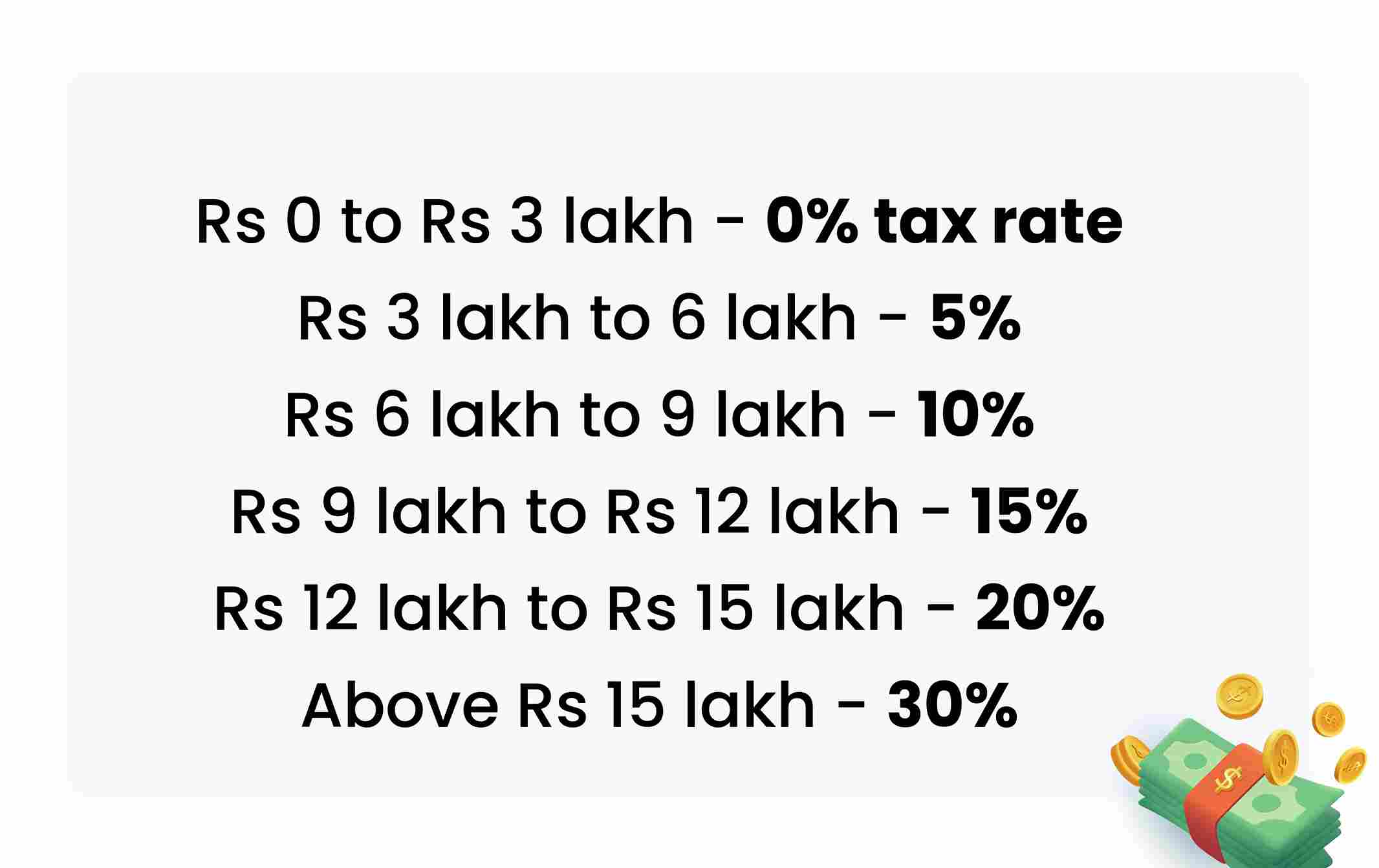

For those opting for the new tax regime, the total income limit for rebates under section 87A of the Income-tax Act of 1961 has been raised from Rs 5 lakh to Rs 7 lakh. Simply put, if your taxable income is less than Rs 7 lakh, you are exempt from paying income tax under the new tax regime.

Under the new tax regime, the basic exemption limit has been increased from Rs 2.5 lakh to Rs 3 lakh. Individuals earning up to Rs 3 lakh are exempt from paying income tax under the new regime, as shown below:

How the Indian Stock Market Reacted to the Budget?

Domestic indices lost ground, slipping into negative territory before finishing on a mixed note amid volatility as budget jitters subsided.

During the day, the BSE Sensex jumped over 1100 points, reaching an intraday high of 60,773.44, and the NSE Nifty 50 surpassed 17,970, but indices began to fall immediately after Finance Minister Nirmala Sitharaman’s speech ended, falling nearly 1%.

The BSE Sensex rose 158.18 points, or 0.27%, to 59,708.08, while the Nifty 50 fell 45.85 points, or 0.26%, to 17,616.30.

Bottomline

The Budget places a strong emphasis on capital spending, tax breaks, increasing consumption demand, and assisting SMEs. Furthermore, the government’s commitment to fiscal consolidation bodes well for the interest rate outlook. These factors should help to prepare the economy for the next stage of growth, crowd in private corporate capex, and fuel credit growth for financiers.

MSMEs, which have yet to fully recover from Covid disruptions, will benefit from the revamped credit guarantee scheme, which calls for Rs. 2 lakh crore in credit flow at lower interest rates. Furthermore, the move to link larger companies’ tax deduction on expenditure to timely payments to MSMEs will improve these entities’ liquidity position.

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!