The world’s biggest lockdown imposed to contain the spread of COVID-19 has severely impacted the domestic economic activities as it brought nearly 70% of economic activity, investment, exports, and discretionary consumption to a standstill.

And will eventually drag down the GDP growth of the country to a negative single-digit band for FY21E.

So, to improve the prevailing turbulent economic environment and to provide a boost to the ailing economy the current government announced the Atma Nirbhar Bharat Abhiyan, a financial package of Rs 20 lakh crore equaling to 10% of the national GDP.

What is the concept behind Atma Nirbhar Bharat Abhiyan ?

The focal point of the concept is to make the nation self-reliant with more focus on local manufacturers and service providers.

This will strengthen the economy, improve the standard of living and most importantly improve the trade deficit and the exchequer balance of the country.

Making the country self-reliant in all spheres- from manufacturing to supplying. It will help the country to reduce its dependence on imports and may also give a boost to exports.

The fall in imports will help reduce the trade deficit and will eventually lead to a trade surplus.

And will also ensure that the country is able to sustain and tackle any black swan event that may emerge in the future.

As per Prime Minister Narendra Modi, the fiscal stimulus will help revive every sphere of the economy- from demand, supply to manufacturing.

The package will focus on land, labor, liquidity, and laws, so as to achieve self-reliance. The relief measures were announced in tranches by Finance Minister Nirmala Sitharaman.

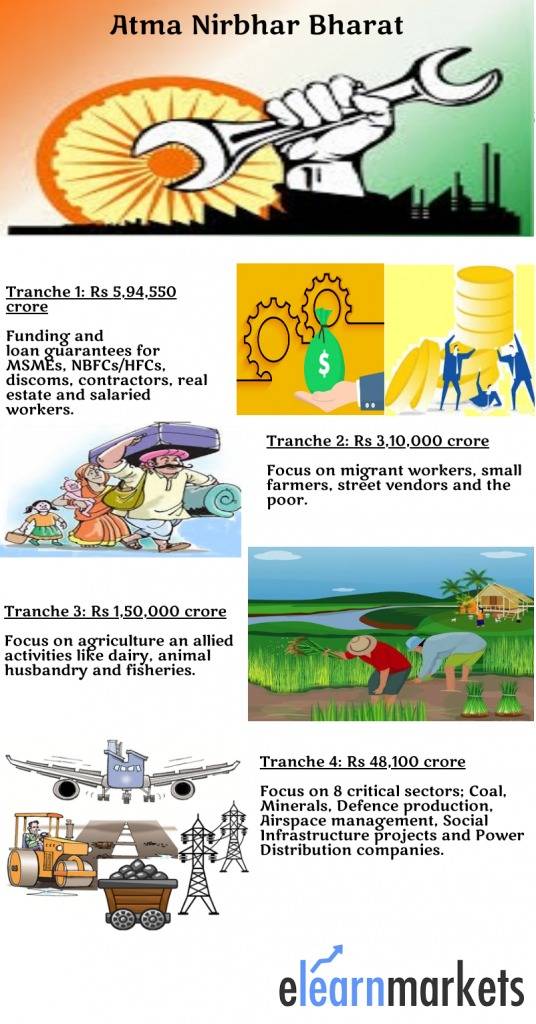

Atma Nirbhar Bharat Abhiyan Package Breakup

Now, let us take a look at the complete break-up of the Atma Nirbhar Bharat Abhiyan launched to make India ‘self-reliant’ amid and post Covid-19 times.

Tranche 1-

This set of relief measures are worth Rs 5,94,550 crore and includes funding as well as loan guarantees for MSMEs, NBFCs/HFCs, discoms, contractors, real estate, and salaried workers.

Tranche 2-

This set of relief measures are worth Rs 3,10,000 crore with a focus on migrant workers, small farmers, street vendors, and the poor.

Implement the principle of Economics with Macroeconomics Made Easy Course by Market Experts

Tranche 3-

These sets of relief measures are worth Rs 1,50,000 crore. The core focus of these measures is on the agriculture and allied sectors like dairy, animal husbandry, and fisheries so as to strengthen the overall farm sector.

Tranche 4-

These sets of measures are worth Rs 48,100 crore with a focus on 8 critical sectors which are Coal, Minerals, Defence Production, Airspace management, Social Infrastructure Projects, Power distribution companies, Space sectors, and Atomic Energy.

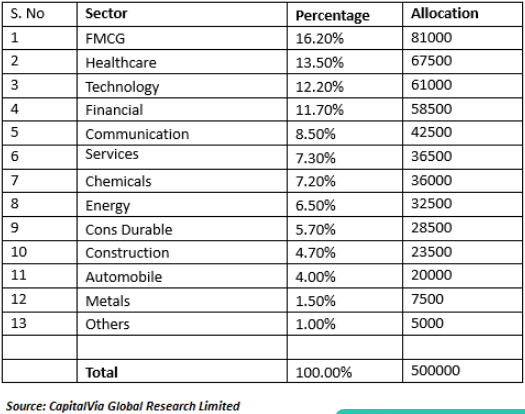

Sectors to benefit from Atma Nirbhar Bharat Abhiyan

1. Micro, Small and Medium Enterprises-

The scheme’s major focus was on the MSMEs sector and its development as there are about 67 million MSMEs operating in the non-agricultural sector in India, and provide sustenance to a large proportion of the population.

The government will offer Rs 3 lakh crore as a collateral-free or unsecured loan to MSMEs with an annual turnover of Rs 100 crore or an outstanding loan of Rs 25 crore. The loan tenure will have a tenure of four years with a moratorium period of 12month. Additionally, Rs 20,000 crore loans will be provided to stressed MSMEs.

The government has given a new definition for the MSMEs where it had done away with the distinction between manufacturing and service MSMEs and also increased the limit for investment in these units.

The change in definition will allow these units to expand and at the same time avail the benefits of MSME classification.

It has also disallowed tenders from foreign companies up to Rs 200 crore mainly to protect these small units from unfair competition.

The boost to the MSME sector will consequently benefit a lot more industries, especially the automobile sector as most of the auto companies are MSMEs. It will help resume business, strengthen the supply chain, and will also help reduce dependence on other countries.

2. Power Distribution Companies-

The government will provide a Rs 90,000 crore bailout to cash-starved discoms and independent power producers.

Discoms functioning in Union Territories is expected to be privatized, so as to strengthen as well as bring efficiency to the entire sector. Thus, provide stability to the stressed power sector.

3. Agriculture and allied sectors-

The fiscal assistance will focus on improving the farm gate infrastructure like warehousing, cold chains, post-harvest management infrastructure, dairy infrastructure along with investment in cattle feed, beekeeping, and herbal and medicinal plants.

National Bank for Agriculture & Rural Development (Nabard) will provide a financing facility for funding agriculture infrastructure projects at the farm gate and for cluster formation across all levels.

Thus, addressing fund gaps in the supply chain and also making value-added local products reach global markets.

It will launch Pradhan Mantri Matsya Sampada Yojana for the development of marine and inland fisheries.

This will help to fill in the gaps in the value chain and will also lead to an additional fish production of 70 lakh tons in the next five years and provide employment to about 55 lakh people.

It will also focus on formulating agricultural marketing reforms like barrier-free inter-state trading, the choice to sell produce at attractive prices, and also provide an e-trading platform for agricultural produce.

4. Civil Aviation-

The government will ease the restriction placed on the utilization of the Indian Air Space for commercial flights (currently 60% of domestic airspace is available), and will help these companies save about Rs 1000 in terms of operational costs.

5. Coal Sector and Minerals-

The government will be ending the monopoly of Coal India Ltd (CIL), by introducing commercial mining of coal. The government is focusing to reduce the country’s dependence on coal imports and be fully self-reliant in coal production.

6. NBFCs/HFCS-

The government has come up with a special liquidity scheme worth Rs 30,000 for investing in investment-grade debt papers of NBFCs, HFCs, and MFIs. The scheme will be fully guaranteed by the government and will be especially beneficial for the housing sector.

A partial credit guarantee scheme will also be allocated for NBFCs where the first 20% of the loss will be borne by the government.

Thus, providing the required liquidity support essential for the smooth functioning of the sector.

7. Real Estate-

The government has extended the CLSS (Credit Linked Subsidy Scheme) for middle-income households to March 2021. This will lead to investments of Rs 70,000 crore in the housing sector, thus boosting the already ailing real estate sector.

The states and regulatory authorities have also been advised to extend the registration and completion date of real estate projects under RERA to de-stress developers and ensure the timely completion of projects.

The boost in the real estate sector will lead to a surge in demand for related sectors like steel, cement, transport and also lead to employment generation.

Atma Nirbhar Bharat Abhiyan Shortcomings:

The package, however, failed to boost confidence and bring optimism among the corporates, as the focus of the package is more on indirect benefits than on direct benefits. The government should have designed packages that would provide cash support rather than relying more on loans.

The collateral-free or unsecured loans announced for MSMEs may lead to higher default by the companies and lead to higher NPAs.

The banking sectors, especially the PSU, are already reeling under the bad loan issues and with unsecured loans, may see further deterioration in their asset quality.

Higher default rates will also increase the cost burden of the government, as it may have to provide a cushion to the ailing banks.

The total government expenditure that will be incurred through the package is only 1% of India’s GDP growth. As such these measures will not be adequate enough to boost the demand sentiment in the economy.

Key Takeaways:

- The government announced the “Atma Nirbhar Bharat Abhiyan” so as to revive every sphere of the economy from demand, supply to manufacturing, and make India self-reliant to sustain and tackle any Black Swan event in the future.

- The package is divided into four tranches, where each tranche has their own focus areas.

- The package’ score focus is on MSMEs and agriculture and its allied activities.

- However, the package fails to bring optimism and confidence among the corporate as it focuses more on indirect benefits, with a major focus on loan disbursal.

- It would have been for the benefit of the corporate if the government would have provided direct benefits like cash support and pause or reduction in GST payments.

- This would have helped in reducing the prices of the products, thus leading to higher demand

A country can become Atma Nirbhar in true sense when its youth is educated with topics such as economics, finance and more. You can join our macroeconomics certificate course and skill yourself to be able to grow along with your country now!

Happy Learning!

Very informative! Now I have truly understood what Atma Nirbhar Bharat Abhiyan is all about. Kudos to the authors for explaining and writing everything so well!

very well written in brief.

Very much useful!!! Thank you so much.

Very much useful thank you

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

Nice Blog!!

Hi,

We are glad that you liked our blog post.

Thank you for Reading!