With the 2024 Lok Sabha elections rapidly approaching, the political climate in India is becoming more intense. Prime Minister Narendra Modi’s Bhartiya Janata Party (BJP) is vying for a third term in office, and the opposition parties are attempting to come together to challenge the BJP’s hegemony.

The Lok Sabha Election Dates 2024 have not yet been established but are expected to take place in April and May.

The Election Commission of India (ECI) just announced the preliminary date of the elections, generating excitement throughout the nation. The Chief Electoral Officer of India announced the predicted date of the Lok Sabha election as April 16, 2024.

There are 545 members of the Lok Sabha, including two reserved seats for members. There will be 543 seats up for election; use the Lok Sabha Election 2024 Predictions to determine which party will prevail. In this election, the majority consists of 272 seats.

The election results will greatly impact the stock and bond markets and the Indian economy. Numerous businesses and sectors will see changes in the future as a result of government policies and initiatives. A BJP victory may help certain industries and equities, which an investor needs to be aware of.

As the 2024 Lok Sabha Elections are approaching, let us discuss what are the factors to Consider While Picking Stocks For the 2024 Lok Sabha Elections and what sectors investors should keep on their radar:

Table of Contents

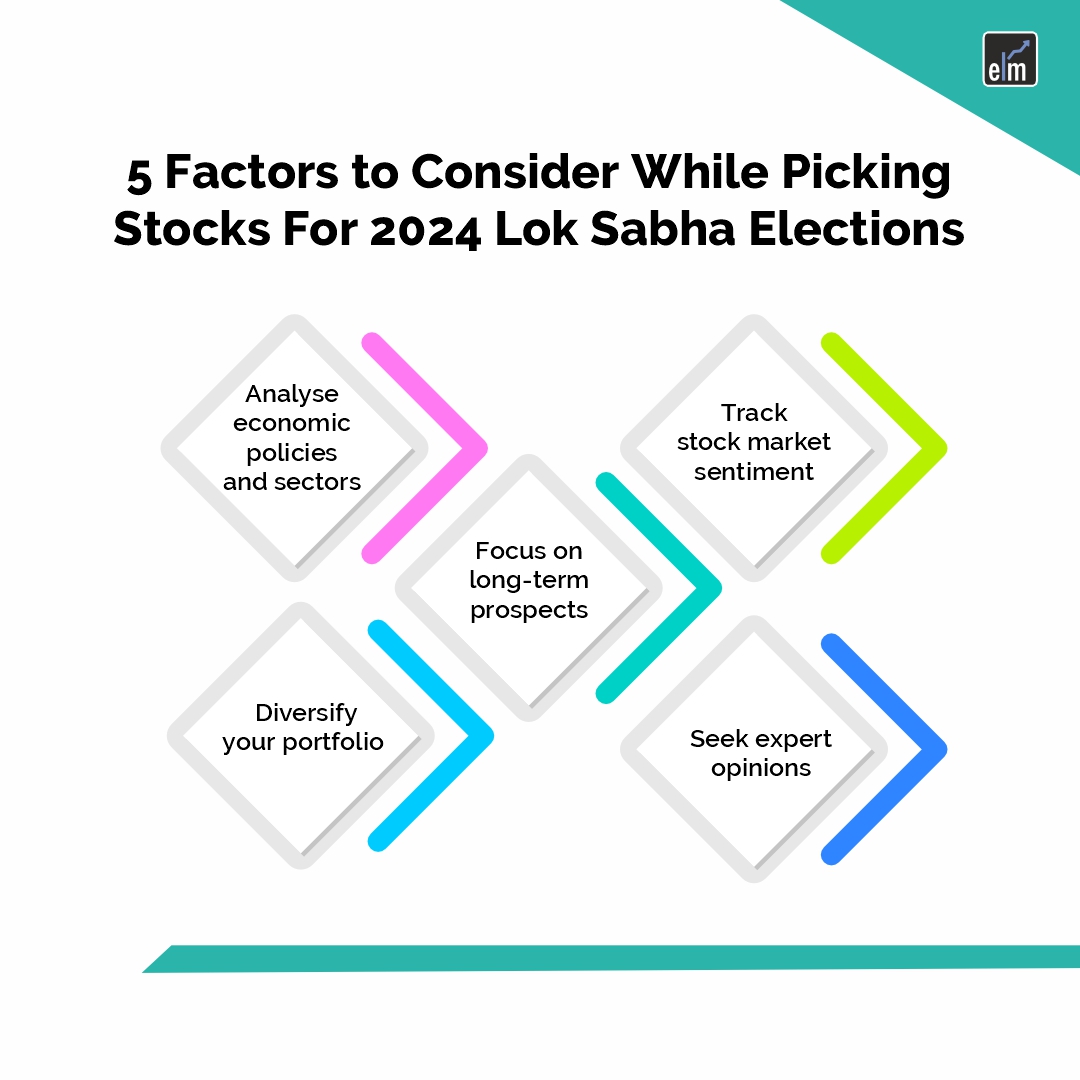

5 Factors to Consider While Picking Stocks For 2024 Lok Sabha Elections

When it comes to picking stocks ahead of the Lok Sabha Elections 2024, it’s essential to approach it with caution and do thorough research. Here are a few tips to consider:

1. Analyse Economic Policies and Sectors

Examine the economic policies that political parties are proposing and the potential effects they may have on different economic sectors. Depending on the party’s objectives and focus, certain sectors might profit more than others.

2. Track Stock Market Sentiment

Prior to the elections, monitor investor activity and market mood. Also, monitor market volatility and how political events affect various equities and industries.

3. Focus On Long-Term Prospects

Focus on stocks with strong long-term growth potential rather than placing all of your short-term wagers on the results of the next election. Seek out businesses with solid foundations, a competitive edge, and long-term business plans.

4. Diversify Your Portfolio

To reduce risks, spread your assets among a variety of industries and equities. With diversification, the effects of any one party or election result on your portfolio as a whole are lessened.

5. Seek Expert Opinions

Seek advice from financial consultants or specialists with knowledge of stock market analysis during election seasons. Their advice and thoughts might offer insightful viewpoints on possible investment opportunities.

7 Sectors to consider for 2024 Lok Sabha Elections- Stock Market Trading

Some Sectors that the traders may keep on the radar for trading in the stock market for the 2024 Lok Sabha elections:

1. Railways

The capital expenditures of Indian railways can increase dramatically. While launching multiple new trains on well-travelled lines, the government might give priority to updating the present trains with amenities.

The Union Budget, which is due after the elections, is also anticipated to include a statement regarding the network’s infrastructure expansion.

In the most recent budget, the BJP government showed its love for railroads by allocating Rs 2.40 lakh crores for capital expenditures to expand the Indian railway network. This amount is nine times higher than what the UPA administration declared for the 2013–14 budget year.

2. Infrastructure

Since greater spending on infrastructure projects is frequently a part of political agendas, government concentration on infrastructure development can benefit industries like construction, cement, steel, real estate, and infrastructure stocks.

3. Renewables

Government policies encouraging the adoption of renewable energy sources may lead to growth in industries like solar power, wind energy, and electric vehicles given the emphasis on clean energy and sustainability.

4. Defence Sector

The “Make in India” movement has spread to the defence industry under the BJP government, going beyond consumer durables and textiles.

Four “Positive Indigenization Lists” have been produced by the ruling administration in an effort to promote domestic manufacturing and lessen reliance on imports. 411 service-related items make up this list, which is divided into three subsists under defence public sector Undertakings (DPSUs). This indicates that 3,783 products on the list are currently produced locally.

To understand what defense means to the BJP government, take a look at the budget from the prior year. A sum of Rs 5.94 lakh crore has been allocated to the Ministry of Defence (MoD). This amount represents 13.18% of the entire budget of Rs 45.03 lakh crore.

5. PSU Banks

The increase in non-performing assets (NPAs) and bad loans in PSU banks has long alarmed the government. The country has witnessed the unlikely merger of many well-known banks since the BJP became office.

The government took this action to improve the overall health of the banking industry and capital adequacy ratios (CARs).

6. Ethanol Sector

When combined with gasoline, ethanol produces less greenhouse gas emissions. To encourage the manufacture of ethanol, the government has started the Ethanol Blended Petrol (EBP) Program. This program contributes to increased energy security, reduced fuel imports, foreign exchange savings, environmental preservation, and support for the agricultural industry.

The government announced a “National Policy on Biofuels” in 2018, with the goal of blending 20% ethanol by 2030. However, the goal has been advanced to 2025–2026 as a result of the government’s successful initiatives since 2014.

7. Realty

Economic expansion is closely associated with the real estate industry. Real estate stocks may be impacted by laws pertaining to developer incentives, home loan interest rates, and affordable housing.

Conclusion

Recall that a variety of factors, including political happenings, worldwide economic trends, and investor confidence, can affect market attitudes. Investors should remain aware as the elections draw near and take these industries into account when making investing decisions.

Frequently Asked Questions (FAQs)

Is it advisable to make significant investment decisions solely based on election outcomes?

Election results can affect sectoral trends and market sentiment, but before making judgments, one must take into account firm fundamentals, long-term investing objectives, and broader economic considerations.

Should I diversify my portfolio during election periods?

One of the most important tactics for reducing the dangers brought on by market volatility is diversification. To reduce your exposure to election-related risk, think about diversifying your investments across different industries and asset types.