Bond yields tell about a country’s economy. The yields on long-term bonds are higher, because investors require greater return in exchange for tying up their money for long term. An inverted yield curve gives an adverse report on the economy like a slowdown or recession.

Interest rates are inversely related to Bond prices and directly related to bond yields. When interest rates rise then new bond yields are high and more attractive to investors while the old bonds with lower yields are less attractive, thereby forcing the bond prices lower.

Does Rise in Bond Yields affect Equity Markets?

It is generally seen that the equity markets move negatively as compared to that of bond yields in the long term. Some of the reasons why it happens are:

1. When the bond yields go up, then investment into debt market becomes more attractive. This makes equities expensive and debt cheap. Thus money flows into debt more.

2. The yield on bonds is normally the risk-free rate which goes into calculating cost of capital. When bond yields are higher then the cost of capital also increases. This means that the future cash flows will be lower. This compresses the valuations of the stocks. Thus the interest rates cut by the RBI is positive for stocks as the cost of capital becomes less and thus stocks interest burden gets reduced which finally impacts price performance..

3. Corporate’s pay a higher interest cost on debt when bond yields go up. As a result the debt servicing cost goes higher, thus then comes the risk of bankruptcy and default and this makes mid-cap and highly leveraged companies vulnerable.

Effect of high Bond Yields

High bond yields reflect the growth and inflation of any economy. If growth is strong, bond yields usually rise. They also rise when inflation is high

Increase in bond yields and interest rates impacts Stock markets adversely. Stock market gains could be threatened because higher yields make it more expensive for companies and institutions to borrow money, and this tends to slow down economic growth, which could spell doom for the corporate.

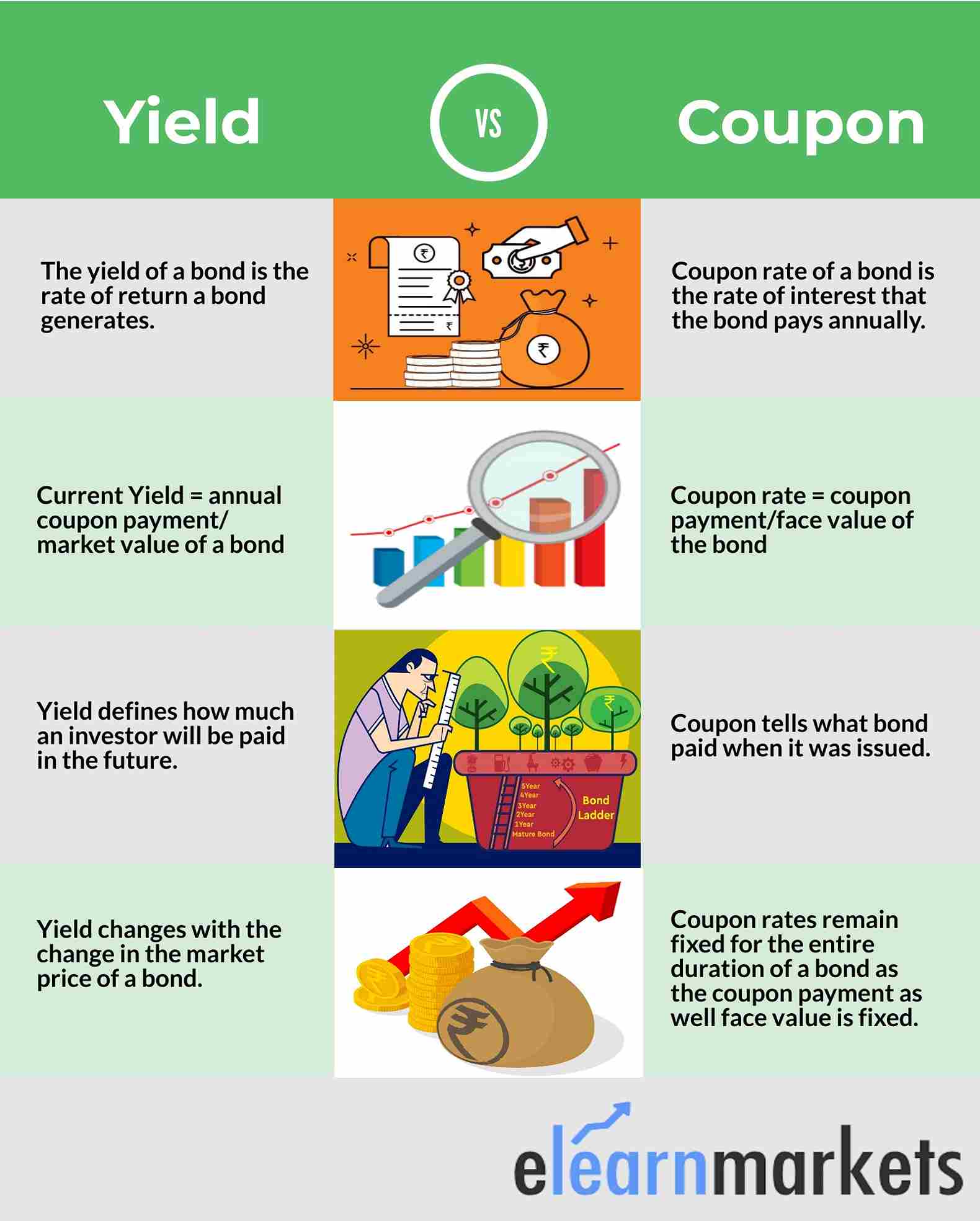

The higher is a bond’s coupon rate, or interest payment, the higher is its yield. The higher is a bond’s price; the lower will be its yield. In case of a higher bond price the investor buying the bond has to pay more for the same return on his investment.

Thus any fall in interest rates increases the bonds price and vice versa. This is because the new bonds will come with a lower coupon rate due to fall in interest rates thereby making it unattractive for a buyer. So now the old bonds in the markets would be more lucrative for the investors as it has a higher coupon rate. So the buying in old bond increases thus raising the bond prices.

What is Quantitative Easing?

If the Government buys bonds from the open market, it increases the money supply in the economy by swapping out bonds in exchange for cash to the general public. Conversely, if the Government sells bonds, it decreases the money supply by removing cash from the economy in exchange for bonds. Thus money is decreased from the markets when Inflation is high and money is given to the markets when economy needs to revive.

This process is called quantitative easing.

Are Bonds better than Stocks?

Bonds are not very liquid their prices do not change per minute thus they tend to be less volatile and less risky than stocks, and when held till maturity can offer more stable and consistent returns. Interest rates on bonds are normally higher than savings rates at banks or corporate deposits.

Default in any bond can only happen when any company or government fails to service its interest or the debt on the bonds that it has sold in the markets. As a bond investor it’s rare that you lose 100% of your investment or your uncollected interest.

Bonds can be a good investment in a bearish market sentiment because the bond prices generally rise when stock prices fall. This is only because the investors feel that bond investing during bearish market is a safer bet than equities.

What are the types of bonds?

- Fixed Rate Bonds

- Floating Rate Bonds

- Zero Interest Rate Bonds

- Inflation Linked Bonds

- Perpetual Bonds

- Subordinated Bonds

- Bearer Bonds

- War Bonds

Key Takeaways

- Hold the bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year.

- To profit from bonds investment is to sell them at a price that’s higher than what you pay initially.

- The disadvantages of bonds include rising interest rates, market volatility and credit risk.

- Bond prices rise when interest rates fall and fall when interest rates rise. But bonds are not as risky an investment as stocks.

- Perhaps the most important advantage of investing in bonds is from a taxation standpoint as the interest payments made to the bondholders may be deductible from the corporation’s taxes.

Click here to know more about the Premium offering of StockEdge.

You can check out the desktop version of StockEdge using this link.