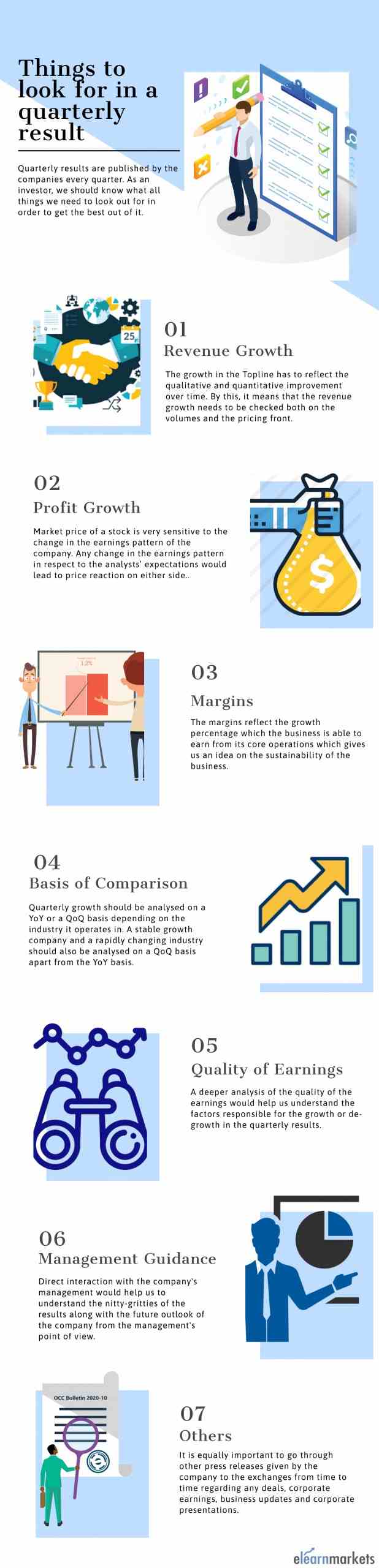

Key Takeaways:

- Quarterly results are like the trailer of the Company’s performance for the current fiscal year.

- For an analyst or an investor, the quarterly results are really a good tool to check out on the quality of the management.

- Retail Investors need to go through the financial results, Investor presentations and concall highlights in detail in order to get a crystal clear view of the company.

- Along with the quantitative factors, we also need to assess the qualitative factors playing out behind the numbers in order to properly estimate the future cash flows.

- Along with the quarterly results, we must also keep a track of the company’s announcements that are released from time to time to get an understanding of the way forward for the company.

Equity Investments are dynamic in nature.

Due to the highly volatile nature of the Stock Markets, the long term theory is losing some ground as Investors are now becoming traders.

Thus the quarterly results become an important metric to look out not only for short term traders but also for long term Investors.

We know that according to the Indian corporate regulations, the listed Indian companies have to file their quarterly results to the exchanges on a regular basis.

How do we as a layman interpret the quarterly results?

Corporate has to be dynamic in nature and the quarterly results are the mirror to their dynamism.

The quarterly results are the best way to judge the ongoing performance of the company and to get the latest updates on the company that we are invested in or want to invest.

Nowadays a host of stuff is published by the companies for the investors to get a better understanding of the performance and the future outlook.

Evaluate the company’s performance with Company Valuation Course by Market Experts

There are numerous platforms and analysts giving their viewpoints on the same.

So, it is imperative for us to know which all critical points we should analyze in order to get a better understanding of the company for trading or investing.

Things to look out for in a quarterly result

1. Revenue growth:

Revenue or Sales or Topline are all synonyms used in the business terminology for a Company.

One of the most important parameters to analyze is the topline growth. The growth in the top line has to reflect the qualitative and quantitative improvement over time.

This means that the revenues need to grow on the volume’s front and also on the pricing front.

If the revenue growth is backed by volumes then it shows that the business is picking up at the ground level and the demand for the product is robust.

On the other hand, if the growth is only due to pricing front then it shows that the pricing power of the company has improved within the industry due to which the products are being accepted even after the price hike.

But this can even be an onetime affair because finally, the next growth has to come due to volumes.

2. Profit growth:

The market price tends to react to the profitability of the company very effectively.

In the case of quarterly results, the profits (operating and net) tend to extremely price sensitive.

Any change in the earnings pattern with respect to the analysts’ expectations would lead to price reaction on either side.

For example, if the majority of the analysts expected the stock to outperform and in this scenario if it underperforms then the stock will see price hammering and vice versa.

It is therefore important to assess as to the quality of the growth of the operating profit which brings us to the next step.

3. Margins:

The margins reflect the growth percentage which the business is able to earn from its core operations.

This gives an idea of the sustainability of the current margins. The costs incurred by the business and the measures taken to curb the rise in costs will reflect in the future margins.

Thus growth in margins is equally important to look for.

Also, we need to keep an eye on the various factors contributing to the margins.

In a quarterly result, the margins will tend to be quite volatile as compared to the yearly margins. We need to check the factors responsible for margin volatility.

For this, management guidance is very necessary. Any sustainable margin would be a positive trigger for the company.

4. Comparison on a QoQ and YoY basis:

This is one of the most tactical parts when we analyze the quarterly results. So should we analyze the quarterly result on a QoQ basis or on a YoY basis?

Basically, in general, we put more stress on a YoY basis as it reflects the seasonality of the operations much better.

It gives a much broader view of the company’s developments. But in some sectors or companies where there are rapid changes and continuous growth, like consumption, here we should also look at the QoQ changes.

For example, the Telecom industry has recently witnessed some growth in their ARPUs so in that case, QoQ comparison makes more sense than YoY to get a fair idea of the performance of the sector or the company.

5. Quality of Earnings:

In the quarterly profits and earnings, we need to dig deeper in order to get a look at the quality of earnings. This means which factors supported the growth or de-growth in the earnings during the quarter.

For example: If a sharp fall in the Raw material prices has led to margin expansion then the sustainability of the margins may be short lived. Also, if the opposite happens that is if the raw material prices rise then what is the course of action for the management to combat such price pressure .

Any extraordinary income or loss during the quarter has to be adjusted as these incomes or losses are not recurring in nature.

So it is better to adjust the figure and then ascertain the growth or de-growth.

While the stock price is generally determined by the earnings, the qualitative factors determine the valuation which is normally given by the company during their Concall after every quarterly result.

6. Guidance as compared to the performance:

The management commentary is one of the most important parameter that an analyst usually looks into.

Both the commentary on current quarter and the guidance for coming one or two years are used for forecasting and valuation purposes.

Investors need to know what the management is expecting and also how is it planning for the road ahead.

7. Other press releases:

Along with the above parameters, it is equally important to go through other press releases given by the company to the exchanges from time to time regarding any deals, corporate earnings, business updates, and corporate presentations.

These documents give us a brief outlook on various updates that the company has undertaken or is about to take.

Other than these, going through the Audit report and Notes to accounts is also important in order to understand any accounting changes or if the auditor has raised any red flags for the company.

Happy Learning!

yes.. absolutely

these tips are very useful for before investing in stocks

Nice Blog! Thanks for sharing this information.