It’s that time of the year again when we need to know how to use tax-loss harvesting to improve our returns.

We need to sit down and calculate our total income and expenditure to know our tax liability for the year. As the current financial year comes to a close this March 31st, we thought it would be a good idea to enhance your knowledge about taxation.

Though as honest citizens, it is necessary to pay taxes to ensure our country’s progress and smooth functioning. Generally speaking, no one likes giving away a huge chunk of their earnings as income tax. For someone who falls under the highest income tax bracket, their total tax liability could be close to 30%, which has a huge effect on their finances.

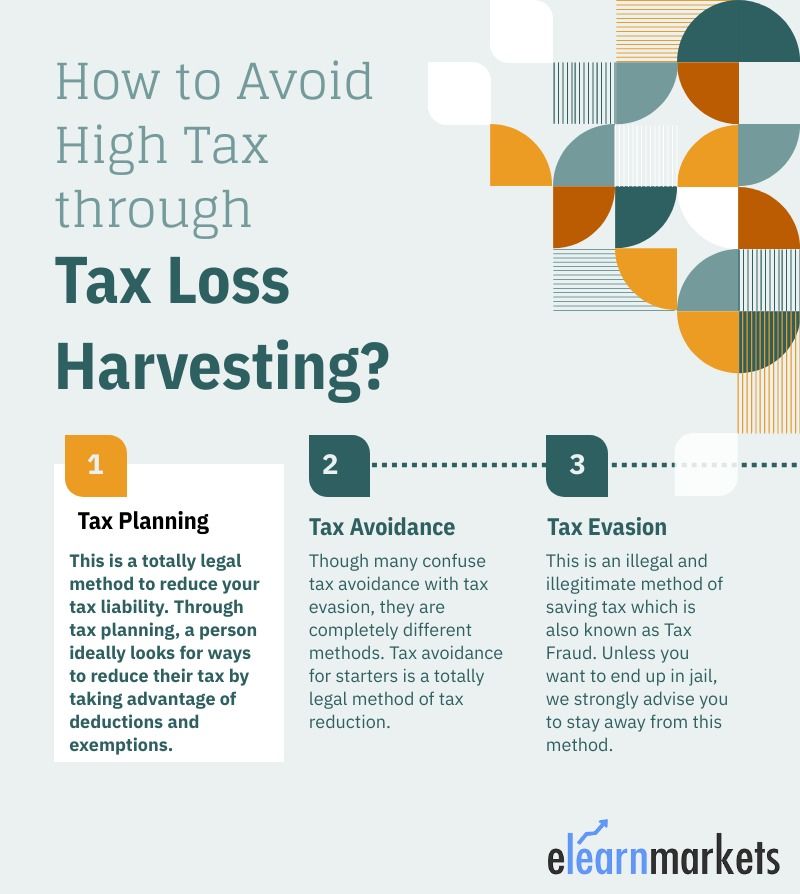

So there are essentially 3 ways a person can reduce their tax liability:

- Tax Planning – This is a totally legal method to reduce your tax liability. Through tax planning, a person ideally looks for ways to reduce their tax by taking advantage of different means such as deductions and exemptions.

- Tax Avoidance – Though many confuse tax avoidance with tax evasion, they are completely different methods. Tax avoidance for starters is a totally legal method of tax reduction. It is the use of smart strategies to minimise a person’s tax liability by taking advantage of various tax related instruments and laws.

- Tax Evasion – This is an illegal and illegitimate method of saving tax which is also known as Tax Fraud. Unless you want to end up in jail, we strongly advise you to stay away from this method.

Since we have already covered these topics under Tax Planning in our previous blogs, here we will talk about Tax Avoidance methods extensively.

To read more about Tax planning, click here – 7 Best Tax Saving Schemes for Filing Income Tax Return

One really effective tax avoidance strategy is Tax Loss Harvesting!

All about Tax Loss Harvesting

The profits that we make from our investments in listed stocks or equity mutual funds are termed as Capital Gains.

The investments which are redeemed or the profits of which are booked within 12 months are subject to a Short Term Capital Gains(STCG) Tax of 15%. On the other hand, investments redeemed after a period of 1 year are subject to a Long Term Capital Gains Tax(LTCG) of 10%.

Note: LTCG is only applicable on profits above Rs.1 lakh. So up to Rs.1 lakh is exempt from the 10% LTCG tax.

But what if we told you a way to significantly reduce your capital gains tax liabilities at the end of each financial year?

The answer is through Tax Loss Harvesting.

Using this method, you basically redeem investments that are running at a loss. This is because the Income Tax Department allows us to offset our capital gains against the capital losses suffered.

So assume it’s close to March 31st and you sell an investment at a loss, you can use that loss to reduce your capital gains for the financial year. You may again reinvest in that instrument if you believe that your investment will bounce back and book your profits in the following year. You can keep repeating this cycle to make the most of this technique.

Let’s understand Tax Loss Harvesting better with an example.

Example of Standard Capital Gains Calculation for March 2021:

Let’s assume the following portfolio of Vaibhav as of March 2021:

- Reliance shares purchased in June 2020.

- SBI Equity Mutual Fund purchased in March 2019.

- ITC shares purchased in June 2020

As he was making a profit of Rs.1,00,000 from his Reliance shares and Rs.1,50,000 from the mutual fund, he decided to book his profits in March 2021. Since he was at a loss of Rs.35000 from his investment in ITC shares, he decided to hold on to it for the longer term.

Reliance Shares were redeemed within 12 months, so he would be subject to pay Short Term Capital Gains Tax(STCG) of 15% on his total profits.

STCG = 15% x 100000 = Rs.15,000.

For mutual fund,

LTCG = 10% x (150000-100000)= Rs.5,000.

Total Capital Gains Tax = 15,000 + 5,000 = Rs.20,000

Example using Tax Loss Harvesting for March 2021:

Vaibhav’s portfolio will be the same as the above example:

- Reliance shares purchased in June 2020.

- SBI Equity Mutual Fund purchased in March 2019.

- ITC shares purchased in June 2020

But in this instance, since Vaibhav uses Tax Loss Harvesting, he will also sell his position in ITC shares and incur a loss of Rs.35000.

So, his total short term capital gains is Rs.1,00,000(Reliance profit) – Rs.35,000(ITC Loss) = Rs.65,000.

So, STCG = 15% x 65000 = 9,750

LTCG(same as earlier) = 10% x 50,000 = Rs.5,000

Total Capital Gains Tax = 9,750 + 5,000 = 14,750

Total Tax Avoided = Rs.5,250 ( Rs.20,000 – Rs.14,750)

As you can see, using Tax Loss Harvesting Vaibhav has avoided paying Rs.5250. This method can be very useful for any investor or stock trader who makes multiple investments throughout the year.

Check out more articles on StocKEdge blog.

Happy Investing!

Good article

Hi,

We are glad that you liked our post.

Thank you for Reading!