You may know about the role of the Securities and Exchange Board of India (SEBI) if you are in the Financial and Capital Market for about some time?

Most of us know that SEBI is just a regulatory body but in reality, it plays a much wider role in our Financial Market.

Let’s understand in brief what is SEBI and what important role does it play in our economy?

| Table of Contents |

|---|

| What is SEBI? |

| Role of SEBI |

What is SEBI?

Securities and Exchange Board of India (SEBI) is an apex body, which maintains and regulates our Capital Market. It was established in the year 1988 by the Indian government. Later in the year 1992, it received the statutory powers and the status of the fully autonomous body.

It has framed a set of regulations, bye-laws, and surveillance systems so as to provide the end-users with safety and transparency while dealing in securities. It has introduced many regulatory measures and codes of conduct for various intermediaries which include Portfolio Managers, Brokers and Sub-Brokers, Underwriters, Merchant Bankers, and so on.

Also Read: Indian Capital Market Regulators – Role and functions

Role of SEBI:

1. Restricts Illegal Practices

It forbids illegal and fraudulent practices of the firm which operates in the securities market.

2. Safeguard Investor’s Interest

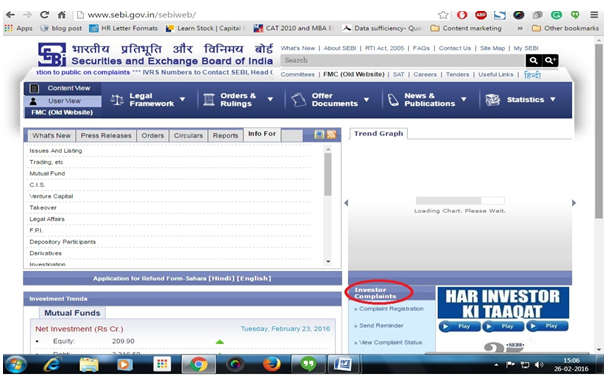

It protects an investor’s interest in the Capital Market through guidance and proper education. So if you have any complaint about anything related to Capital Market, you can simply visit the Sebi portal to register your complaint, in the manner shown below:

3. Regulate working of Exchanges

It regulates and keeps a check on the working of Stock Exchanges and other aspects of the Securities Market.

Also Read : Role, Objective, Structure and Functions of SEBI

4. Monitor the workings of Mutual Funds

It monitors and regulates the working of Mutual Funds. It keeps tight supervision on their business operations and protects investors from any unfair practices.

5. Monitor the functioning of Intermediaries

Keeps a tight check on the functioning of the intermediaries like Merchant Bankers, StockBrokers, and other intermediaries present in the Capital Market.

6. Regulate Takeovers and Acquisitions

They issue guidelines to regulate Takeovers, Mergers, and Acquisitions of firms to protect investors’ interests.

7. Prohibition of Insider Activity

It prohibits insider activity and also restricts the undesirable practice of brokers and other agents in the Capital Market.

8. Conducting Audit

It conducts an audit, inspection, and other suitable measures to keep a check on the workings of Stock Exchanges and other Intermediaries.

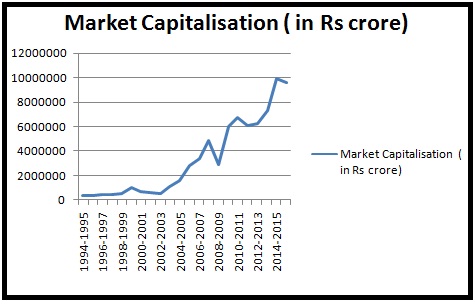

SEBI has played a really important role in regulating the capital markets and in the development of our overall economy. If you see the market value of NSE-listed companies combined together, it stands at Rs 92,09,386 crore as of January 2016 as compared to Rs 3,63,350 crore as of 1994-1995(as shown in the chart below)

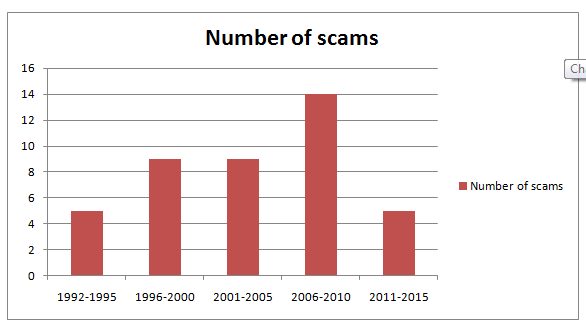

Now, let’s see how SEBI has played an active role in keeping a tight check on the scams and scandals in our economy.

There was a gradual increase in the number of scams held in our country since the 1990s and it was a common phenomenon every year in those days. However, the number of scams has also come down gradually in the last few years

Here’s a quick overview of the number of major scams held in our country-

SEBI has to date played a significant role in maintaining efficiency and transparency in the economy and has also introduced various products fulfilling the need of market participants.

Let’s hope that SEBI will keep playing the role in this manner to improve the workings of our capital market and make our economy free from any scams and frauds.

Keep learning!!

Well written Ankit!

I am Alpesh I am student of 12th this is very useful for me cause I am sp student I want to say thank you for this information.

And this is really well written..

Glad to hear that the article helped you. Thanks Alpesh for your feedback!

Thank you so much sir it really helped me a lot!!! For making my sp project

Great info, thanks for sharing this!

Hi,

Thank you for Reading!

Keep Reading

This actually answered my problem, thank you!

I think when a co issues right shares it issues only to resident investors (excl nri in estors) why so they are equal share holders of the co.

Hi,

PE-Put Option and CE- Call Options are terms in options trading. Theoretically, CE stands for ‘Right to Buy’ and PE stands for ‘Right to Sell’. When the market goes up, you should buy CE. When the market goes down, you should buy PE.

Thank you for Reading!!