Do you know that we can borrow and lend securities of companies? Yes! SLB (Stock Lending and Borrowing) Mechanism is the temporary lending of securities by a lender to a borrower of securities for a set period of time and for a set charge.

The SLB mechanism is widely popular around the world because it offers liquidity in the equity market, which improves market efficiency.

Securities lending and borrowing are an OTC (over-the-counter) commodity in most jurisdictions, where custodians allow borrowing and lending transactions between institutions. SLB, on the other hand, is an exchange-traded product in India.

So, in today’s blog let us discuss more this Stock Lending and Borrowing Mechanism and how it works:

What is Stock Lending and Borrowing (SLBM) Mechanism?

The Securities Lending and Borrowing Board (SLB) is a legally approved medium for lending and borrowing securities. SEBI drafted the regulations in May 1997, and they were last updated in November 2012.

In the Indian securities market, all market players, including consumers (excluding Qualified Foreign Investors), have been allowed to lend and borrow securities, but only through an Authorized Intermediary (AI).

Currently, there are only two permitted intermediaries: NCL (NSE clearing limited) and BOISL (BSE clearing corporation). NCL is favored and receives the majority of transactions.

How does it work?

Below is the process of SLB:

- The lender submits an order with the participant, specifying the stock, quantity to lend, time frame, and expected loan fees. Lending fees are quoted per share, hence in the case of Tata Motors, 1000 shares might be lent at Rs 3/share.

- The borrower submits an order with the participant, specifying the stock, time frame, quantity, and lending costs he is willing to pay.

- On the lending fees, order matching works similarly to trading on an exchange.

- To ensure that the lender does not default after saying yes to lend, he is requested for 25% of the total amount of stock he is loaned right away. As soon as the stock leaves his demat account and enters the market, the margin is released.

- Borrower is required to bring in 125 percent of the stock value he is borrowing as margin, as well as additional loan fees. After borrowing the 125 percent, he can sell the stock, thus blocking only 25% of the 125 percent. However, he would have to bring in a total of 125 percent when making the purchase.

- MTM on the margin every day to guarantee there is no possibility of a borrower default.

- The stock is returned to the lender at the end of the contract, and the borrower’s margin is freed.

Which stocks can be lent/borrowed and for how long?

Typically, all equities trading in the F&O segment, as well as a few other stocks mandated by the Exchanges, are available in the SLB segment.

The list of available stocks can be found (Securities Lending & Borrowing –> List of eligible securities). The duration of a lending contract might range from one month to twelve months. The greatest amount of liquidity available for borrowing and lending is usually one month.

Another noteworthy feature is that there is a mechanism in place in case the borrower or lender wishes to make an early repayment or recall.

The borrower would request an early repayment with the fees they are willing to receive, and the lender would want an early recall with the fees they are willing to get.

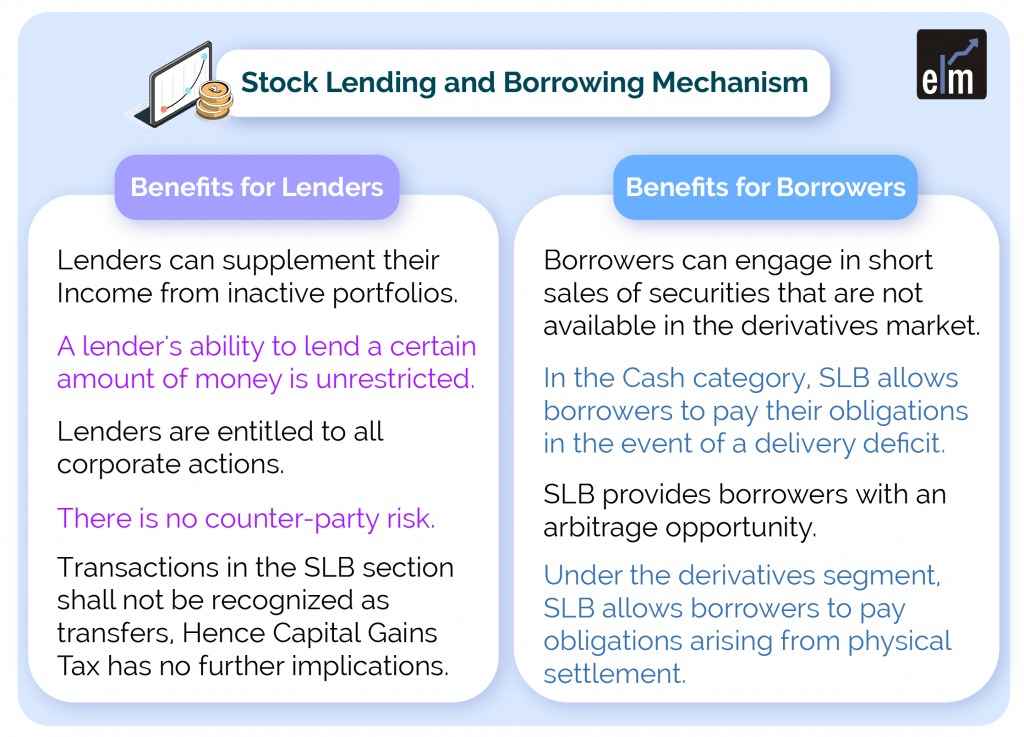

Benefits for Lenders

Below are the benefits for lenders:

- Lenders can supplement their income from inactive portfolios by charging a fee to lend the stock, which varies depending on demand and time value.

- A lender’s ability to lend a certain amount of money is unrestricted.

- Lenders are entitled to all corporate actions, such as dividends and bonuses, that occur throughout the lending period.

- There is no counter-party risk because the Clearing Corporations guarantee all transactions.

- Transactions in the SLB section shall not be recognized as transfers, according to Income Tax Circular No. 2/2008, issued February 22, 2008, and Section 47(xv) of the Act. As a result, Capital Gains Tax has no further implications.

Benefits for Borrowers

Below are the benefits for borrowers:

- Borrowers can engage in short sales of securities that are not available in the derivatives market (once the borrowing is done from the SLB segment).

- In the Cash category, SLB allows borrowers to pay their obligations in the event of a delivery deficit and avoid an auction (seller shortage).

- If there is a price differential between the Cash and Derivatives markets, SLB provides borrowers with an arbitrage opportunity.

- Under the derivatives segment, SLB allows borrowers to pay obligations arising from the physical settlement.

You can join our course on Online NSE Academy Certified Capital Market Professional (E-NCCMP)

What happens in the case of a corporate action like a Dividend payout, stock split or others?

The borrower would pay the dividend to the Exchange on the record date +1 (1 day after the stock goes ex-dividend), and the Exchange would then transfer it on to the shares’ lender.

When a stock split occurs, the borrower’s obligation is proportionately adjusted, and the lender receives the revised quantity.

What’s vital to remember is that it’ll be the same as if the lender held the stock, so he’ll benefit from any corporate action even if he doesn’t have any equities in his Demat account.

Read more about Corporate Action from ELM School

Also, as a lender, you would have no idea who you were lending the stocks to, and the borrower would have no idea who he was borrowing the stocks from.

Bottomline

SLB is thus a smart option for investors to supplement their income by leasing their idle assets for a charge and for a certain period of time. Traders, on the other hand, can borrow stocks in order to take advantage of arbitrage opportunities or meet their stock exchange obligations.

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.