These savings options come with a number of attractive features, namely tax benefits, attractive interest rates, safety, etc. These investment products are designed to satisfy the various needs of investors and include some of the features mentioned above.

Some of the most common fixed-income securities include the National Savings Certificate, Public Provident Fund, and Kisan Vikas Patrika.

However, today, in this article, we’ll talk only about the National Savings Scheme (NSC). The inception of the National Savings Certificate (NSC) dates back to the 1950s when it was issued by the government to collect funds for nation-building.

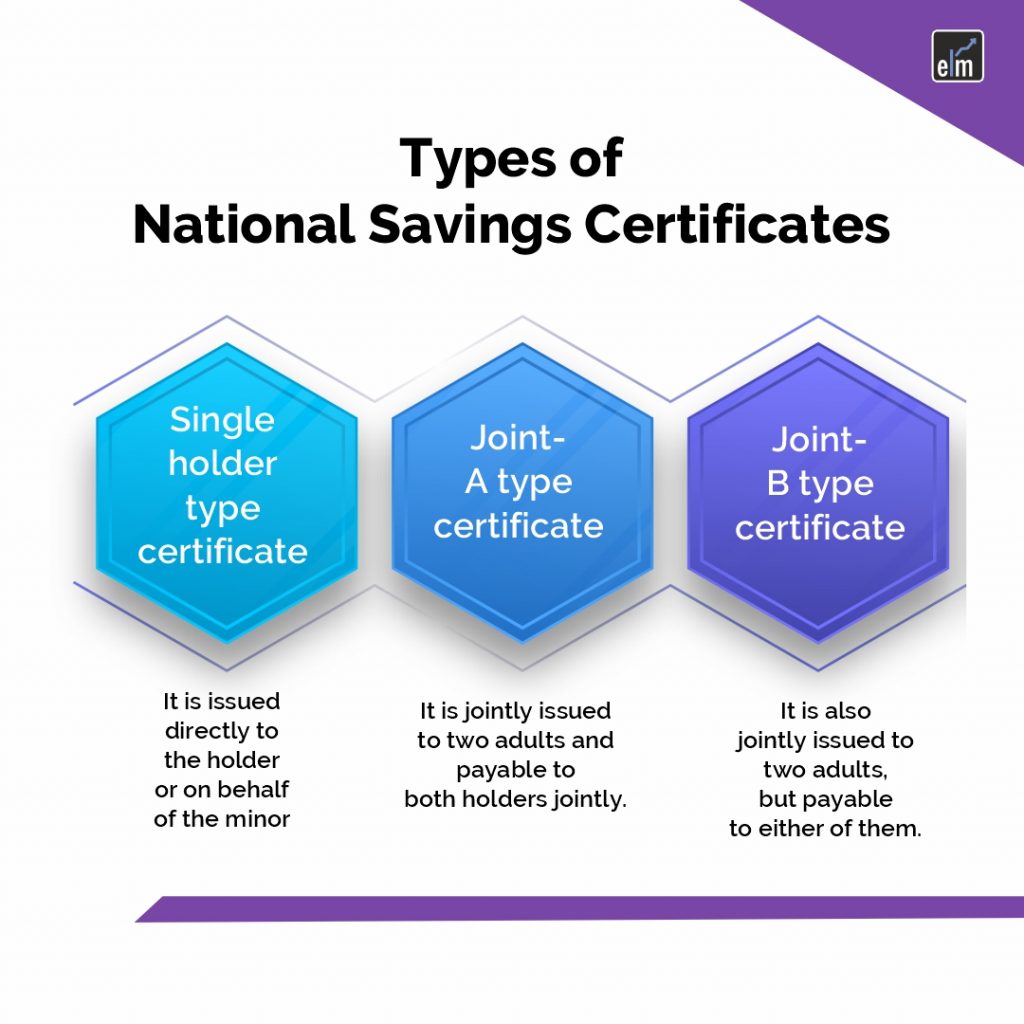

What is a National Savings Certificate?

National Savings Certificate, more commonly known as NSC, is a savings bond issued by the Indian government for small savings and for income tax savings in India.

These certificates are issued by the post office and can be taken from any branch of the Indian postal office. It can be issued for a period of 5 years and 10 years and can also be kept as collateral with the banks for availing loans.

It was launched by the Indian government in order to promote savings habits among the Indian masses and channel these funds on the right path for the growth of the country. The government, in order to encourage more investment under this scheme, has allowed the claim of a tax deduction under 80 C.

The interest rate on 5-year NSC is at par with that of other Fixed Income instruments like PPF.

The interest on NSC is declared by the government each year before 1st April, and it is compounded yearly w.e.f. 1st April 2016.

You can calculate returns using the NSC Calculator.

How much to Invest in NSC?

The minimum investment to be made in NSC is Rs 100, and there’s no maximum limit on the amount invested.

But the maximum tax deduction you can claim under 80C stands at Rs 1,50,000. It is issued in various denominations of Rs 100, Rs 500, Rs 1000, Rs 5000, and Rs 10,000 and an individual can buy any number of certificates of any denomination.

However, an NRI is not allowed to invest in NSC.

Key features

Some of the main features of National Savings Certificate are stated below-

1. No premature evaluation

You cannot withdraw the investments prematurely unless it is the case of death of the holder.

2. Various denominations

The certificate is available in various denominations including Rs 100, Rs 500, Rs 1000, Rs 5000 and Rs 10,000.

3. Minimum denomination

You can start your investment in NSC with a minimum of Rs 100.

4. No maximum limit

There’s no limit on the amount to be invested in NSC

5. Only for individuals

It’ ‘s only meant for individuals, and entities like trusts, HUF, and companies cannot invest in it.

Benefits

An individual can avail the following benefits by investing in NSC-]

1. The certificates can be used as collateral to avail of loans from banks.

2. You can claim a deduction up to Rs 1,50,000 under 80C of the Income Tax Act.

3. The certificates can be bought on behalf of the minors.

4. The interest earned on National Savings Certificate gets compounded and is reinvested which implies an increase in the invested amount without buying any extra certificates.

Documents Required

The documents needed to purchase National Savings Certificates are stated below-

1. Application form

The form is known as Form 1 and it allows you to declare nominee and the amount to be invested.

2. Identity and address proof

You can show your documents like Aadhar card, Voter ID card, Passport, Driving license etc.

Premature Evaluation

National Savings Certificate comes with a lock-in period and cannot be withdrawn before the maturity date subject to the following conditions:

1. On the death of the holder or holders (in case of joint holders)

2. The holder of the certificates forfeits the certificate through a pledge.

3. On order by a court of law to be paid prematurely

However, the conditions stated on the amount that you will get by closing NSC prematurely are stated below-

1. If the certificate is withdrawn within a year of its issue, then you will receive only the invested amount without any interest.

2. If NSC is withdrawn between 1-3 year, then the interest paid will be only simple interest.

Nomination Facility

The subscriber of the National Savings Certificates (NSC) can choose any individual as a nominee at the time of buying the certificate in Form 1 or before NSC matures in Form 2.

In case of the death of the holder, the nominee becomes entitled to receive the investment proceeds.

In case of death of the holder, the nominee shall be entitled to-

1. Encash the certificate

2. Divide the amount into proper denominations in favour of individual nominees.

However, the right of the nominee comes into play only in case of the death of the original holder.

Bottomline

National Savings Certificates are a great way to accumulate funds in a long-term time frame. You have an option to hold it jointly, or you can hold it singly and nominate someone, which is not possible in other savings products like PPF. However, you should conduct your own research and compare it with other savings instruments to make a better decision.

Frequently Asked Questions (FAQs)

1. What is a National Savings Certificate (NSC)?

The Government of India offers the National Savings Certificate (NSC), a savings program intended to promote modest to moderate personal savings.

2. Who can purchase National Savings Certificates?

Any Indian national who is at least eighteen years old may buy NSCs. In addition, parents may purchase NSCs for children.

3. Where can I purchase National Savings Certificates?

In India, specific post offices provide NSCs for sale.

i m in great need of money that is why i want to withdraw my nsc without completing my maturity period.

Hello Arindam,

Thank you for your comment.

A National Savings Certificate(NSC) can be withdrawn before maturity only under the following conditions:

1.On the death of the holder or holders(in case of joint holders)of the NSC Certificate.

2. The holder of the certificate forfeits the certificate through a pledge before a Gazetted Officer.

3.The court orders the premature payment

If the NSC Certificate is prematurely withdrawn within one year from its issue: you will receive only the amount invested and no interest.

If the NSC Certificate is prematurely withdrawn within a period of 1-3 years from it’s issue you will get the amount invested and the simple interest.

You may read more about another great and safe investment option: Public Provident Fund.

Happy Reading!

I’m really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you modify it yourself? Either way keep up the nice quality writing, it’s rare to see a great blog like this one nowadays..