Types of bonds- Bonds are one of the many investment options in India in which investors can invest their hard-earned money.

A bond is a debt instrument where the issuer company borrows funds from the bondholder and, in return, the issuer company is obliged to pay interest that is known as the coupon.

The bondholder enters into a formal contract with the issuer who decides to repay borrowed money with interest at specific periods like on a semi-annual, annual or monthly basis.

The difference between bonds and stocks is that stockholders have an equity stake in the company, whereas the bondholder has a creditor stake in the company.

In India, the Government as well as the business owners issue these for raising funds to finance its long-term investments or their current expenditures needs.

These are considered to be safe instruments as there is low risk involved in them as compared to other investment options available in India.

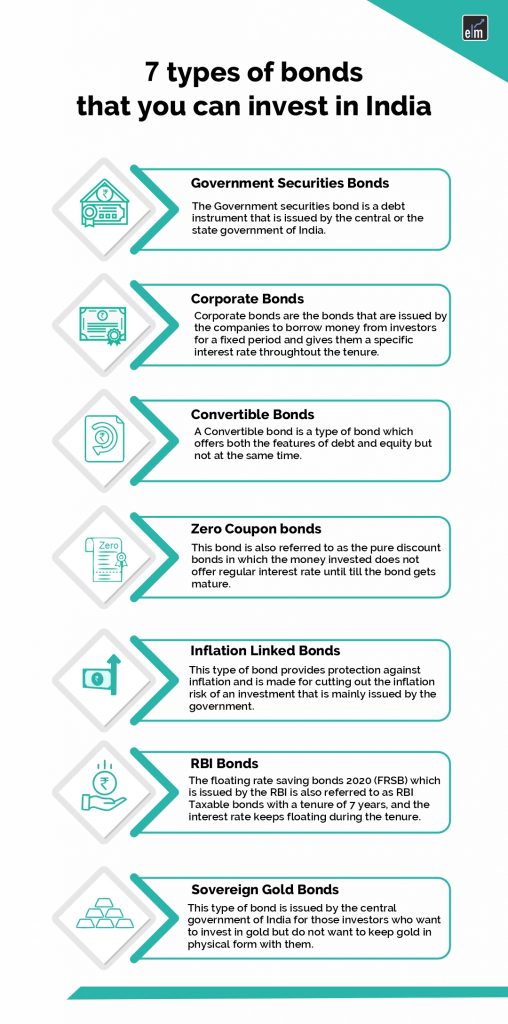

In this blog, we will discuss 7 types of bonds that investors can invest in India:

7 Types of Bonds that Investors Can Invest in India

1. Government Securities Bonds

The Government securities bond is a debt instrument that is issued by the central or the state Government of India.

In India, government bonds fall under the category of government securities (G-Sec) that mainly offer long-term investments between 5 and 40 years.

Bonds that are issued by the state government are also known as State Development Loans.

The Government of India has made these government securities so that the small investors can invest in small amounts for earning interest with lower risks.

Interest can be fixed or floating that is disbursed on a semi-annual basis on these types of bonds. However, most of the government bonds are issued at a fixed interest.

- Issuer: National governments, such as the US Treasury for US Treasuries, the UK government for UK Gilts, or the Japanese government for Japanese Government Bonds (JGBs), are the ones that issue government bonds.

- Governments sell bonds to raise money for a number of reasons, such as to finance infrastructure projects, finance spending, or pay off current debt.

- Types: There are several varieties and maturities of government bonds. In the US, Treasury bonds (T-bonds), Treasury notes (T-notes), and Treasury bills (T-bills) are a few common varieties. The maturity period varies depending on the type and might be anywhere from a few days to several decades.

- Interest Payments: Bondholders who purchase government bonds normally get periodic interest payments at a set or variable rate. The state of the market at the time of issuance affects the interest rate.

2. Corporate Bonds

Corporate bonds are issued by companies to borrow money from investors for a fixed period and give them a specific interest rate throughout the tenure.

Companies usually issue bonds to investors to expand their business for future growth through raising new capital or for starting a new project.

For the above purposes, the company asks investors to invest their money in exchange for a specific rate of return for a tenure instead of taking a loan from the banks.

After the tenure ends, investors receive the face value along with the interest rate.

This type of bond is preferred by those investors who want to earn a fixed interest rate for the tenure of their investment.

3. Convertible

These offer both the features of debt and equity but not at the same time.

This can be converted into a predetermined number of stocks, and the bondholders can become shareholders of the company and get all the benefits that are offered to shareholders.

Investors can take the benefit of both debt and equity instruments after investing in convertible bonds.

- Interest Payments: Just like regular bonds, convertible bonds usually give bondholders periodic interest payments. The bond’s terms and conditions specify the interest rate and the frequency of payments.

- Conversion Ratio and Price: The number of shares that an investor can obtain for each converted bond is determined by the conversion ratio. The cost at which a bondholder can convert a bond into equity shares is known as the conversion price. The offering paperwork for the bond provides information on the price and conversion ratio.

- Maturity: Convertible bonds have an expiration date, just like conventional bonds do. At maturity, bondholders have the option of converting their bonds into equity shares or receiving their principal amount plus any interest earned

- Marketability: Since convertible bonds are typically traded on the secondary market, investors have the ability to buy and sell them before they mature. Some of the factors influencing the market price of convertible bonds are the cost of the underlying stock shares, the state of interest rates, and investor mood.

- Risk and Return: Investors owning convertible bonds may see a capital appreciation if the price of the underlying stock shares rises. They do, however, also entail the risk of changes in the value of the underlying shares and the default of the issuing corporation.

4. Zero-Coupon

As the name suggests, this financial instrument does not give any interest.

It is also referred to as the pure discount bond in which the money invested does not offer a regular interest rate until the bond gets mature.

The annual returns on the principal amount include the face value, and this amount is paid to the investor when the bond matures.

5. Inflation-Linked

This type of bond protects against inflation and is made for cutting out the inflation risk of an investment that is mainly issued by the government.

In Inflation-linked bonds, the principal and interest rates rise and fall with the rate of inflation.

6. RBI Bonds

The floating rate saving bonds 2020 (FRSB) which is issued by the RBI is also referred to as RBI Taxable bonds with a tenure of 7 years, and the interest rate keeps floating during the tenure.

The interest rate is reset every six months, the first being on January 1, 2021, this means that the interest rate is paid every six months rather than receiving it at maturity.

The floating interest rate can rise when the rates in the economy go up.

7. Sovereign Gold Bonds

This type of bond is issued by the central government for those investors who want to invest in gold but do not want to keep gold in physical form with them.

The interest earned from this bond is exempted from tax. It is also considered a highly secured bond as it is offered by the government.

Investors who wish to redeem their investment can redeem it after the first five years, which will only affect the date of subsequent interest disbursal.

How to Invest in India?

Investing in these financial instruments can be done in the primary or secondary market. In the primary market, one can subscribe to the public issue of large companies. Alternatively, one can purchase this financial instrument from the secondary markets being traded on exchanges. Usually, bonds are considered to be illiquid are kept till maturity.

Nowadays even small investors can buy government bonds. In India, buying the purchasing government bonds is easier than ever by using the website NSE (National Stock Exchange) or The NSE app for buying government bonds is “NSE goBID“.

NSE makes available to the users both a mobile app as well as a web-based platform. Thus, when you want to buy government bonds via these apps, you’re buying them in the primary market.

Bottomline

Government Bonds are the most secure forms of investment in India, which are attributed to its Sovereign guarantee. Risk-averse investors can invest in this type of securities. It is also a suitable long-term investment option for those who do not have experience or knowledge of investing in stock market tools.

For more stock related queries visit web.stockedge.com

Frequently Asked Questions (FAQs)

1. What are bonds?

Governments, municipalities, and businesses can issue bonds as debt securities to raise money. Purchasing a bond is simply giving money to the issuer in return for regular interest payments and the bond’s face value being returned when it matures.

2. How do bond prices and yields relate?

The link between bond yields and prices is inverse. Yields decrease when bond prices rise, and vice versa. This is so because bond yields show investors what they will get in relation to the bond’s current market value. The effective yield falls as bond prices rise and vice versa.

Sir u people doing great job 🙏🙏🙏🕉️🕉️

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading

Sir u people doing great job 🙏🙏🙏🕉️🕉️ vivek sir I am big fan of you.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading

Good read