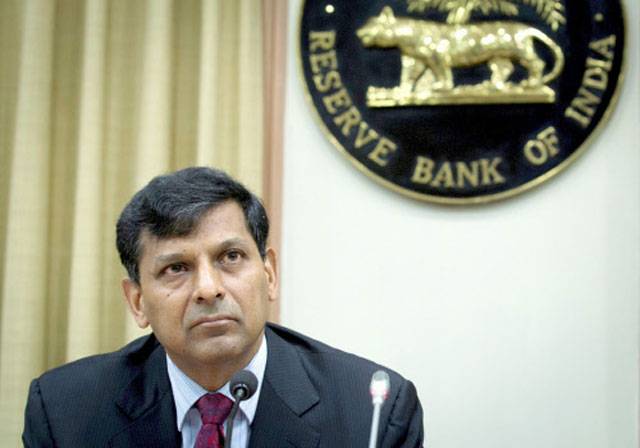

The Reserve Bank of India cut its interest rate on 2nd of June by 0.25% i.e. 25 basis points. The rate cut was as expected by most analysts and economists. It was nothing too massive or feeble, the decision was made as per the requirements of the economy. It was described as the “Goldilocks policy” by Mr. Raghuram Rajan, Gov. of Reserve Bank of India.

Here are five things the governor said could weigh against further easing.

1. Prices of Crude Oil At a Global Level

The inflation level in India has been reduced due to the help of lower crude oil prices. But in recent months, Crude oil prices at the global level seem to be rebounding. Reports say that the current level of prices is far below the average of $110 (for Brent) seen between 2011 and mid-2014, benefitting the consumers. Besides, the current rebound in oil prices is expected to ease pressure on the producers to a small extent.

Oil prices are likely to come under pressure going into the meeting of the Organisation of the Petroleum Exporting Countries (OPEC) on 5 June in Vienna. In its previous meeting in November last year, OPEC had rejected the proposals to cut oil production by 30 million barrels per day, which accelerated the decline in oil prices. OPEC delegates have already hinted that no change to production policy is likely at the cartel’s meeting in early June, meaning that OPEC will continue to produce more than is needed.

If crude oil prices keep on increasing, inflationary pressures might hurt the economy, Mr. Rajan said.

2. The impact of the Fed Meetings

Economies and people all over the world seem shaken about the uncertainty regarding when the U.S. Fed decides to hike interest rates and the Reserve Bank of India is also being cautious about the frequent changing speculations about the Fed’d forward guidance. RBI has takes a cautious stance to not lower rates anymore in case the Fed decides to hike rates as it would make the U.S. a more attractive place to invest and most of the capital that FIIs have invested in India will flow out.

3. Monsoon data to be observed before any further rate cut.

India on Tuesday cut this year’s monsoon expectation to 88 percent of the normal levels, prompted by an El Nino weather pattern and raising fears of the first drought in six years in a country where nearly half of farmland lacks irrigation. This year, the monsoon expectation is forecast to be below 7% of the long-term average. Although agriculture accounts for just about 15 percent of a $2 trillion economy, three-fifths of India’s population of more than 1.2 billion depend on farming for their livelihood. This could lead to hike in the rate of food prices and will lead to more inflation. Mr. Rajan mentioned that he will wait and observe the monsoon data before he decides to cut rates any more. The target inflation of 6% of banks is what he is aiming to meet in January 2016.

4. The Monsoon and how the Government will respond to it

Mr. Rajan said that in case of a less that expected monsoon, the government of India will have to prepare contingency plans to control the inflation on low production of food . They have to prepare alternate places for storage of seeds and fertilizers, credit facilities and crop-insurance programs.

Even if management of food takes place reasonably, Mr. Rajan said that the expectation of inflation will be reduced by August. But after that, it might rise to 6.0% in January 2016 which is slightly higher that the forecasts in April.

5. Infusion of Capital

The common perspective of economy is that the investments and capital inflow into the economy is fully functional and healthy. But the truth is that it is not. It requires more infusion. FII inflow has been week and there is a need in the medium term to reduce supply constraints and stay on the path of fighting inflation. Mr. Rajan also mentioned about the inflow of funds into centrally owned banks to secure proper fund flows to useful sectors.

Bottom Line

In order to get the latest updates about Financial Markets visit https://stockedge.com/