As a well-informed investor carrying out fundamental analysis in the capital markets, wouldn’t you like to have an investment that gives extra returns? Normally, risk-averse investors, who fear volatility in the markets, invest in dividend paying stocks to earn regular income.

But is it always a safe investment option? Read on to find everything related to dividend paying stocks.

| Table of Contents |

|---|

| File Your Tax Returns on Time |

| Periodically Review your Net Worth |

| Keep Track of Your Money |

| Create an Emergency Fund |

| Educate Yourself |

What is dividend?

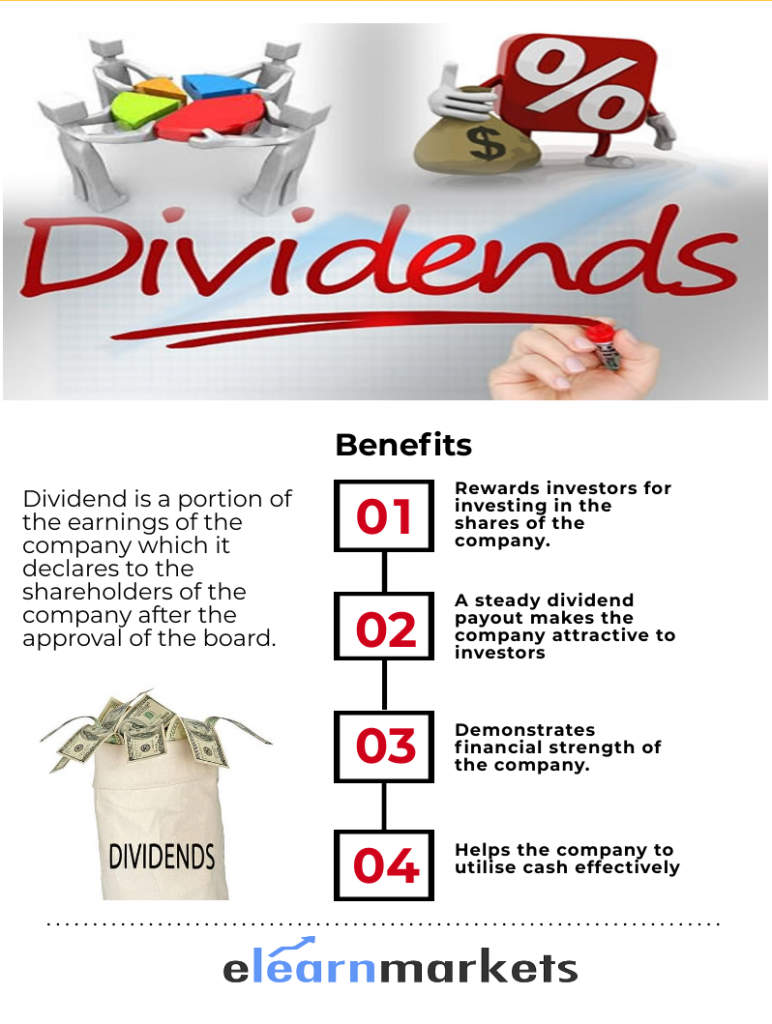

A dividend is a corporate action, where a portion of the profits or surplus which the company earns, is distributed to its shareholders.

It is a return on the investment made in the share capital of a company, and it is distinct from the return on borrowed capital, which is in the form of interest.

Dividends can be declared primarily in two ways- cash dividend and stock dividend.

Cash dividends are by way of cash which the company pays to its shareholders. However, stock dividends, as contrary to cash dividends, are paid in the form of stocks.

This means that the shareholders receive free stocks with respect to their holding also known as a bonus. This is a way of rewarding the shareholders but without reducing the cash balance of the company.

Dividends are paid out of the retained earnings of the company, which it utilizes to reinvest in businesses or any related matters.

Therefore, when the company pays any dividend, it reduces its cash balance and the retained earnings in the equity section by the amount of dividend declared.

Learn to evaluate company with Company Valuation Course by Market Experts

Dividends are generally paid annually, and are referred to as annual dividends. They can also be paid during the year; these are known as interim dividend.

Why is Dividend paid?

A company can pay dividends for the following reasons and benefits –

- The company is earning enough profits, so it can redistribute a portion of it to the shareholders.

- To make the company more attractive to the potential investors.

- The financial discipline of the company persists by not wasting it on unnecessary acquisitions, investments and other related matters.

- The company will be able to chalk out a different position for itself in the industry in terms of financial soundness.

- The dividends paid by companies are assumed as potential future earning expectations by the management.

- Companies that increase their dividend payouts or companies that institute a new dividend policy would be more likely to see appreciation in their stocks.

Are PSU Investments a good avenue to create wealth?

Generally it has been assumed that the Public Sector Undertakings, or PSUs prefer the dividend route to attract investors.

The PSUs are exposed to various concerns like government intervention, pricing of products, stringent corporate governance issues, obsolete manner of workings etc. which somehow leads to a low performance.

Suggested Read : Dividend versus buyback: Which is better?

However, their dividend paying stocks ability makes them somewhat attractive to the investors looking for consistent dividend.

PSU companies give high dividends because majority of shares are held by the Government. So, when the government is in need of funds, then PSU Dividends are its best option.

For investors, they are generally viewed as safe haven for steady income in the form of dividend without much price appreciation.

The dividend yield (dividend expressed as a percentage of the share price) is generally high and sustainable for PSU companies.

Some companies do not pay Dividends, so are they bad investments?

Many private companies neither give dividends nor show much price appreciation over the years. These companies are not investor-friendly, as they don’t benefit the investor from any perspective.

However, not all companies who don’t pay dividends, are bad investments.

A company might not pay dividends if it is using its retained earnings to invest for any future growth. In that case, companies can offer capital or price appreciation when profitable investments are made.

For example, Berkshire Hathaway never gave any dividend its stock price kept on increasing.

Is Dividend payment mandatory?

In India, there is no mandate for the company to pay dividends. It is done as per the discretion of the company.

A company can choose the dividend route to reward the shareholders when it doesn’t have any other means to reinvest its profits.

However, if there are preference shareholders in a company, then according to the negotiations, the dividend will be first paid to them and then to other individual shareholders.

Sometimes, when the company starts making profits, then the preference shareholders may demand their dividend retrospectively.

This means that they can ask for the Dividend from the time they invested in the company.

What does DDT or Dividend Distribution Tax mean?

Previously, dividend payments by the company was subject to dividend distribution tax, or DDT, in the hands of the company.

However, in Budget 2020, the Government has removed the DDT and now the dividends will be chargeable in the hands of the recipient at their applicable income tax slabs.

After the removal of DDT, the investors who still want regular incomes from dividends should keep in mind the taxation effect with it.

Therefore, after this announcement, investments will become a little costlier. This is because the removal of the DDT will increase the taxable income of the recipient.

However, if the dividends payments are sustainable, and the dividend yield is high enough to adjust for the taxation impact, the investors should prefer taking up the dividend paying stocks.

To know which are the dividend paying stocks, watch below:

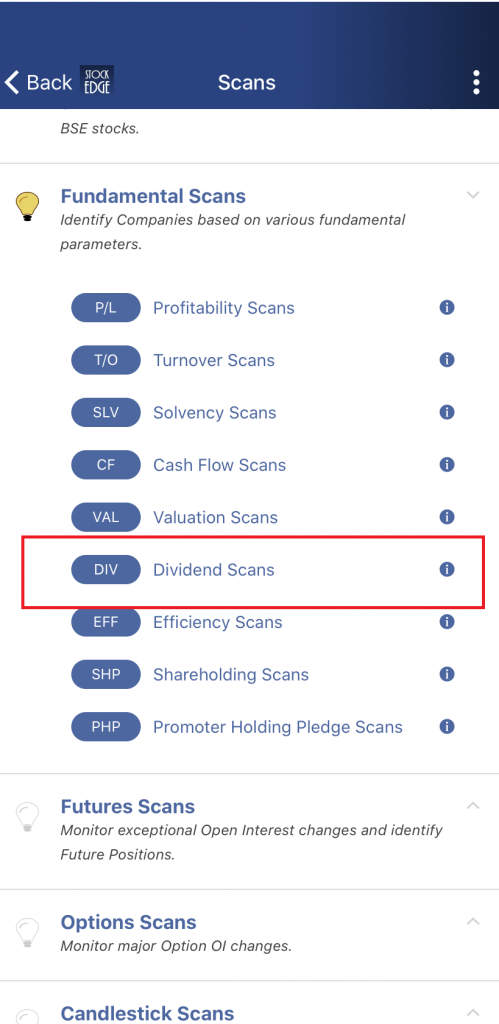

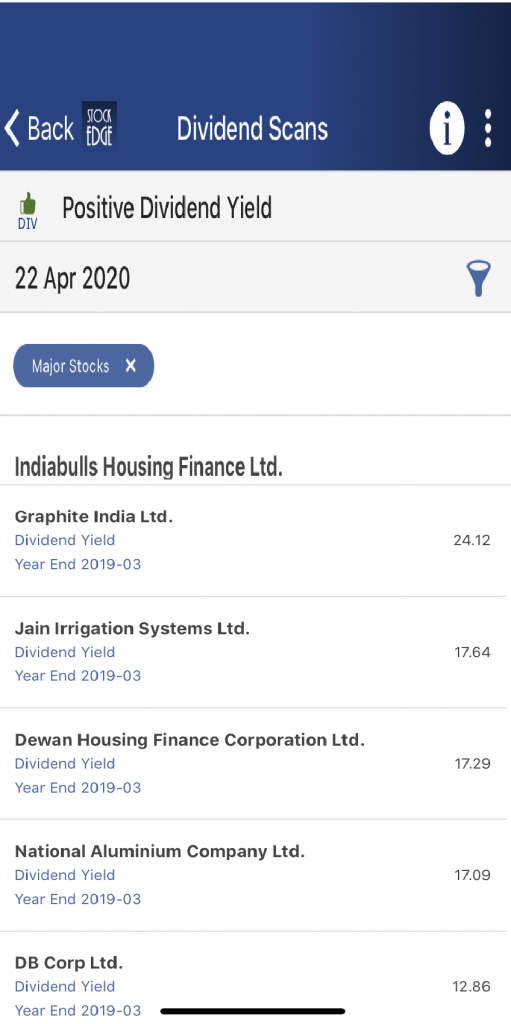

You can also use fundamental scans to filter out stocks with consistently paying dividends and positive dividend yield by using StockEdge App, now also available in the web version as shown below:

- From the Fundamental Scans in StockEdge, select the Dividend Scans:

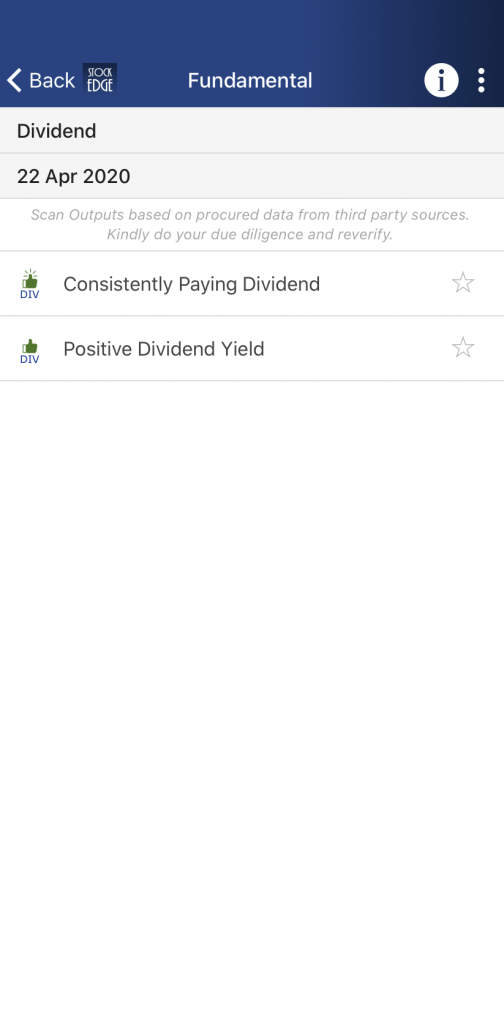

- There are two dividend scans: Consistently Paying Dividend and Positive Dividend Yield:

- You will get a list of stocks with Consistently Paying Dividend as shown below:

- You will get a list of stocks with Positive Dividend Yield as shown below:

Key Takeaways:

- Dividend paying stocks are viewed as safe and reliable investment companies.

- The removal of DDT, should be viewed by investor to analyze investment in dividend paying stocks due to their taxation impact.

- Dividend paying stocks are viewed as a regular source of income for the shareholders.

- They imply good financial strength of the company.

After reading this, are you willing to invest in dividend paying stocks? Let us know by commenting below.

Happy Learning!