Capital market, also known as the securities market is a market where the funds from the investors are made available to the companies and government for the development of the projects.

Similarly, if a company wants money to expand its business, then it can issue shares in the stock market and investors who want to invest in that company can buy these shares.

The Capital Market includes the bond market as well as the securities market.

It serves as a pathway for entities that have a surplus fund that is being transferred to the ones who need capital for their business purpose.

These funds are being utilized by the companies in multiple ways into productive areas.

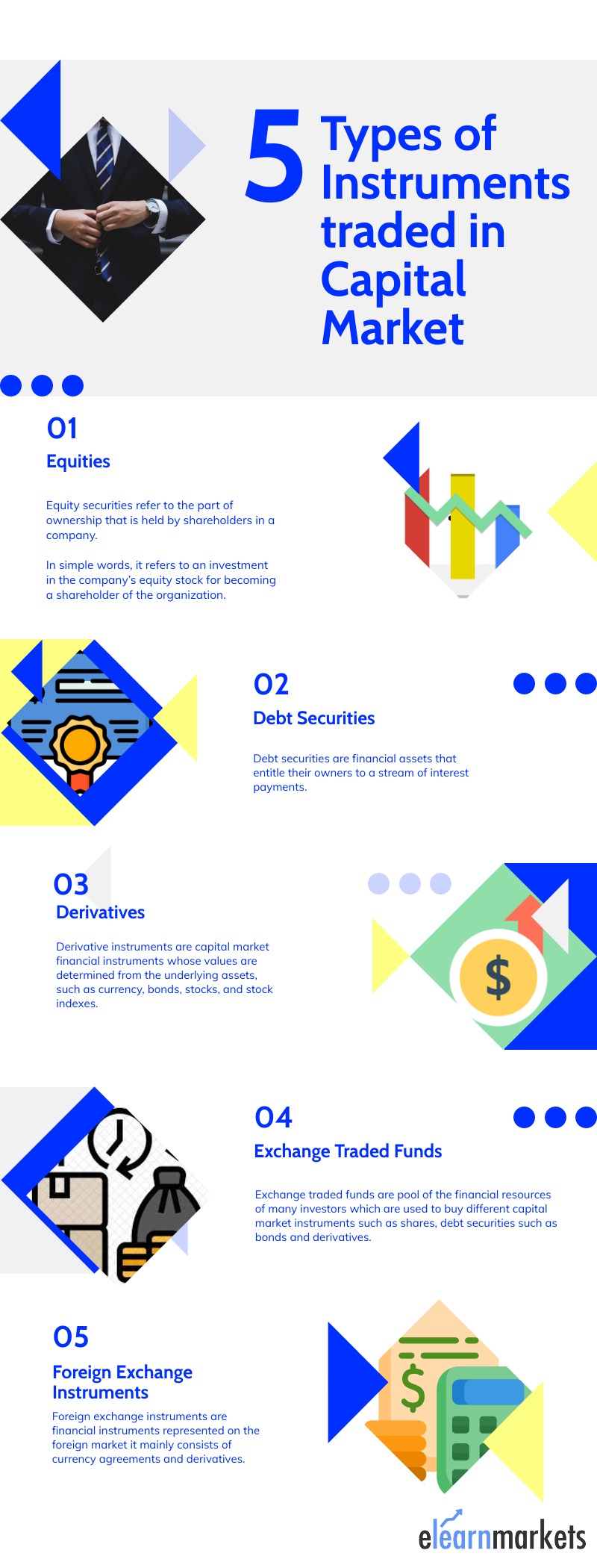

In this blog, we will discuss what are the functions and 5 types of instruments that are traded in the capital market.

What are the Functions of the Capital Market?

It is the best medium of finance for companies and offers different modes of investment avenues to all investors which encourage building capital.

The main functions of the capital market are:

- The capital market acts as the link between the investors and savers.

- It helps in facilitating the movement of capital to more productive areas to boost the national income.

- It boosts economic growth.

- It helps in the mobilization of savings for financing long term investment.

- It facilitates the trading of securities.

- It reduces transaction and information cost.

- It helps in quick valuations of financial instruments.

- Through derivative trading, it offers hedging against market risks.

- It helps in facilitating transaction settlement.

- It improves the effectiveness of capital allocation.

- It provides continuous availability of funds to the companies and government.

What are the types of Capital Market?

Capital Market can be divided into Primary Market and the Secondary Market:

1. Primary Market:

The primary market is a new issue market that mainly deals with the issues of new securities.

It is a place where the trading of financial instruments is done for the first time also known as Initial Public Offer (IPO).

Now, let us discuss the main functions of the primary market:

- Origination: Origination refers to the examination, evaluation, and process of new project proposals in the primary market. It begins before an issue is presented in the market with the help of commercial bankers.

- Underwriting: Underwriting firms ensure the success of new issues that guarantee minimum subscription. When the issue remains unsold then it is bought by the underwriters.

- Distribution: For the success of the issue generally the brokers and dealers who are in direct contact with investors are given the job of distribution.

2. Secondary Market:

The secondary market is another type of capital market where trading takes place for existing securities.

It is known as the stock market where the securities are bought and sold by the investors.

Let us discuss the main functions of the secondary market:

- It regularly informs about the value of security.

- It offers liquidity to the investors for their assets.

- It involves continuous and active trading.

- It provides a marketplace where the securities are traded.

What are the instruments traded in the Capital Market?

Below are the 5 types of instruments that are traded in the capital market:

1. Equities:

Equity securities refer to the part of ownership that is held by shareholders in a company.

In simple words, it refers to an investment in the company’s equity stock for becoming a shareholder of the organization.

The main difference between equity holders and debt holders is that the former does not get regular payment, but they can profit from capital gains by selling the stocks.

Also, the equity holders get ownership rights and they become one of the owners of the company.

When the company faces bankruptcy, then the equity holders can only share the residual interest that remains after debt holders have been paid.

Companies also regularly give dividends to their shareholders as a part of earned profits coming from their core business operations.

2. Debt Securities:

Debt Securities can be classified into bonds and debentures:

1. Bonds:

Bonds are fixed-income instruments that are primarily issued by the centre and state governments, municipalities, and even companies for financing infrastructural development or other types of projects.

It can be referred to as a loaning capital market instrument, where the issuer of the bond is known as the borrower.

Bonds generally carry a fixed lock-in period. Thus, the bond issuers have to repay the principal amount on the maturity date to the bondholders.

2. Debentures:

Debentures are unsecured investment options unlike bonds and they are not backed by any collateral.

The lending is based on mutual trust and, herein, investors act as potential creditors of an issuing institution or company.

3. Derivatives:

Derivative instruments are capital market financial instruments whose values are determined from the underlying assets, such as currency, bonds, stocks, and stock indexes.

The four most common types of derivative instruments are forwards, futures, options and interest rate swaps:

- Forward: A forward is a contract between two parties in which the exchange occurs at the end of the contract at a particular price.

- Future: A future is a derivative transaction that involves the exchange of derivatives on a determined future date at a predetermined price.

- Options: An option is an agreement between two parties in which the buyer has the right to purchase or sell a particular number of derivatives at a particular price for a particular period of time.

- Interest Rate Swap: An interest rate swap is an agreement between two parties which involves the swapping of interest rates where both parties agree to pay each other interest rates on their loans in different currencies, options, and swaps.

You can also learn future and options in detail from our mentors.

4. Exchange-Traded Funds:

Exchange-traded funds are a pool of the financial resources of many investors which are used to buy different capital market instruments such as shares, debt securities such as bonds and derivatives.

Most ETFs are registered with the Securities and Exchange Board of India (SEBI) which makes it an appealing option for investors with a limited expert having limited knowledge of the stock market.

ETFs having features of both shares as well as mutual funds are generally traded in the stock market in the form of shares produced through blocks.

ETF funds are listed on stock exchanges and can be bought and sold as per requirement during the equity trading time.

5. Foreign Exchange Instruments:

Foreign exchange instruments are financial instruments represented on the foreign market. It mainly consists of currency agreements and derivatives.

Based on currency agreements, they can be broken into three categories i.e spot, outright forwards and currency swap.

How to Invest in these Instruments?

The first step that investors need to take in order to invest or trade in these capital market financial instruments is by opening a trading account through a registered broker.

Then you will be able to place a buy or sell order from your trading platform for trading or investing in these financial instruments.

After opening the account you can research the stocks in which you want to invest with the help of StockEdge.

Watch our video below on how to start investing in the stock market:

Bottomline:

All these five types of instruments are part of the capital market. As each of them is unique and has distinguishing features, they are traded in different ways. Thus, it is important to understand these different types of capital market instruments so that you can invest in them according to your financial goals.

You can check out our share market courses online to enhance your knowledge further

Frequently Asked Questions:

What is the difference between the money market and capital market?

Money markets are mainly used for short-term borrowing of the assets which are held for less than a year or one year whereas, Capital Markets are used for long-term securities which have a direct or indirect impact on the capital. Capital markets include both the equity market and the debt market.

How to learn about the capital market?

You can learn about the capital markets through our courses like Certification in Online Foundation Of Capital Market and Online NSE Academy Certified Capital Market Professional (E-NCCMP)

What are the two main types of capital markets?

There are mainly two types of capital markets, primary and secondary markets.

What is the difference between the primary and secondary markets?

The primary market is where a private company goes public by making its shares available for trading to the public while the secondary market is where those shares are traded by investors.

How are Bonds different from Debentures?

Bonds are backed by the collateral or asset of the issuer. On the other hand, debentures are not backed by any of the physical assets or collateral.

Happy Investing!

Really good helpfull keep it up

Hi,

We really appreciated that you liked our blog.

Keep Reading!