If you’re in the financial market for quite some time or involved in trading and investment, you might have heard about derivative. Derivative is a vast topic which is often used for speculative and hedge investments. If you know about fund managers, you might know that they often use derivative products like options in order to hedge their investment position. Derivative comprises of various investment products like forwards, futures, options, and swaps. However, today we’ll discuss in detail about option trading strategies along with its styles and types of options.

James Chanos said-

Derivatives in and out of themselves are not evil. There’s nothing evil about how they’ve accounted for, and how they’re financed, like any other financial instrument if done properly

An option is a financial contract which gives the buyer the right but not an obligation to buy or sell the underlying asset at an agreed-upon price on or before a specified date. In short, it is used as a hedging instrument.

Let’s understand this with the help of an example. Since predicting weather conditions is really a difficult task, hence the farmers had to hedge their position to bad weather. So farmers purchase the derivative contract in case the crop gets damaged due to bad weather. However, if the weather is good, he just loses the cost of purchasing the contract. In short, it’s very similar to buying an insurance policy.

What are the Types Of Options?

1. Call option

It gives the holder the right, but not the obligation to buy an underlying asset at an agreed upon price for a certain interval of time. Investors often buy call option when they are expecting the price to rise in the near future, while they’ll sell the call if they are expecting a decline in the share price. However, if the stock fails to meet the strike price before the contract expiration, the option expires and will be of no value.

Say the stock of VIP industries is presently trading at Rs 100 per share. Assuming a call option buyer purchases one unit of the call option at Rs 3 per unit. On the expiry, say the stock is trading at Rs 120, so the call option buyer ends up making a profit of Rs 17 (120-100-3). On the other hand, if the price on expiry would have been Rs 99, he would have lost only Rs 3 i.e. premium value.

2. Put options

It gives the holder the right to sell at an agreed-upon price but he’s obligated to buy the stock at the exercise price. It can be exercised anytime before the expiry of the contract. So an investor with the view of the decline in stock price will buy put or sell if they think that the price will rise.

Say the stock of VIP industries is presently trading at Rs 100 per share. Assume that an put option buyer purchases one unit of the put option at Rs 2 per stock. On the expiry say the stock trades at Rs 80, so the put option buyer ends up making a profit of Rs 18 (100-80-2). On the other hand, if the price on expiry would have been Rs 105, he would have lost only Rs 2.

Also Read : Know everything about Margin for Options Trading

In both, the scenario, the maximum loss to an option buyer is limited to the option premium while the profit may be unlimited. But in case of option seller, the maximum profit is limited to option premium and the maximum loss can be unlimited.

The concept of hedging is very similar to buying insurance.

It’s a protection with regards to unforeseen events but you never wish to use it.

What are the Option styles?

The most common option styles are discussed below-

a. American option

It is an option which can be exercised on before maturity, thus increasing the value of the option.

b. European option

It can be exercised only on maturity.

What are the different options trading strategies?

There are many option trading strategies and you can even create your own strategies to trade in options. However, the most common ones are discussed below-

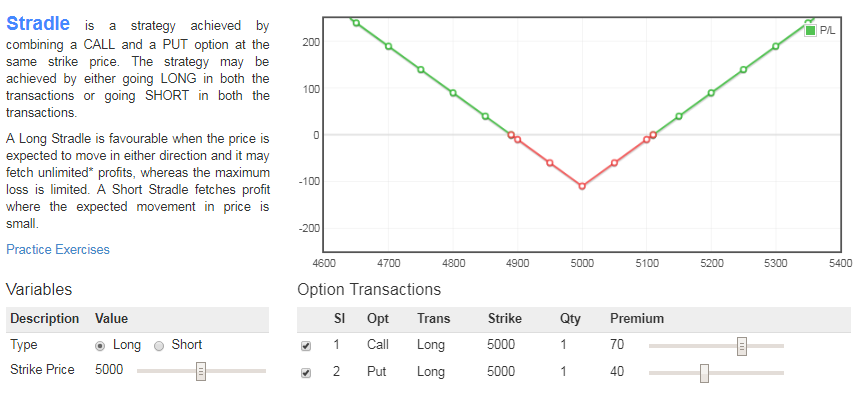

1. Straddle

It is one of the main option trading strategies where in the vestor holds a position simultaneously in call and put with the same strike price and expiration date.

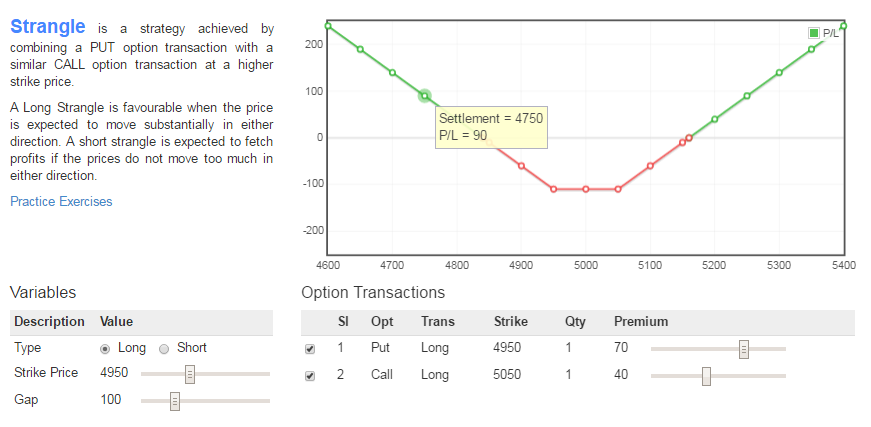

2. Strangle

It is an option strategy where the investor holds position simultaneously in both call and put with different strike prices but with the same maturity. It is profitable only when there is a large movement in the price of the underlying asset.

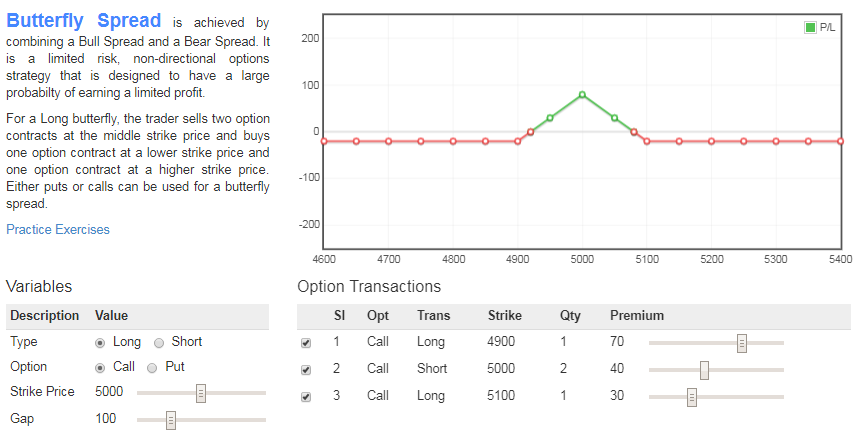

3. Butterfly

It is a limited risk, neutral options strategy which combines four option contract with the same expiry but with three different strike prices. In short, it’s a combination of bull and bear spread.

However, selling a straddle would provide a trader greater opportunity to profit as compared to a butterfly if the final stock price is near the exercise price but it may even result in a large loss.

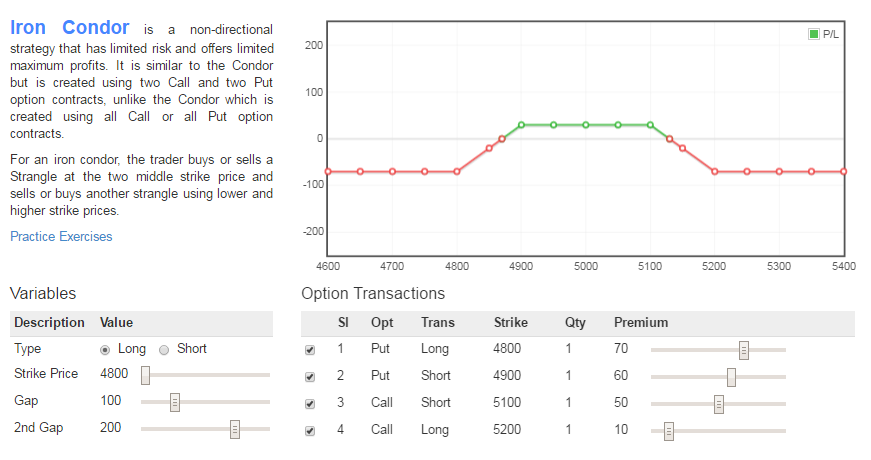

4. Iron Condor

This type of option trading strategies involves a call spread and a put spread with the same expiration with four different strike prices.

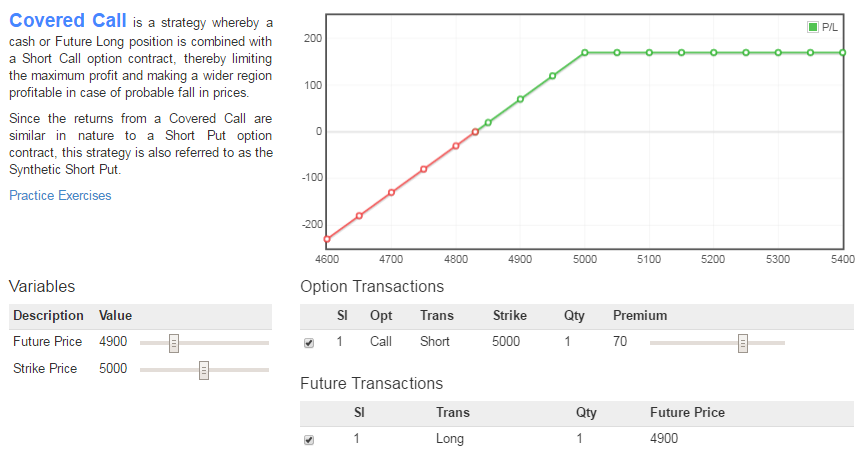

5. Covered call

It is an option strategy where the investor holds a long position in an asset and writes call options on that same asset to hedge the downside risk to a certain extent.

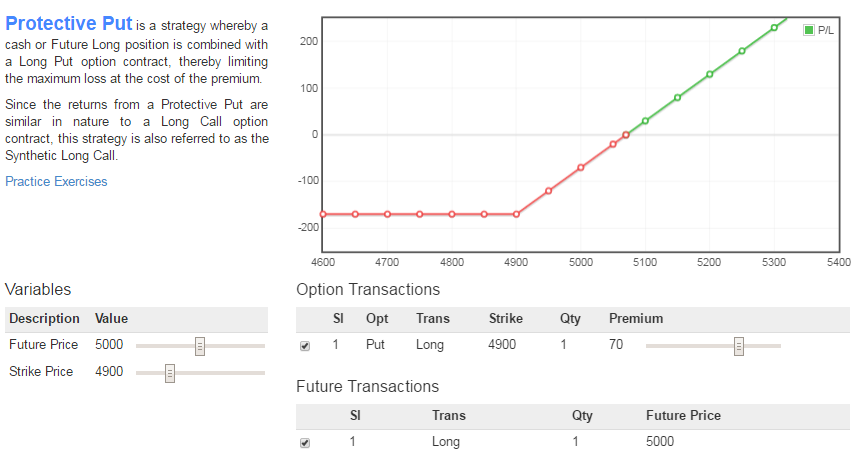

6. Protective put

It involves taking a long position in an asset and buying a put option on that same asset. In this case, the only risk involved is limited to the amount of premium.

Learn, practice or create your own option strategies.

What are Option valuation?

When you will develop an options strategy, there will be risk and reward from a change in price, changes in volatility and time decay.

In a very simple term, the value of an option can be categorized into two parts-

a. Intrinsic value: It can be defined as a difference between the market value of the underlying asset and its strike price.

b. Time value: It refers to decrease in the value of underlying option premium with the passage of time.

What are Option Greeks?

The change in option price may take place on account of directional price shift in the underlying asset, time decay or change in implied volatility. The understanding of option’s sensitivity to greeks can be very helpful and can improve your trading in options. The concept of greeks comes from Black Scholes model. Most buyers are concerned with Greeks like theta, delta, and vega.

Let’s understand them one by one-

a.Delta

It measures option’s sensitivity with the change in the underlying stock price. It can be used both in buying and selling opportunities.

b. Theta

It measures options sensitivity to time. It measures the decay in time and gives us rupee value of decay per day. There is a significant decrease in value as the option reaches towards expiration. On the other hand, option writers use theta to their advantage.

c. Vega

It measures options sensitivity to a change in implied volatility. There will be an increase in the value of option premium with the rise in implied volatility.

d. Gamma

It measures the sensitivity of delta to a change in the value of the underlying asset. In simple terms, it is the change in the value of the underlying asset and it is more closely tracked by people who sell options since it provides an indication of the risk exposure if the price moves against your position.

e. Rho

It measures option’s sensitivity to a change in interest rates. So any increase in interest rate may decrease in the value of option since it will increase the cost of carrying the position.

If you want to learn Options Trading Strategies and make a -profit from any market, join the NSE Academy Certified Option Strategies course Now!

Margin requirement

When anyone is buying options, he just needs to pay the premium so as to enjoy the right. But in case of writing (selling) options, the person has to deposit the margin amount either in cash or securities kept as collateral.

The margin requirement in case of writing options is similar to futures. The minimum margin requirement is usually between 5% and 10% of the contract size. However, the margin amount may even be raised during the period of increased volatility. Margin requirements also vary by option type.

Also, some options trading strategies require no margin since the underlying stock can be used as collateral. Both covered calls and covered puts have a margin requirement.

Bottomline

One thing which you should keep in mind is that options are sophisticated trading tools and so you should be educated and capable enough to handle it, otherwise the consequences can be dangerous.

I hope that the write up gives you a basic insight into the world of options. Please give your valuable feedback in the comment section below.