Many investors are choosing to purchase and sell stocks on their own online instead of paying advisors high commissions to conduct trades as a result of the widespread use of digital technology and the internet. But before you start buying and selling stocks, it’s crucial to comprehend the various order forms and their proper applications.

In Intraday, the positions are squared off within the same trading session and in carry-forward trade, either delivery is taken or the position is carried forward to a later date (Futures and Options). There are different types of orders for trading.

Read to find out the top 9 types of orders that every trader should know –

Below are different types of orders that you can place from your trading account:

Different Types of Orders

1. Market Order

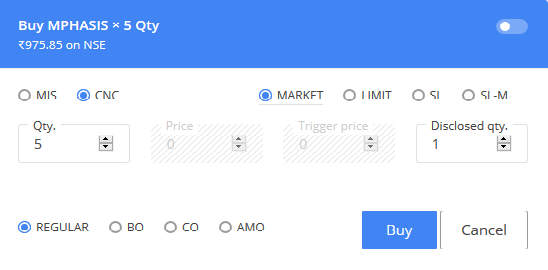

Market Order is the simplest type of order. A market order is a trading order to buy or sell a security at the best possible price in the current market.

It means once the order to buy or sell is entered, the system will execute the orders with the best prices available in the market. Market order gets executed almost immediately.

In a market order, the trader or investor does not have control on the price but there is a very high probability that the order will get executed.

A buy market order for 5 shares of company A will purchase 5 shares at the current lowest offer price in the order book.

A sell market order for 5 shares of company A will sell 5 shares at the current highest bid price in the order book.

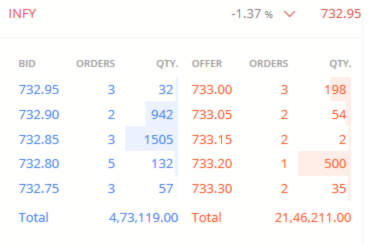

Eg: Considering this order book, if we place a market order to buy 5000 shares of this company, it will match this order with the lowest offer price available.

First 4500 shares will be bought at Rs. 998. The next 500 shares will be bought at Rs. 999

There can be a slight difference between the price we are seeing on our screen and the price at which the order gets executed.

It is because the price we see on the watchlist is the last price at which a transaction took place and the last transaction may not be my transaction.

There may be differences due to slippage- which means getting a different price due to high volatility in stock price.

2. Limit Order

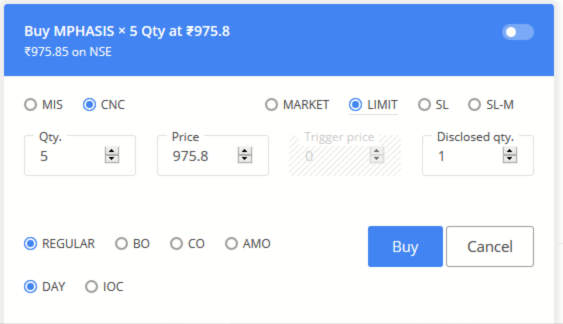

A limit order is one of the types of orders, where the trader can set a price to buy or sell a security. Unlike market order, where the trader doesn’t have any control over the price, in a limit order, the trader will set the price.

If a trader places a limit order to buy shares at Rs. 100, the shares will be bought at Rs. 100 or lower.

If the trader places a limit order to sell shares at Rs. 100, the shares will be sold at Rs. 100 or higher.

A limit order is one of the types of orders which can be used during high volatility to control the price at which we buy or sell a security.

A limit order can be used if someone is not actively following the price movement of a stock and wants to buy or sell at a pre-determined price.

A limit order can also be left open with an expiration date.

- A limit buy order will execute at the order price or lower than that price.

- A limit sell order will execute at an order price or higher than that price.

3. Stop-Loss Order

A stop-loss order is one of the most important types of orders where a trader can limit his or her losses by exiting a trade if a specific price is reached.

By placing a stop-loss order, one can save oneself from incurring high losses if the price goes against them. When a trader places a buy order, he is expecting the price to rise, so that he can earn a profit.

But it may so happen, that instead of the price rising, the price falls. To avoid high losses when prices fall, he can place a stop-loss order at a price below the buy price.

Example:

A trader places a buy order:

- Share price = Rs. 500

- Stop loss at Rs. 498

He expects the share price to go higher, to earn a profit. In case the price falls below Rs. 500, say it falls to Rs. 495.

The trader will book a loss of Rs. 2 per share (500 – 498) and exit the trade.

If he had not put a stop-loss, the loss would have been Rs (500-495) = Rs 5 per share, which is greater than the above scenario.

Similarly, when a trader places a sell order, he expects the price to fall, so that he can earn a profit.

But it may so happen, that instead of the price going down, the price goes up.

To avoid high losses when prices go down, he can put a stop-loss at a price higher than the selling price.

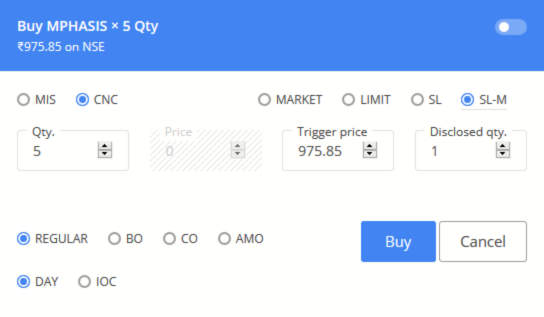

4. Stop-loss market order

A stop-loss market order is type of order, where the trader sets a trigger price to exit the trade if the price goes against his expectation.

Suppose there is a sell position at Rs. 1000 and the trigger price for stop-loss is placed at Rs. 1002.

If the price hits Rs.1002, it will place a buy order to exit the trade.

The buy order will be executed at the market price. It is used by traders to make certain that the exit trades get executed if the price goes against them.

In the stop-loss market order, trades are placed with a trigger price.

If a buy trade is placed and the price falls and hits the trigger price, it will exit the trade at any price available in the current market.

In the stop-loss market order, the losses can be more if there is high volatility in price.

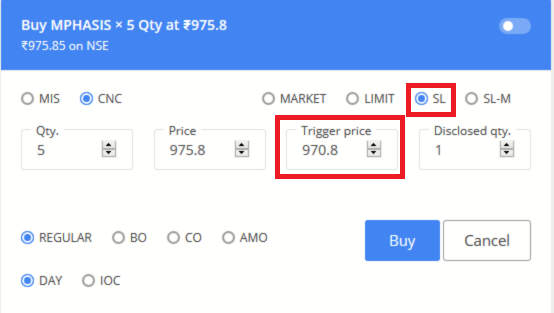

5. Stop-loss limit order

Stop-loss limit order is almost similar to stop-loss types of orders but it does not get executed at market price.

It will get executed at the specified limit price set by the trader.

In these types of orders, the trader will have to set a trigger price and a limit price.

Eg: We place a stop-loss limit sell order when we already have a long position.

A long position at price – Rs. 1000

Stop-loss limit price- Rs. 990

Trigger price – Rs. 991

If the price falls to Rs. 991, it will trigger a sell order at Rs. 990. And if the price gets to Rs. 990, it will get executed.

6. After Market Order (AMO)

Aftermarket orders are types of orders that are placed beyond market hours.

The normal market hours are between 9.15 am to 3.30 pm.

But, the entire period outside market hours cannot be used to place aftermarket orders.

Different brokers specify a time interval, within which we can place the AMOs.

There are also conditions on the price of security you can set in limit orders, normally it is in range of 5-10% of the adjusted closing price but the exact range varies among different brokers.

AMOs can also be set at market price.

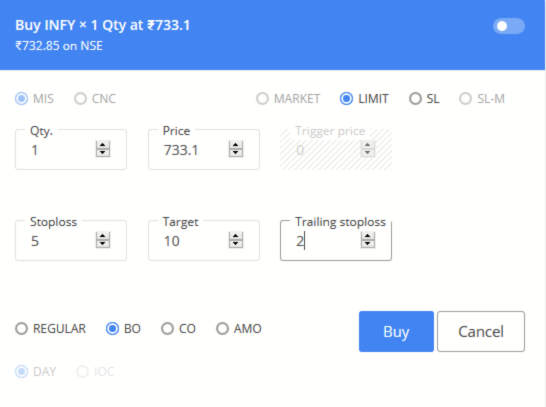

7. Bracket Order (BO)

Bracket order is a type of orders in which 3 orders are bundled into one.

You can enter a new position with a target and a stop-loss. All bracket orders are limit orders.

The stop-loss and target will have to be in absolute points (i.e. 1,2,5,10, etc).

Eg: If the share of ABC is trading at Rs. 1000. We can put a bracket order to buy it at Rs. 1000 with a target of 10 points and a stop loss of 5 points.

For every bracket order that gets executed, we have 2 corresponding orders that get placed automatically.

One is the target order and another is the stop-loss order.

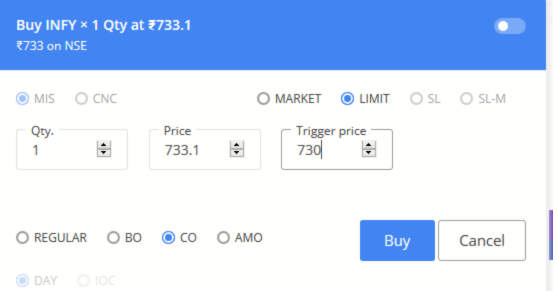

8. Cover Order

Cover order is one of the types of orders by which we can enter a position along with a stop-loss in the same order form.

9. Based on Time Duration

Also based on time duration, there can be:

Good For Day Order – order will stay valid till the end of the current trading session.

Good Till Day Order – We can keep our order active for a few days.

Eg- If we place an order on 1st March and it does not get executed, we can carry it forward to say till 4th March.

If it doesn’t get executed even on 4th March, the order will be cancelled.

Immediate or Cancel Order – Types of orders once placed will be executed immediately if it is not executed they will cancel themselves.

In this case, it may so happen that the order will be partially executed.

Eg- If we place an order to buy 1000 shares and only 600 shares get immediately purchased, the rest order of 400 will gets cancelled.

You can use StockEdge for market research

Conclusion

For individual investors, understanding the distinction between a limit and market order is essential. The order type is also determined by your investment strategy, and there are instances when one or the other will be more suited.

Because a market order is less expensive and the investment decision is based on factors that will play out over months and years, the present market price is less important to a long-term investor. A limit order to buy in with a stop-loss order to sell is typically the bare minimum for a trader, who is looking to act on a shorter-term trend in the charts and is much more conscious of the market price paid.

Frequently Asked Questions(FAQs)

What are the 4 main types of orders?

The 4 main types of orders in the stock market are- market orders, limit orders, stop-loss orders and stop-loss market orders.

What is trade order type?

Market orders, limit orders, and stop-loss orders are the three most typical types of orders. An quick buy or sell order for a securities is known as a market order. Although the execution of the order is guaranteed with this form of order, the execution price is not.

A very nice , useful knowledge for beginners. If you can send me li k to further information, are glad to know

I enjoy you because of your own efforts on this site. Kate really loves working on investigations and it is easy to understand why. Most of us know all concerning the compelling medium you present precious solutions by means of the website and in addition attract contribution from people on that content while our own girl is without question discovering a great deal. Take pleasure in the rest of the new year. You’re carrying out a terrific job.

Thanks for it):-

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

super

Hi,

We really appreciated that you liked our blog.

Keep Reading!