Do-It-Yourself (DIY) is a phenomenon which is catching people’s attention across various domains in life be it cooking, crafts, hobbies etc.

This is a good vibe as people have started doing things on their own and are becoming independent. It is the feeling of being in total control.

Even the investing domain is not an exception from this DIY bug.

This has been an old concept in investing; but recently it has gained popularity.

In this blog we will be discussing about the DIY investing concepts and also the benefits as well as the disadvantages of this concept:

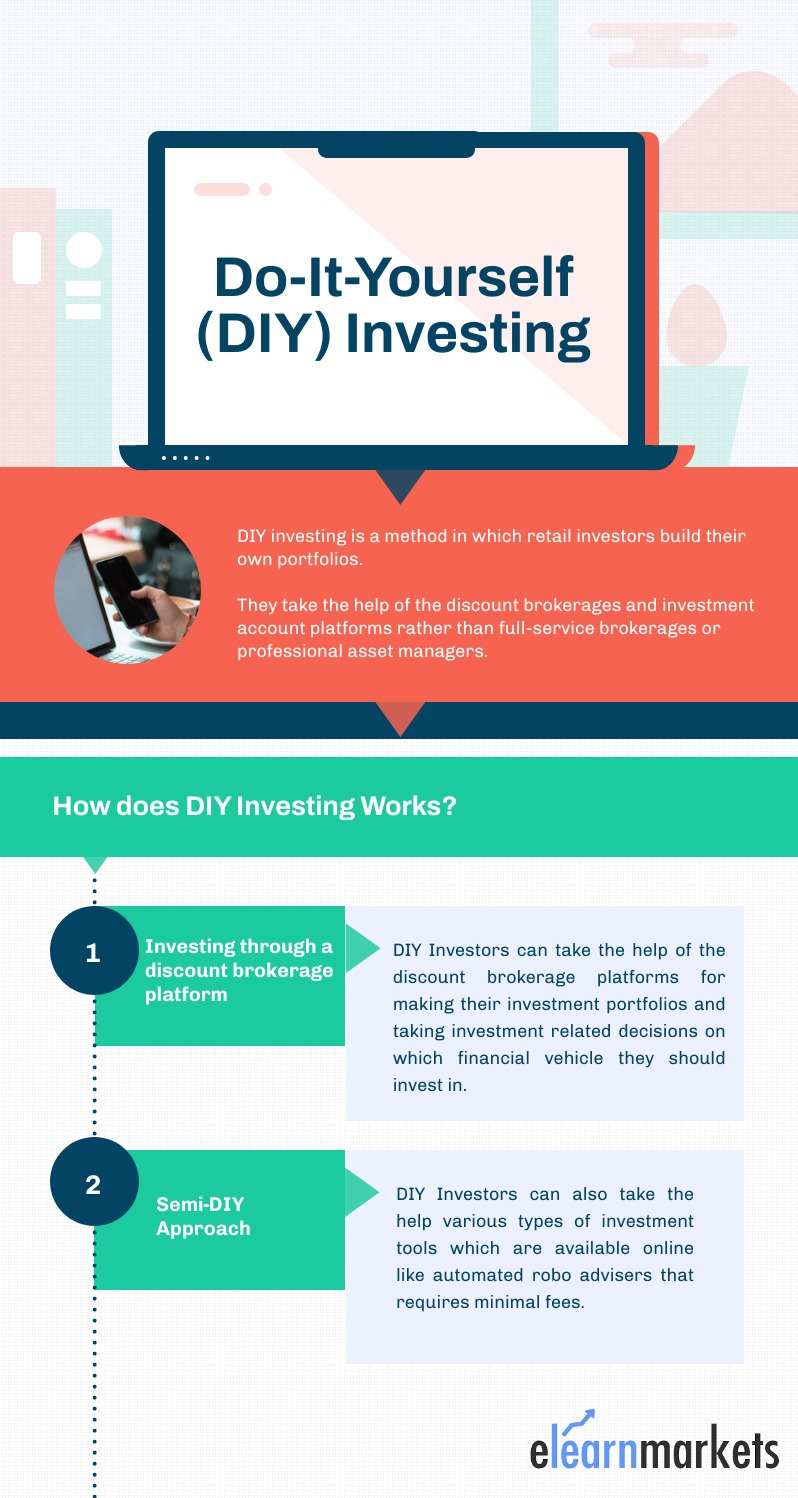

What is Do-It-Yourself (DIY) Investing?

DIY investing is a method in which retail investors build their own portfolios.

They take the help of the discount brokerages and investment account platforms rather than full-service brokerages or professional asset managers.

How does DIY Investing Works?

Many retail investors manage their own investments but in recent years these two concepts have helped a lot of DIY investors i.e. the start of discount brokerages and the availability of various types of online investment tools.

These two tools make it convenient for the investors to build and monitor their own portfolios.

There are also some hybrid financial advice models which integrate some forms of free interactive personal financial advice.

In building a DIY portfolio, investors can take a number of different approaches.

Different Approaches of DIY Investing:

Here are two types of approaches which DIY investors can follow while making their portfolio:

1. Investing through a discount brokerage platform:

DIY Investors can take the help of the discount brokerage platforms for making their investment portfolios and taking investment related decisions on which financial vehicle they should invest in.

They can place their trading orders through these discount brokerage platforms with minimum brokerage fees.

2. Semi-DIY Approach:

DIY Investors can also take the help of various types of investment tools which are available online like algo driven stock scan platforms such as web.stockedge.com.

Steps of DIY Investing:

1. Decide how you want to invest in the stock market

There are many ways to approach stock investing. You can choose from below options which represent how you want to invest in the stock market.

Here are the options:

- I want to choose stocks and funds on my own

- I want an expert to manage the process for me

If you choose option 1 then you have to do everything on your own from researching about the companies to monitoring your portfolio.

2. Choose an investing account:

One needs to have an investment account to start investing in the stocks.

This means you need to open a trading and demat account through a broker who is registered with SEBI and Depository Participant.

An important point: Brokers allow you to open an account with a minimal amount.

3. Know the difference between investing in stocks and funds

Going the DIY route may be difficult, but don’t worry.

Stock investing isn’t that complicated. For many people, stock market investing means choosing among these below two investment vehicles:

- Stocks: If you want to invest in specific companies, then you can do so by buying the stocks of it and making a diversified portfolio by yourself.

- Mutual Funds: or you can invest in different companies by investing in mutual funds.

4. Create a Budget:

The amount of money you need to buy an individual stock depends on how expensive the shares are.

A 30-year-old investing for retirement might have 80% of his or her portfolio in stock funds; the rest would be in bond funds.

5. Manage your Stock Portfolio:

If you follow the steps above to buy stocks over time, you have to revisit your portfolio a few times a year to make sure it’s still in line with your investment goals.

Benefits of DIY Investing:

DIY investing can save investors from paying commission fees to the professional money managers and asset management companies.

Investors are also self-independent when they make their own investment decisions according to their time and financial conditions.

Disadvantages of DIY Investing:

DIY investors do not receive professional advice and advisory services from the professional money managers. They are on their own and the learning curve may be steep.

Also it may be difficult for the DIY Investors to manage a good portfolio.

Good portfolio management is not only just about earning profits when the market’s up, but also curbing losses when the market is down.

This can be difficult for novice investors to maintain.

Furthermore, financial advisors not only advise and help in monitoring the investment portfolios, but they also offer financial advice in other financial areas of their clients’ such as insurance, accounting services, estate planning, and lines of credit, either themselves or through a referral network.

Key Takeaways:

- DIY investing is a method in which retail investors build their own portfolios.

- Many retail investors manage their own investments but they can also take help of discount brokerages and various types of online investment tools.

- DIY investing can save investors from paying commission fees to the professional money managers and asset management companies.

- Investors are also self-independent when they make their own investment decisions according to their time and financial conditions.

- DIY investors do not receive professional advice and advisory services from the professional money managers.

- Good portfolio management is not only just about earning profits when the market’s up, but also curbing losses when the market is down.

- Learning is the Key. You can visit our Stock Market Investing course and enhance your knowledge.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.

Happy Investing!

Very nice topics explain

Hi,

Thank you for reading our blog!!

Keep Reading!