Time value of money plays a huge role in finance. Want to learn more about the elements of valuation? Enroll in the NSE Academy Certified Finance for Non-Finance People course on Elearnmarkets.com.

Very similar to Net Present Value (NPV) method, Internal Rate of Return (IRR) also considers the time value of money.

It is extensively used as a performance measure of investments in the real estate sector but is often misunderstood.

What is IRR? How it is used in the practical world? What are its drawbacks?

In this article, we will discuss all the above questions and clarify the topics with relevant examples.

What is Internal Rate of Return (IRR)?

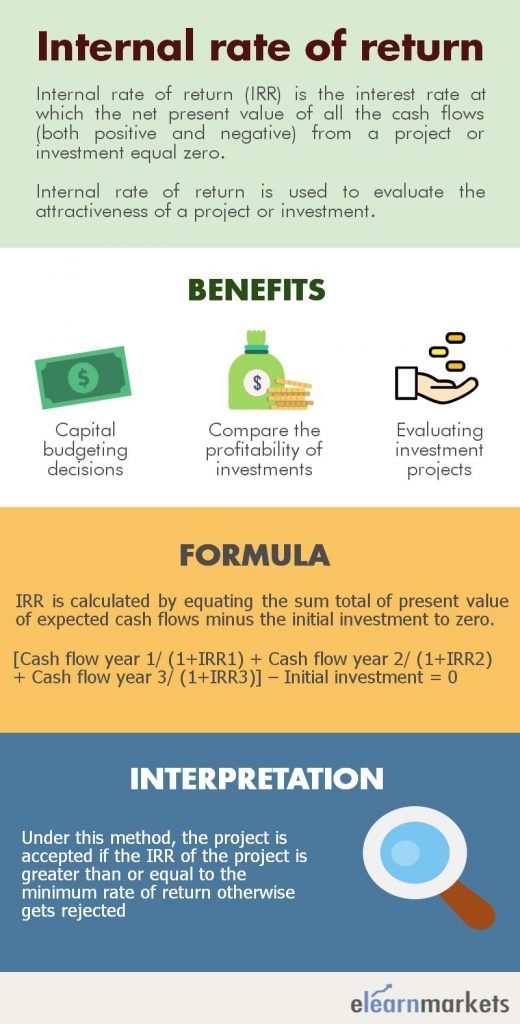

IRR is an important metric for cash flow analysis, generally used for evaluating investment projects, business case scenarios, and capital raising programs.

In simple words, it is the % earned on every dollar invested for each period.

IRR analyzes a project by comparing the IRR with the minimum required return of the company.

It is simply the rate at which the project promises to generate a return during its useful life.

IRR is also known as time-adjusted rate of return method.

Like NPV or payback period.

IRR takes into account an investment view of the company’s expected financial results.

It implies that the magnitude and timing of cash flow are compared to the cost of cash flow. In short, IRR is all about the stream of cash flows.

Under this method, the project is accepted if the IRR of the project is greater than or equal to the minimum rate of return.

However, if the IRR is lower than the minimum required rate of return, the project gets rejected by the company.

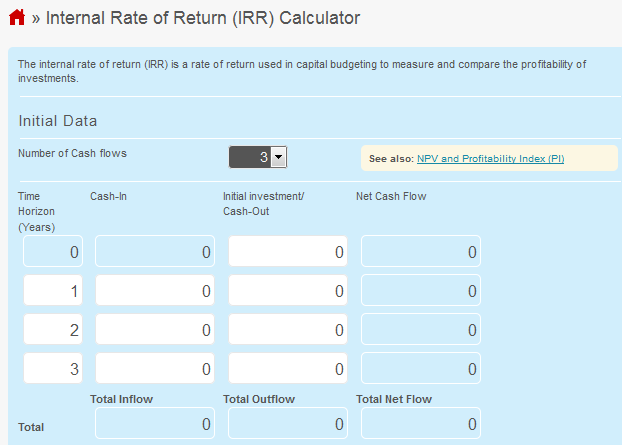

IRR is calculated by equating the sum total of the present value of expected cash flows minus the initial investment to zero.

Internal rate of return formula

[Cash flow year 1/ (1+IRR1) + Cash flow year 2/ (1+IRR2) + Cash flow year 3/ (1+IRR3)] – Initial investment = 0

To know more about Internal Rate of Return watch the video below:

Internal Rate of Return Example

Say there are two proposed investments competing for funds: Company A and company B. The expected cash flows of both companies are shown below-

Year 0 -220 -220

Year 1 120 92

Year 2 100 59

Year 3 80 36

Year 4 55 19

Year 5 35 9

Year 6 20 4

Year 7 10 2

Total 200 0

There is an initial outlay of cash of Rs 220 in both the cases.

In the period of 7 years, company A brings a net gain of Rs 200 while company B brings in Rs 240 in the same period.

It is important to note that the cash flow streams of both companies differ significantly.

On one hand, company A has a large initial return which comes down each year, thus it is “front loaded”. On the other hand, company B initially has smaller returns which grow with every passing year, thus it is “back-loaded”.

Use the IRR calculator.

After feeding the data in a financial calculator or excel function comes as follows-

Company A: IRRA = 30.6%

Company B: IRRB = 20.8%

Thus Company A is preferred over company B.

Internal rate of return (IRR) myth

One of the biggest limitations of IRR is its reinvestment rate assumption.

This assumption states that the interim cash flows will be reinvested at the IRR (which is practically not always feasible).

This is the biggest misconception about IRR which is still followed by many B-schools even today.

To overcome this limitation, there is Modified internal rate of return (MIRR).

Modified internal rate of return (MIRR)

MIRR is a better and improved version of IRR. It does not assume that the cash flow of the project is reinvested at the IRR.

Rather, it includes a discrete reinvestment rate in the business model.

MIRR= nʆ(Sum of terminal cash flows / Initial investment) – 1

How is IRR used by the company?

Both NPV and IRR are used by the company to evaluate investment projects.

NPV simply tells you about the return one can expect from the project.

However, IRR is very helpful when you need to present to the non-finance people.

The reason being it is easy to understand and very intuitive.

Say if you explain to a non-finance folk that IRR from the project is 15% and the hurdle rate of the company is 10%, so one can easily make out that the company generates 5% extra return on the project.

While if you say that NPV from the project is Rs 2 lakh, it will not be clear to the audience.

Moreover, IRR is easily comparable while NPV is not.

Conclusion

The IRR is a simpler and a popular measure of investment performance.

Understanding IRR will help you in analyzing potential investments and will help you in long term.

In order to get the latest updates on Financial Markets visit Stockedge

Interested in improving financial skills and learning tools but language is a barrier? Then join excel full course in hindi and become Skilled!

Nice

Hi,

Thank you for your feedback.

Keep Reading!