Traders often come across the word “stock ratings” when they see business channels or read financial newspapers.

We often get messages or stock recommendations on whether to buy, sell or hold the stocks.

These are termed as the stock ratings which are given by the research analysts.

In this blog, we will explain what buy, hold, sell, outperform, and underperform stock ratings are and how the knowledge of these stock ratings can help stock traders to make the right trading decisions.

What are Stock Ratings?

A stock rating is a measure of the performance of a stock in a given specific time period.

Analysts and brokerage firms use these ratings when they issue stock recommendations to stock traders and retail traders.

Analysts research financial statements of various companies, talk to management and customers or listen to the conference calls of those companies to arrive

These ratings are usually issued quarterly i.e at intervals of three months.

Stock ratings include a target price which helps traders to understand a stock’s intrinsic value when compared to its market value.

What does the stock rating mean?

Research Analysts give their recommendations on the stock by analyzing financial statements, listening to the company’s conference calls quarterly, and reviewing the company’s management on their future prospects.

These analysts can even contact directly the management and its customers to have a clear idea on how the company is performing as compared to its past performance and to its peers.

Research Analysts also conduct surveys and various researches to know the future prospects of the company.

After the analysis detailed research reports are issued by these investment banks and analysts on the stock.

Types of stock ratings

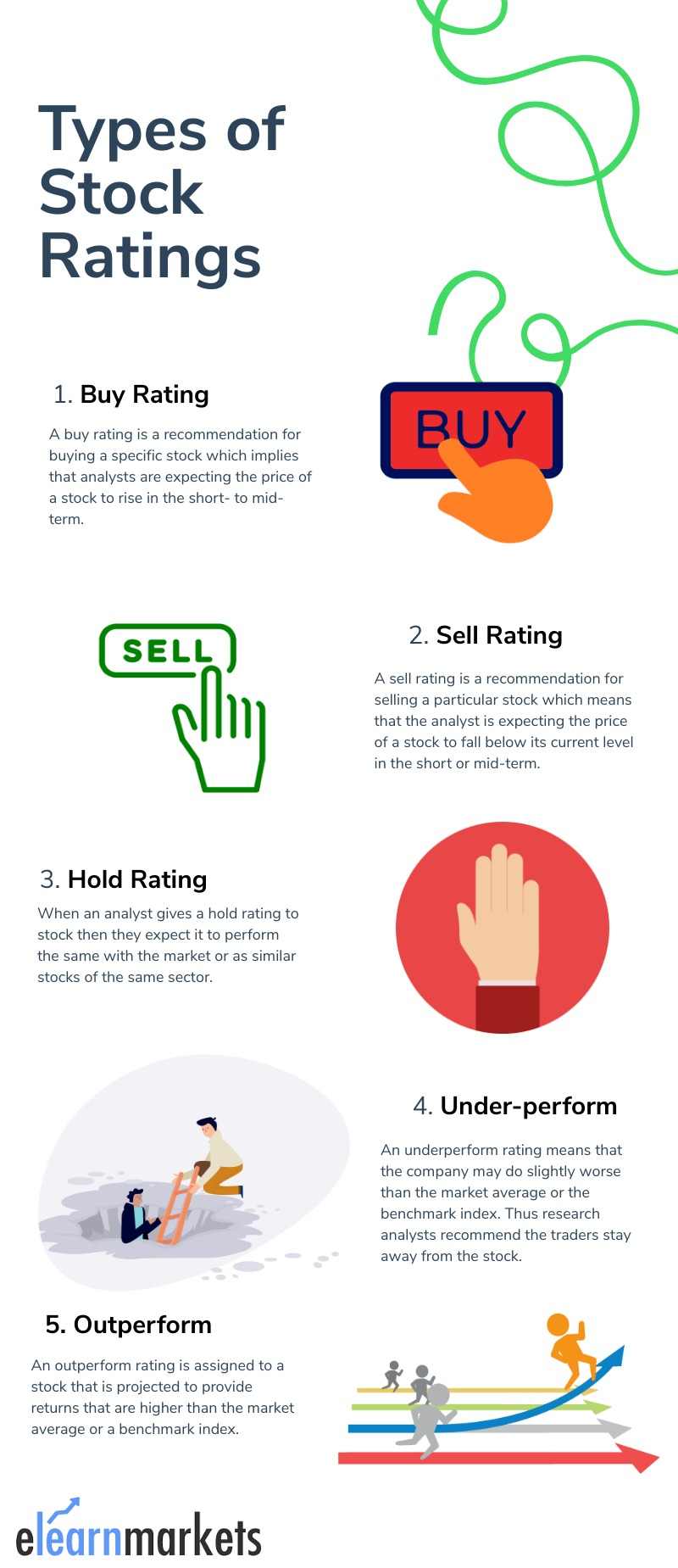

Stock Ratings can be categorized into buy, sell, hold, underperform and outperform ratings:

1. Buy Rating

A buy rating is a recommendation for buying a specific stock which implies that analysts are expecting the price of a stock to rise in the short- to mid-term.

The analysts are usually of the opinion that the stock can surpass the return of similar stocks in the same sector because of reasons such as the launch of a new product or service.

2. Sell Rating

A sell rating is a recommendation for selling a particular stock which means that the analyst is expecting the price of a stock to fall below its current level in tcrehe short or mid-term.

A strong sell rating means that analysts are expecting the price of the specific stock to fall significantly below its current level in the near term.

If any analysts recommend a strong sell rating on any stock, then a particular company may end up losing its vital business from the company.

3. Hold

When an analyst gives a hold rating to stock then they expect it to perform the same with the market or as similar stocks of the same sector.

This rating tells the stockbrokers not to buy or sell the stock but to hold.

A hold rating is assigned to a stock when there is uncertainty in a company for example regarding new products/services.

4. Underperform

An underperform rating means that the company may do slightly worse than the market average or the benchmark index. Thus research analysts recommend the traders stay away from the stock.

For example, if a stock’s total return is 3% and the Nifty’s total return is 6%, then it underperformed the index by 3%.

5.Outperform

An outperform rating is assigned to a stock that is projected to provide returns that are higher than the market average or a benchmark index.

For example, if a stock’s total return is 10% and the Dow Jones Industrial Average’s total return is 6%, it has outperformed the index by 4%.

6. Overweight

An overweight rating on a stock usually means that it deserves a higher weighting than the benchmark’s current weighting for that stock. An overweight rating on a stock means that an equity analyst believes the company’s stock price should perform better in the future.

7. Underweight

Underweight is a sell or don’t buy recommendation that analysts give to specific stocks. It means that they think the stock will perform poorly over the next 12 months. This can mean either losing value or growing slowly, depending on market conditions, but it always means that the analyst believes the stock will underperform its market.

Analyze Stock Rating for investment in the stock market

Though these stock ratings may have an effect on the individual stock that may lead to a sharp move in the stock price on either side, investors may have their own opinions on both stock rating and also the price target.

Key Takeaways

- A stock rating is a measure of the performance of a stock in a given specific time period.

- Analysts research financial statements of various companies, talk to management and customers or listen to the conference calls of those companies to arrive at suitable stock ratings.

- Stock Ratings can be categorized into buy, sell, hold, underperform and outperform stock ratings

Disclaimer: We should not only rely on the stock ratings but also do our own analysis before investing. Do stock analysis on StockEdge for free!

This article is very interesting and has very useful information. Thank you and great work!

Hi,

We are glad that you liked our post.

Thank you for Reading!

Very good knowledgeable article, thank u

Hi,

We are glad that you liked our post.

Thank you for Reading!