As there are many IPOs that are lined up for the coming months, it is important for the investors to know what are things to check before investing in IPO.

Calendar 2021 is said to be a record year for IPOs in India.

- Key Terms used in an IPO:

- 10 Things to Check Before Investing in an IPO:

- 1. Read the Red Herring Prospectus:

- 2. Reasons behind Funds Raising:

- 3. Understanding the Business Model:

- 4. Analyzing Management and Promoter Background:

- 5. Strengths and Weaknesses of the Company:

- 6. Valuation of the Company:

- 7. Health of the Company:

- 8. Investment Horizon:

- 9. Comparative Peers:

- 10. The Company’s Potential in the Market:

- Bottom line:

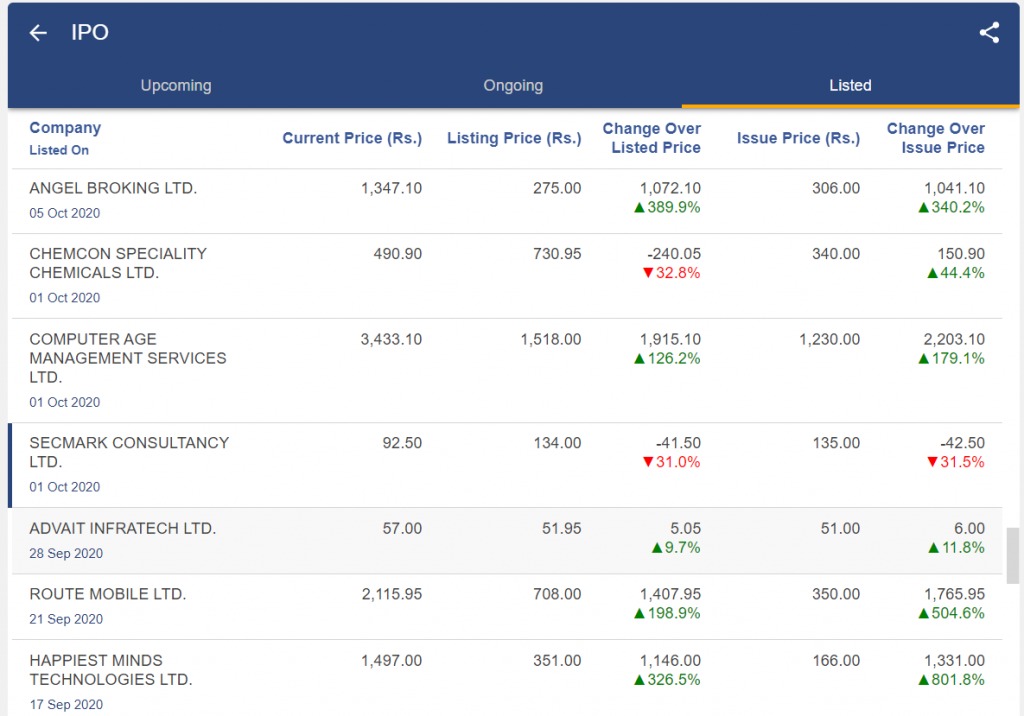

In the last year 2020, Among the stocks which were listed in the exchange, most of them are trading above their issue prices, and some have gained more than 800% as shown below:

Investing in the IPOs is an exciting option for novice investors who just entered the market.

In the upcoming months, big and popular companies like Paytm, Nykaa, Bajaj Energy, and LIC are about to get listed in the market before the end of the financial year 2021.

In the blog, we will discuss the basics of Initial Public Offering (IPO) and what are the 10 Things to Check Before Investing in an IPO.

What is an Initial Public Offering (IPO)?

Initial Public Offering is a process in which a company offers its shares to the public for raising funds.

In an IPO, both institutional, as well as retail investors, can participate and for this reason, Initial Public Offering investments are keenly watched by investors.

The stock’s price is determined by the issue sale during the IPO which may either go up or down and it depends upon the investor interest in the company’s stock.

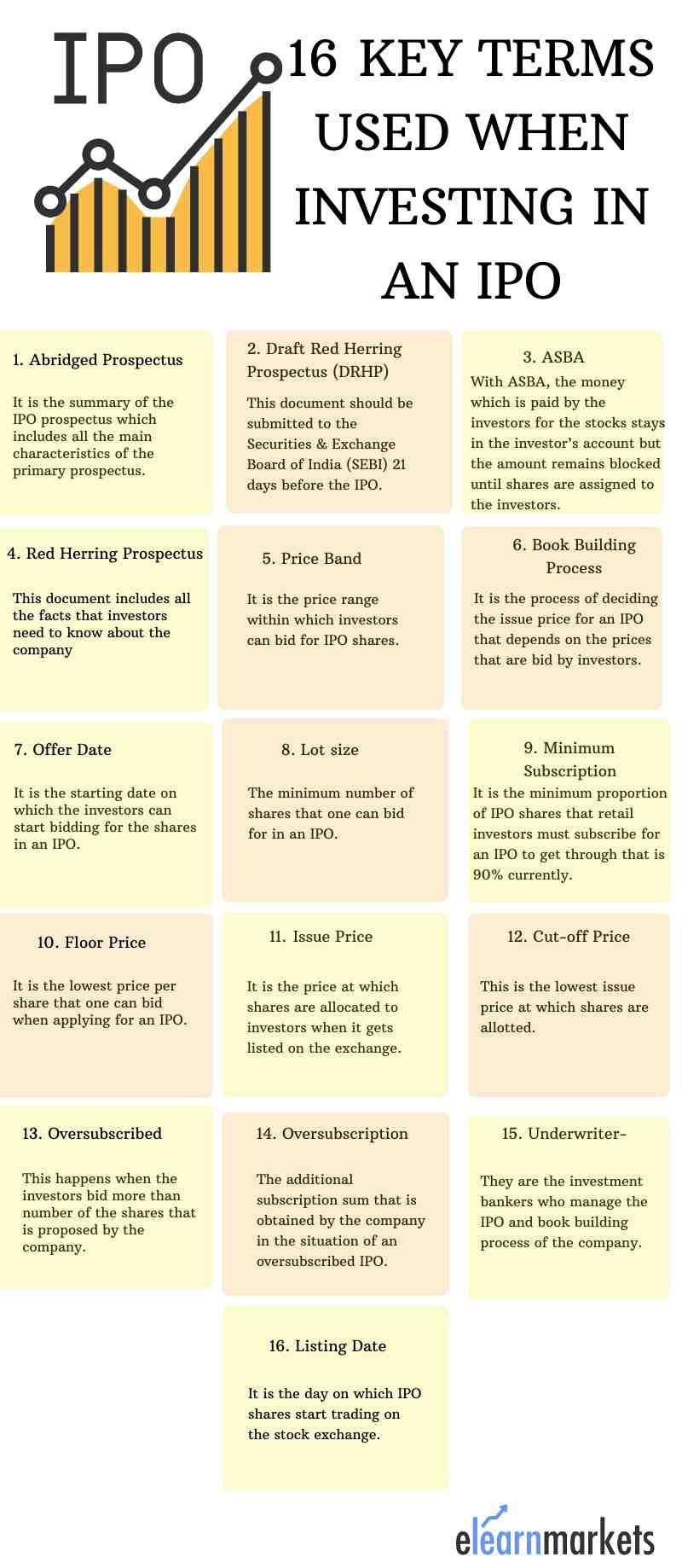

Key Terms used in an IPO:

Below are terms of Initial Public Offering that are frequently used when we discuss or analyze the IPOs:

- Abridged Prospectus- It is the summary of the IPO prospectus which includes all the main characteristics of the primary prospectus.

- Draft Red Herring Prospectus (DRHP) – This document should be submitted to the Securities & Exchange Board of India (SEBI) in 21 days before the IPO.

- ASBA-With ASBA, the money which is paid by the investors for the stocks stays in the investor’s account but the amount remains blocked until shares are assigned to the investors.

- Red Herring Prospectus-This document includes all the facts that investors need to know about the company such as the company’s business account, management qualifications, future approach, IPO price band, etc.

- Price Band-It is the price range within which investors can bid for IPO shares.

- Book Building Process-It is the process of deciding the issue price for an IPO that depends on the prices that are bid by investors.

- Offer Date-It is the starting date on which the investors can start bidding for the shares in an IPO.

- Lot size-The minimum number of shares that one can bid for in an IPO. If you want to bid for more shares, then you can bid in multiples.

- Minimum Subscription-It is the minimum proportion of IPO shares that retail investors must subscribe for an IPO to get through that is 90% currently.

- Floor Price-It is the lowest price per share that one can bid when applying for an IPO.Issue Price-It is the price at which shares are allocated to investors when it gets listed on the exchange.

- Cut-off Price-This is the lowest issue price at which shares are allotted.

- Oversubscribed– This happens when the investors bid more than the number of the shares that are proposed by the company.

- Oversubscription– The additional subscription sum that is obtained by the company in the situation of an oversubscribed IPO.

- Underwriter-They are the investment bankers who manage the Initial Public Offering and book building process of the company.

- Listing Date-It is the day on which IPO shares start trading on the stock exchange.

10 Things to Check Before Investing in an IPO:

Below are the 10 Things to Check Before Investing in an IPO:

1. Read the Red Herring Prospectus:

The Draft Red Herring Prospectus is filed by a company with SEBI when it wants to raise money by selling its shares to the public.

This document describes how the company wants to use the public money that will be raised, and what are the possible risks for investors. Thus, investors must go through this document before investing in any IPO.

2. Reasons behind Funds Raising:

One should note that it is crucial to check how the funds raised from the Initial Public Offering will be utilized by the company.

One should check whether the company wants to repay its debt or if the company is planning to raise funds for partly paying debt and expanding the business or for using the funds for corporate purposes.

This shows that the fund will be properly used in the business, which is a good sign for an investor.

3. Understanding the Business Model:

Investors should understand what kind of business model the company has before investing in the Initial Public Offering.

Once they understand what kind of business the company is into, the next step is to recognize the new opportunity in the market.

The reason behind this is that the magnitude of the opportunity and the company’s capacity to capture market share can make a huge difference when it comes to the growth of the company and shareholder returns.

If the business activities of the company are unclear to the investors, then they should stay away from its IPO.

4. Analyzing Management and Promoter Background:

It is important to check who is running the company as they are the backbone of the company.

Investors should look at the promoters as well as the managers of the company as they play an important role in all its operations and functions.

The management of the company plays an important role in driving the business ahead.

One should check the qualifications and number of years that is spent by the top management in the company as it provides an idea about the company’s working culture.

Read what is the IPO procedure in India

5. Strengths and Weaknesses of the Company:

One should do the SWOT analysis of the company before investing in its Initial Public Offering.

The key strengths and weaknesses of the company can be analyzed from the DRHP. Investors should find out what is the company’s position in the sector in which it operates.

One should try to read about the company from various sources and also about strategies so that investors can study the future prospects of the business.

6. Valuation of the Company:

Investors should also check the valuations of the company as the offer price may be undervalued or overvalued depending on the sectors in which it is operating and also the financial ratios.

7. Health of the Company:

It is important to check the financial performance of the company in the past few years for analyzing whether the company’s revenue or profit is growing consistently or not.

If the revenues are increasing, then investing in its Initial Public Offering can be a good investment. It is crucial for the investors to understand the company’s financial health before investing in its IPO.

8. Investment Horizon:

Before investing in its IPO, an investor should have a clear investment horizon.

They should decide if they are planning to invest in the IPO for just trading purposes on a listing day or want to hold the shares longer.

The reason behind this is that trading strategy would depend on current market situations, on the other hand, long-term one will depend on the company’s fundamentals.

9. Comparative Peers:

Investors should also analyze who are the peers of the company. The DRHP consists of comparisons with the peers based on both financials and valuations.

Investors can analyze the comparative valuations to analyze if the company’s valuations are in line with its peers.

10. The Company’s Potential in the Market:

Investors should also check what is the company’s potential i.e opportunities and threats in the sectors in which it is operating.

You can also watch our video on Why do companies come out with an IPO and How to evaluate any Initial Public Offering below:

Bottom line:

Besides the above factors, investors should also research on their own. If they believe that the company has good growth potential then they should consider investing in the Initial Public Offering. It is important to note that one should invest in an IPO only based on a grey market premium.

Happy Investing!

To know more about latest IPOs visit web.stockedge.com