In our previous Marketshala series blog, we had discussed Swing Trading in which we had discussed the Method of Swing Trading.

In another interesting session as part of the highly popular MarketShala series conducted by Elearnmarkets, Mr. Vivek Bajaj, Co-founder Elearnmarkets, and Mr. Chetan Panchamia a prolific intraday trader and trainer with many years of experience came together to decode how to identify whether there are option buyer or sellers by analyzing the option chain and open interest data.

Here is a short discussion of this session. If you want to get a practical understanding of how to identify whether there are options buyers or sellers in the market by option chain analysis, watch the full video at the end of this blog.

What to find the weighted average price?

For finding out whether there are option buyers or sellers we first need to calculate the weighted average price that can be calculated in the following steps:

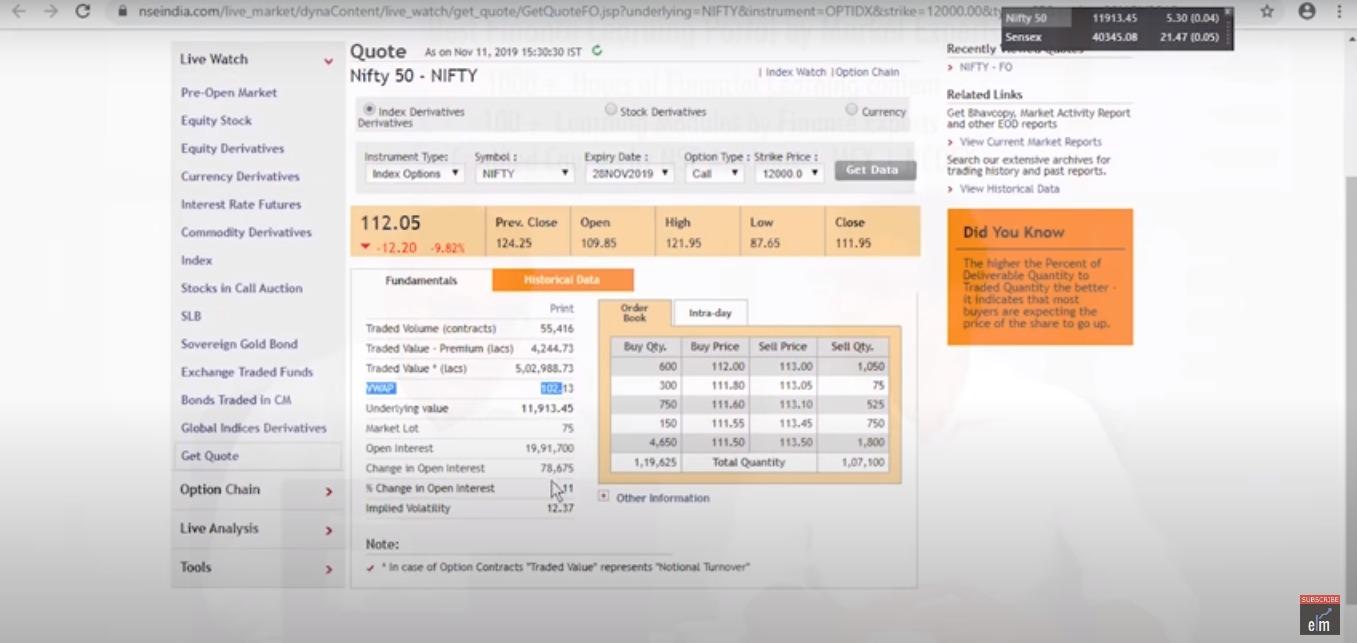

- Firstly we need to get the option chain of Nifty 50, so go to the NSE India website, click on the live market then equity derivatives under the options chain and you will get the option chain of Nifty 50.

- Then we need to find out the highest open interest build-up in the call as we want to know whether there are buyers or sellers in this call open interest.

- Click on the LTP and a window will open in which we will get details on this call open interest.

- From the above screen we can see that the average price is Rs. 102, the closing price is Rs. 112 and the change in open interest is 78,675 shares.

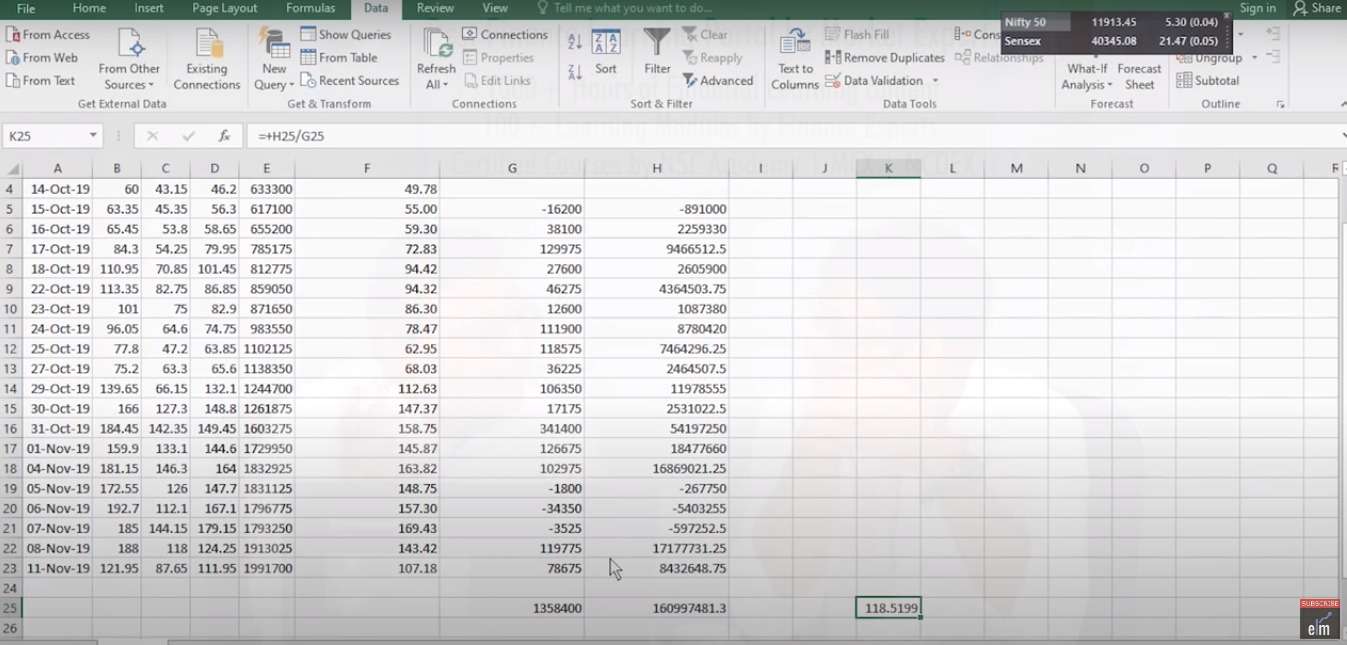

- Then we will go to the historical data and download the last one month’s data in excel.

- After downloading the data, we need to arrange it from the lowest to the highest dates.

- We can delete the settlement price, the number of contracts, turnover, and also the opening prices columns.

- Make a column of average price and calculate the same. For calculating the average price, use the formula: High+Low+Close/3

- Next, we need to calculate the change in open interest. For calculating the average price, use the formula: Today’s Open Interest- Yesterday’s Open Interest and calculate the sum.

- Then we will multiply the average price with the change in open interest and calculate the sum of the prices.

- To get the weighted average price we will multiply the sum of the change in open interest and the multiple of average price and the change in open interest i.e. Rs. 118.

Learn about options with Option Trading Made Easy Course by Market Experts

By finding the weighted average open interest price we will get to know at which price the change in the open interest is maximum.

This is the average price of all the buyers and sellers in the call so 118 is the critical level.

How to analyze Option Chain data?

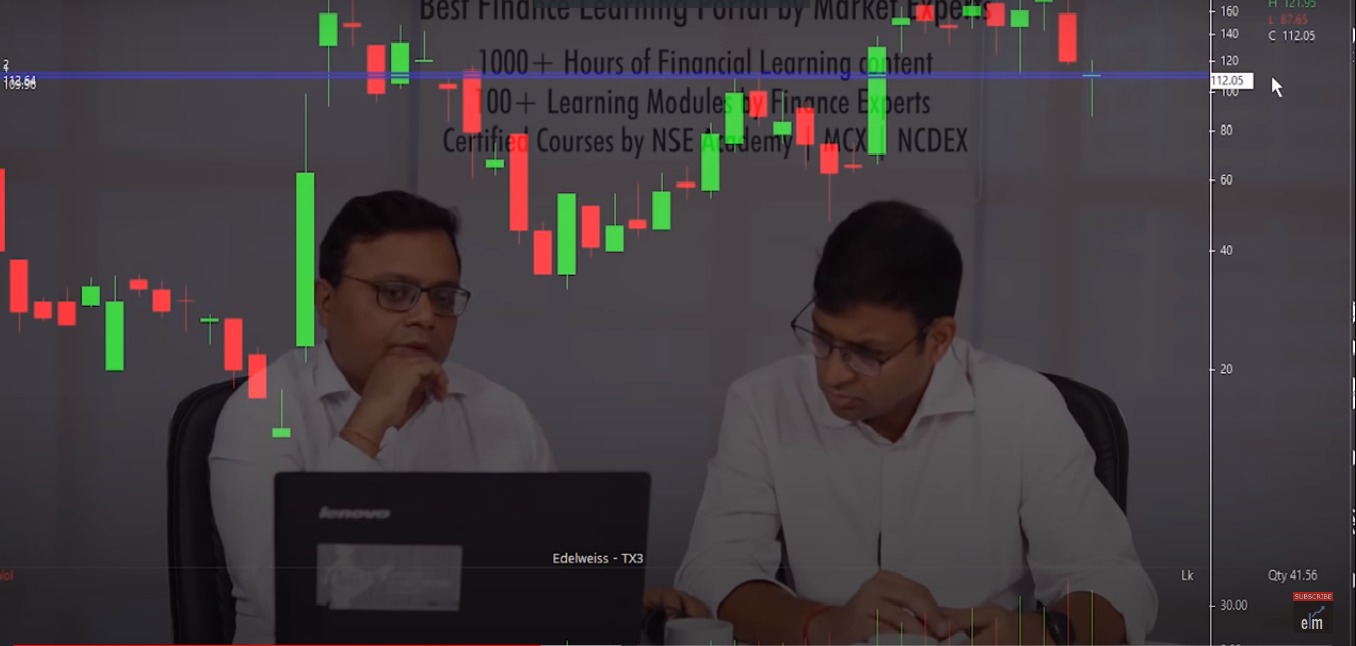

Let us discuss how to analyze option chain data. Now in the chart of 12000 call of Nifty 50, we will insert the horizontal line of 118 level.

From the above chart, we can see that the option buyers and sellers are trading above the average price of Rs. 118.

But from the last candlestick, we can see that the grip of the buyer has started going down and the critical level has come around 87.

If the prices go below the 90-87 level then clearly the seller’s advantage will come and if the prices go above 180-190 levels i.e the recent high of the call then buyers’ advantage may come.

So the range between 87 and 180, can be called the grey zone or no trade zone where the buyers and sellers are fighting for the prices.

This is a dynamic concept as every day the average prices will keep changing.

Similarly, we can do this input at the highest open interest price in the option chain as we did in the call.

So we need to wait for the breakout and then enter a trade as an option buyer or seller by analyzing option chain data.

How to use SuperTend Indicator with this data?

We can also use SuperTrend Indicator to find the breakout levels using 10, 2 as the periods.

If the indicator gets positive then you can enter the buy position above the 90 levels and if the indicator gets negative below 180 level then you can enter a sell position.

If the below level of 90 gets broken and the super trend becomes negative then you enter the sell position and If the above level of 180 gets broken and the super trend becomes positive then you enter the buy position.

You can watch the full video on option chain here:

Happy Learning!

Happy New Year!

Well presented post. I liked the way your shared your article with the help of screenshot and loved the featured Image. Thank you guys for sharing post such a wonderful post. Keep posting

Hi,

Thank you for Reading!

Keep Reading

The blog is really good. Thanks for sharing it.

Hi,

Thank you for Reading!

Keep Reading!