You must have heard a lot of discussions going on about the SEBI new margin rules introduced by the Stock Exchange Board of India (SEBI) recently.

SEBI has introduced these new margin rules for standardizing the leverage norms and to achieve transparency in the stock market.

This new pledging mechanism will also protect the investors’ interest and prevent brokers from misusing clients’ securities.

These new set of rules are effective from September 1.

Before we discuss SEBI new margin rules, first let us discuss what does margin trading and pledging of securities means:

| Table of Contents |

|---|

| What does Margin Trading mean? |

| What does the Pledging of Securities means? |

| The New Margin rules |

What does Margin Trading mean?

Margin means leveraging in the financial markets.

It gives traders the power of buying stocks that they can’t afford to buy.

Through Margin trading, one can buy the stocks by just paying a part of the value of shares.

The margin can either be paid in cash or shares as security and the balance amount is funded by the brokers.

The securities are kept as collateral in the trading account of the investors and the broker acts as the lender of money.

The margin is settled after the position is squared off.

For example, we deposit Rs. 1,00,000 in our margin account and we have a 50% margin that means we have the purchasing power of Rs. 2,00,000.

If we buy stocks worth Rs.80,000 then we will still have a buying capacity of Rs. 1,20,000.

What does the Pledging of Securities means?

Pledging of securities means using our stocks as securities for availing a loan just like we mortgage gold jewelry for a gold loan.

Learn to invest in stock market with Stock Investing made Easy course by Market Experts

Traders especially in the F&O segment use pledging for receiving margin funding from the broker to trade.

SEBI New Margin rules:

Here are the SEBI new margin rules as announced by the Securities & Exchange board of India:

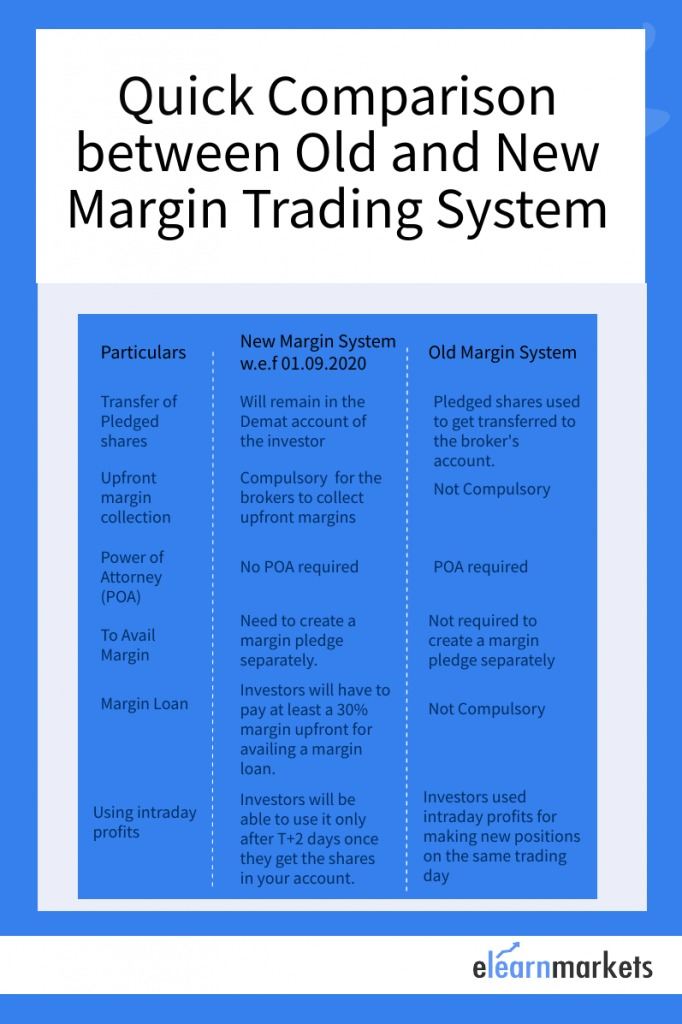

- Transfer of Pledged Shares: The shares will be directly pledged to the clearing corporation that is CDSL or NSDL. The investors will now enjoy all corporate benefits on their shares as these shares are already in their Demat account and not transferred to the broker’s account.

- Upfront margin collection: It has become compulsory for the brokers to collect margins from the investors upfront for any buying or selling of shares.

- Power of Attorney: There will be no Power of Attorney (POA) assigned to brokers by the investors. Earlier the investors had to give authority to the brokers for executing the transactions on their behalf.

- To Avail Margin: For availing margin, now the investors need to create a margin pledge separately.

- Margin Loan: Earlier collecting upfront margin wasn’t compulsory but now the investors will have to pay a minimum 20% margin upfront in the cash segment for availing a margin loan.

- Using intraday profit: The shares that are bought today cannot be sold tomorrow. Earlier the investors used intraday profits for making new positions on the same trading day but now the investors will be able to use it only after T+2 days once they get the shares in your account.

Earlier the stocks used to move to the broker’s account after the investors pledge their securities but now it will remain in the investor’s Demat account.

The broker will have to open a separate Demat account called ‘TMCM – Client Securities Margin Pledge Account’ for this purpose.

The broker will then have to re-pledge these securities to the Clearing Corporation for obtaining margins.

The broker is considered as the custodian of securities but some brokers have already been found guilty of misusing client funds and collaterals.

Thus this SEBI new margin rules will help in addressing this problem as well as protect the interest of the investors.

Keep Learning!