Crypto exchange trading is one of the most lucrative ways to invest in cryptocurrencies. It’s also among the simplest ones since it resembles buying and selling foreign currencies. However, those looking to earn from crypto exchanges should take the time to learn the principle on which they are based before venturing into investing.

Liquidity is one of the most important terms to grasp as a crypto trader. In this article, we’ll explain what crypto liquidity is and how it can affect investors and crypto value.

What is Liquidity in Crypto Markets?

Market liquidity is a term used to describe how quickly assets can be bought and sold on the market. It’s essential for market efficiency as the investors want to be able to transfer assets as they please. High liquidity indicates that the market is dynamic and the purchases are being made.

On the other hand, low liquidity can cause the prices to be erratic. Therefore, secure exchanges are the ones that are liquid and in which trades happen in a dynamic manner.

What Influences Market Liquidity

The value and price of cryptocurrencies depend on market sentiment, and any centralized institution does not regulate it. Public sentiment towards crypto and its value changes over time, and it was known to dip, but in the long run, the market has always recovered after a setback.

Trading volume is another key factor in determining market liquidity. Higher trading volume indicates that the market is liquid and vice versa. The level of adoption and integration of crypto in traditional markets affects the trading volume most of all. Regulations can also have a key impact on how liquid crypto markets are. This doesn’t always mean that governmental regulations slow down trade. Clear and precise regulations can also boost confidence in the crypto market.

How Crypto Exchanges Manage Liquidity

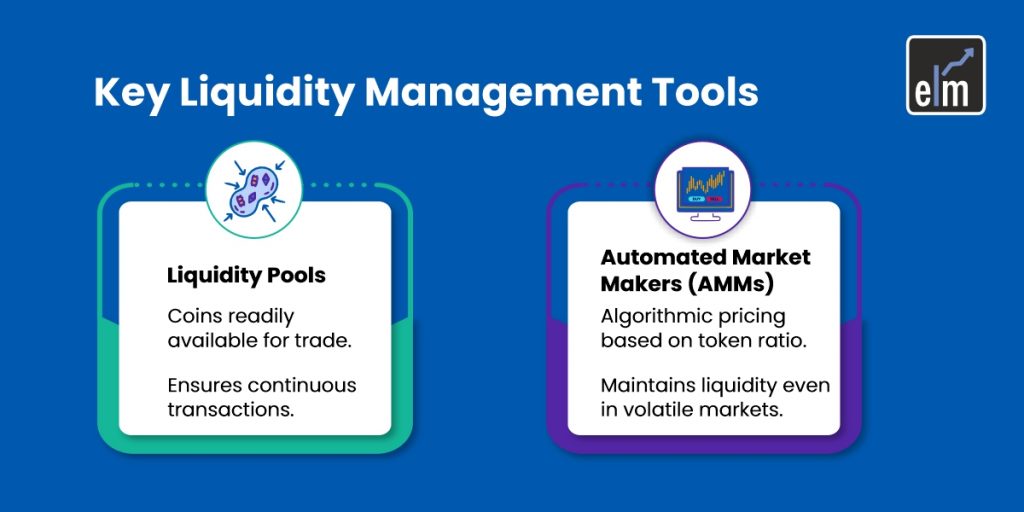

Many decentralized crypto exchanges use automated market makers to manage liquidity. For that reason, secure exchanges are the ones that utilize different tools at once so that they won’t be affected by sudden increases or decreases in trading volume.

Liquidity Pools

Liquidity pools are smart contracts holding the reserve or two or more coins that trade against each other. That way, investors can buy and sell cryptos without the need for individual buyers and sellers to create market conditions. Instead, the trade is managed by algorithms only.

Pricing Mechanism

The price of tokens in a liquidity pool is determined by the ratio of tokens in the pool. AMMs use a formula to calculate the ratio. x × y = k, where x and y are the quantities of the two cryptocurrency tokens in the liquidity pool, and k is a constant. The formula ensures that the pool’s total liquidity is the same after the trades.

Liquidity Providers

Liquidity providers are crypto exchange users who use their tokens to provide liquidity for the pool. In return, the exchange provides them with tokens representing a portion of the pool. They earn a fraction of every transaction fee paid when the investors buy and sell crypto.

How Liquidity Affects Trade

There are three main market features that are directly impacted by the changes in liquidity. All can be affected by both high and low liquidity. The effects are as follows:

Market Volatility

The availability of buyers and sellers makes it higher for any individual trade to affect the change in the price of a cryptocurrency.

High liquidity reduces the cost of trading since it narrows the bid-ask spread.

Markets that have low liquidity, however, are prone to sudden changes. This means that every trade executed on a crypto exchange is more risky and expensive for everyone involved.

Trade Execution Speed

With high liquidity, more assets are available, so the orders are met faster. With low liquidity, trades may take longer to execute as fewer assets and buyers are around. This makes for a worse customer experience from the user’s standpoint.

Impact on Price

When the market is highly liquid, traders can execute trades, often in large amounts, and it won’t affect the prices. However, low liquidity can lead to price changes, even if the orders are small because there aren’t enough assets to trade.

Strategies for Handling Liquidity Problems

Low Liquidity Markets

Traders use limit orders when the liquidity is low. This defines the minimum and maximum price of a cryptocurrency.

Reducing the size of the assets that are transferred minimizes the impact they have on the market.

Avoid market orders during times of low liquidity so that you don’t need to buy at unaffordable prices.

Time the trades at the peak hours since that’s when the liquidity will be highest even when it’s otherwise down.

High Liquidity Markets

1. Scalping is a common technique used during high liquidity markets. This means that traders make quick and frequent trades while the spreads are thin.

2. When crypto exchanges experience high liquidity, investors should take advantage of algorithms to execute their trades. It uses the price discrepancy that comes up and needs to be seized upon quickly.

3. Use market orders for immediate execution when the prices are high.

Conclusion

Understanding liquidity in crypto exchange trading is essential for any investor. High liquidity ensures smoother transactions, stable prices, and faster trade execution, which leads to a better trading experience. On the other hand, low liquidity can cause price volatility, slow trade execution, and higher risks.

By learning how to assess and manage liquidity, traders can make more informed decisions and minimize their risks. Whether the market is highly liquid or experiencing low liquidity, applying the right strategies can help navigate the challenges and maximize the benefits of trading on crypto exchanges.