Key Takeaways

- There are mainly two stock exchanges in India- National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

- NSE has categorized their listed stocks from the view of investors, on the other hand, BSE has categorized from the view of the stocks.

- BSE has grouped the stocks in the Equity Segment into the following groups based on certain qualitative as well as quantitative parameters.

- This categorization was done for guidance and also for the benefit of the investors.

- The main BSE Groups are A’, ‘B’, ‘T’ and ‘Z’ groups.

Under BSE groups there are mainly two stock exchanges in India- National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Both these exchanges have categorized the listed companies in particular groups. With the help of this, traders can select the scripts based on this categorization.

BSE is the oldest stock exchange in Asia which has more than 5500 companies listed. Thus this makes BSE the exchange with the largest number of companies that are listed in the world.

BSE has also categorized its scripts into various BSE Groups. So you must be thinking what are these BSE Groups.

So in this blog, we will be discussing about the various BSE Groups:

Categorization of BSE Groups:

As we have discussed above both the exchanges have categorized their listed stocks but with a different point of view.

NSE has categorized their listed stocks from the view of investors, on the other hand, BSE has categorized from the view of the stocks.

In our previous blog, we have already decoded the NSE series . On the other hand, BSE has classified its listed stocks into various groups.

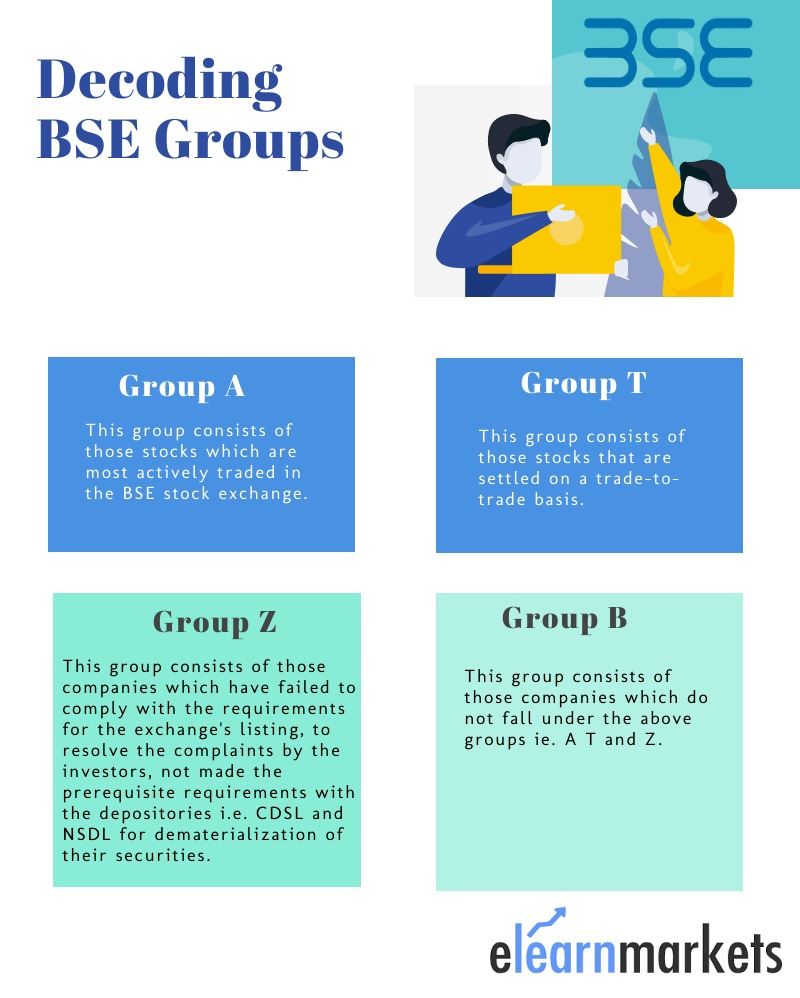

BSE has grouped the stocks in the Equity Segment into the following groups based on certain qualitative as well as quantitative parameters.

This was done for the guidance and also for the benefit of the investors. The main BSE Groups are A’, ‘B’, ‘T’, and ‘Z’ groups.

Below is a list of BSE Group categories:

Group A:

This group consists of those stocks which are most actively traded in the BSE stock exchange. You can read the criteria for “A” Group Companies.

Group T:

This group consists of those stocks that are settled on a trade-to-trade basis.

There is no intra-day trading allowed for these shares falling under this group as the delivery of these stocks is based on a T+2 basis.

Group Z:

This group was introduced in the year 1999. This group consists of those companies which have failed to comply with any of the following conditions:

- The requirements for the exchange’s listing.

- Those companies have failed to resolve the complaints by the investors.

- Those companies that have not made the prerequisite requirements with the depositories i.e. CDSL and NSDL for dematerialization of their securities.

Group B:

This group consists of those companies which do not fall under the above groups ie. A T and Z.

Other Categories:

Group F:

This group consists of fixed income securities of the debt market segment.

Group G:

This group consists of government securities that are traded by retail investors.

Group XC,XD,XT,X:

Some stocks have been also classified into sub-segments as X and XT.

XT consists of all those stocks which are only listed on BSE and are settled on a trade-to-trade basis.

Other stocks which are only listed on BSE fall under the sub-category X. Earlier there were only XC and XD groups which were later merged into group X on 24th November 2017.

Happy Investing!