What is Future Trading?

Understanding Futures Trading Strategies first needs a basic understanding of what Futures are!

Let’s understand it with a story of Chiru and Viru-

Chiru recently won Rs 7 Cr on KBC and was looking to invest some amount in land.

During his search, he found a property on the outskirts of the city with a current valuation of 30 lakhs and had rumours that a national Highway would pass nearby. The owner, Viru, believed the property’s location was too far from the city and lacked nearby facilities. He also doubted the rumours about the national highway being built in the area, thinking it might be constructed elsewhere, which could lower the property’s value even further. Expecting the price to drop, the owner felt that ₹30 lakhs was already a good deal.

On the other hand, Chiru had faith in his information that the highway would indeed be built in that area, which would likely boost the property’s value. For him, ₹30 lakhs seemed like a bargain.

They both agreed to a deal: the price of the property would be fixed at ₹30 lakhs, regardless of what happens in the next year. If the price increases after a year, Chiru would gain, but if the price falls, the seller would benefit. Once the deal was signed, neither of them could back out.

This is a simple way to explain what futures are and how future trading works.

Futures are contracts to buy or sell an underlying asset at a future date. The asset could be a commodity, a security, or another financial instrument. In futures trading, the buyer agrees to buy, or the seller agrees to sell the asset at a predetermined price, regardless of its market price at the time of the contract’s expiration.

In the stock market, futures typically involve assets like company shares or stock indexes, such as the Nifty 50, Dow Jones, or Nasdaq.

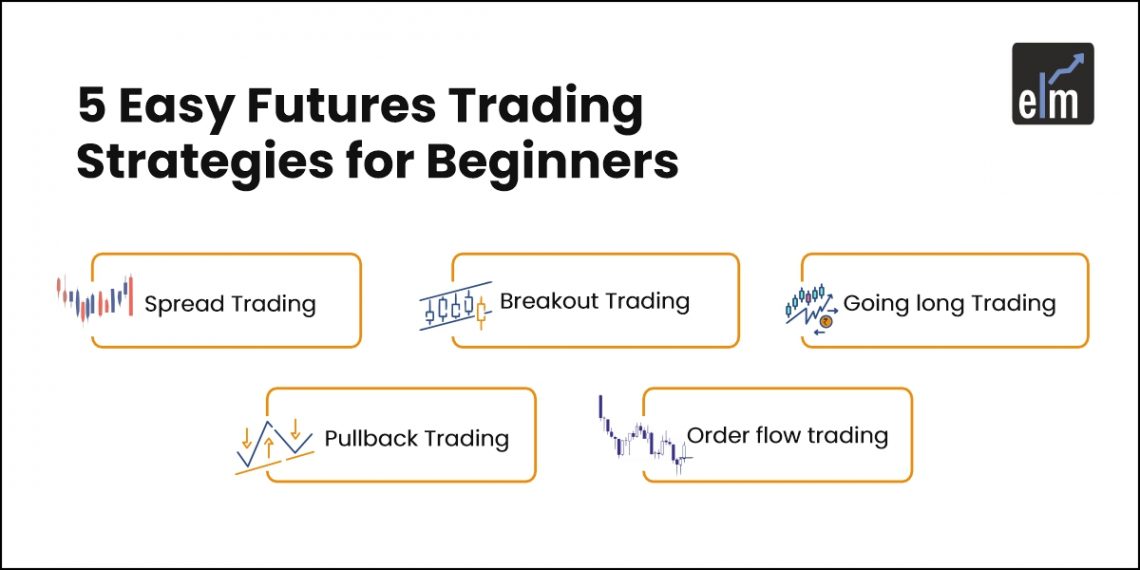

Let’s understand 5 Futures Trading Strategies that are most popular among Traders-

Top 5 Futures Trading Strategies

Spread Trading

Spread trading strategy involves buying and selling of futures contracts of the same asset but with different expiration dates at the same time. Some traders may also buy and sell futures contracts of closely related assets with the exact expiration dates. By taking these offsetting positions, traders aim to profit from the price difference between the contracts. Learning technical analysis can enhance your understanding of market trends and improve the effectiveness of spread trading strategies.

Suppose you buy Nifty Dec Futures at Rs. 21,000 and sell Nifty Jan Futures at Rs. 21,010. This creates a spread of 10 points. You expect this spread to change, allowing you to make a profit.

After a few days, let’s say Nifty Dec Futures rose to Rs. 21,015, and Nifty Jan Futures increased to Rs. 21,017. If you close your position at this point, you will make a profit of Rs. 15 on Nifty Dec Futures but a loss of Rs. 7 on Nifty Jan Futures. Overall, this gives you a net profit of Rs. 8 on the spread.

Breakout Trading

Breakout trading is a popular futures trading strategy and is often introduced in technical analysis for beginners. The idea is to find key support and resistance levels for an asset. Once these levels are identified, traders take positions when the price moves beyond them. If the asset breaks below its support level, traders open a short position, and if it breaks above its resistance level, they open a long position.

Going long Trading

In futures trading, “going long” means buying a futures contract with the hope that its price will increase before it expires. For example, if you buy a futures contract for a top automobile company at INR 800 per share, you’re taking a long position, expecting the auto industry stock price to go up by the time it matures. This idea applies not just to stocks but also to commodities, indices, and currencies. The opposite is “going short,” where you sell a futures contract, expecting its price to drop by the expiration date.

Pullback Trading

Pullback futures trading strategies involve entering the market during temporary price drops, expecting a future rise.

For example, if a BANK NIFTY futures contract usually trades at INR 42,000 but briefly falls to INR 41,000 due to short-term market fluctuations, a pullback trader would take a long position during this dip, expecting the price to bounce back to its average level or higher. This strategy is based on the idea that futures prices don’t move in a straight line but often experience short-term reversals before continuing in the same direction. Technical analysis for beginners can be essential in identifying these pullback opportunities by analyzing key indicators such as support levels and price trends.

Order flow trading

Order Flow Analysis is a powerful method for learning technical analysis by studying the real-time sequence of trades in the market to predict short-term price movements. In simpler terms, it’s about watching how trades are happening and how they influence price movement.

Two key tools are used to analyze order flow: Depth of Market (DOM) and Cluster charts.

DOM displays live orders that are waiting to be executed, showing a list of upcoming buy and sell orders. It’s like seeing where people want to buy or sell, but the trade hasn’t happened yet.

Cluster charts, on the other hand, show the trades that have already been made. They break down the trades, indicating at what prices they were executed and how many were made at each price level.

Conclusion

Planning is crucial for success, especially in futures trading, where risks are high.

The key to success is discipline, as it can mean the difference between big gains and significant losses. Also stick to one strategy that guides your decisions in futures trading strategies, and don’t let emotions cloud your judgment.

What works for someone else may not work for you, so choose a strategy that matches your goals and trading style. Test your plan on trading software before using it in real time.

A well-chosen futures trading strategy will help you maximize wins and minimize losses if you are loyal to it.

If you love learning similar topics, check out Elearnmarkets Profitable Options Trading Strategies course by Mr Chetan Panchamia- One of the finest masterclasses on Options Trading. You can also get well reviewed courses on technical analysis for beginners and other free resources that will push you towards learning technical analysis.

For market updates, visit StockEdge.

Frequently Asked Questions (FAQs)

How to trade futures for beginners?

To get started with futures trading, begin by learning the basics, including how futures contracts work. Open a trading account, research the market thoroughly, and practice with a demo account before investing real money. Incorporating futures trading strategies can help refine your approach and improve your chances of success.

Which time frame is best for futures trading?

The best time frame depends on your strategy; day traders may use 1- to 5-minute charts, while swing traders often use 1-hour to daily charts.

Which is the best indicator for futures trading?

Popular indicators include Moving Averages for trend direction and RSI for spotting overbought or oversold conditions. Choose based on your strategy and market analysis.

Good and informative blog. Thanks, but iske jagah video ho aur wo bhi hindi me to fir mere jaisa Garib (poor) ke liye bahut profitable hoga.