Key Takeaways

- CIBIL Score: A 3-digit number between 300-900 that shows your creditworthiness. A good score helps you get faster loan approvals and better interest rates.

- High Credit Use: Using more than 30% of your credit card limit regularly makes you look credit-hungry. Try to pay off your dues before the billing cycle ends.

- Minimum Due Isn’t Enough: Only paying the minimum amount on your credit card signals repayment pressure. It adds interest and pulls your score down slowly.

- Don’t Make It Risky: Closing old credit cards or co-signing loans can hurt your score. Keep old cards active and only co-sign if you fully trust the other person.

Table of Contents

It’s easy to track your credit card bill and EMIs, but despite that vigilance, India’s average CIBIL score hovers at just 680-715, well below the 750+ threshold lenders prefer for the best terms. If nearly 119 million Indians actively monitored their CIBIL report in March 2024, a 51% year‑on‑year jump, why do so many of us settle for “average”? The answer lies not in ignorance but in small oversights.

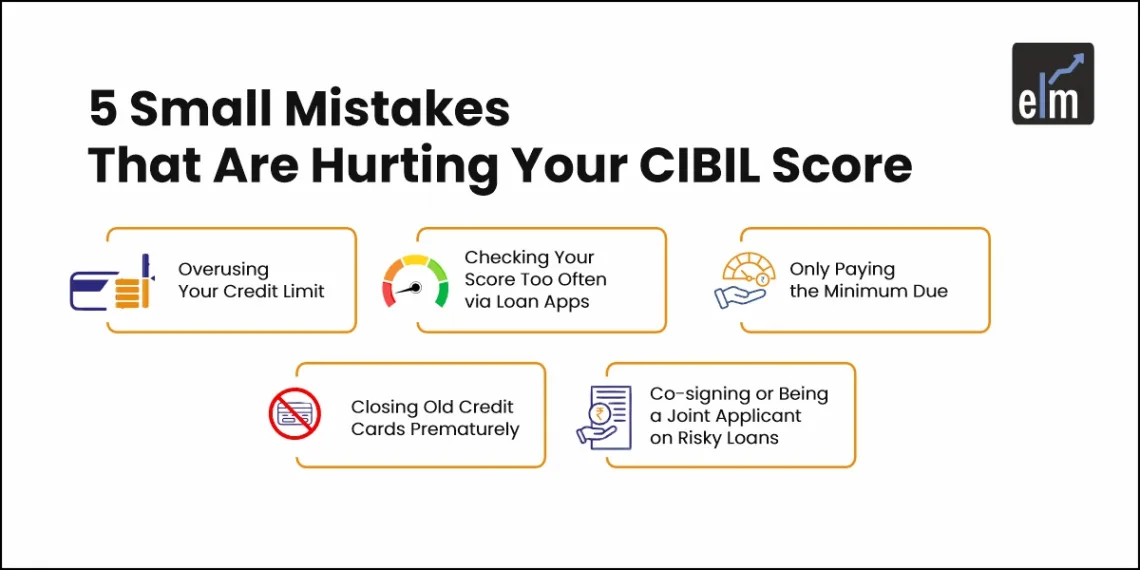

Let’s unpack five sneaky habits that could be dragging your score down without you realising it.

What Is a CIBIL Score?

Your CIBIL score is a three‑digit number between 300 and 900 that summarises your credit behaviour. The closer you are to 900, the more trustworthy you appear to banks and NBFCs.

How Is the CIBIL Score Calculated?

TransUnion CIBIL weighs your credit report across four main factors:

- Payment history (30%): Timeliness of EMI and credit card payments.

- Credit exposure (25%): Your overall balances and utilisation.

- Credit mix & duration (25%): Diversity of loans (home, auto, personal) and length of accounts.

- Other factors (20%): Recent enquiries, defaults, and record‑keeping.

Why Your CIBIL Score Matters

A score of 750+ unlocks:

- Lower interest rates – saving you lakhs over a home loan.

- Higher loan approval odds – even during tight credit cycles.

- Faster processing – because you’re a low‑risk borrower.

Meanwhile, anything below 700 can trigger higher rates or outright rejections.

Five Sneaky Habits That Could Be Dragging Down Your Score

1. Overusing Your Credit Limit

India’s active credit cards crossed 108 million by December 2024, with total balances hitting ₹3.3 lakh crore by June 2024, up 26.5% year‑on‑year. Yet the average credit utilisation ratio remains north of 40%, while experts recommend keeping it below 30%. High utilisation signals dependence on credit and can shave off points fast. Aim to:

- Combine limits (e.g. ₹10 lakhs) but keep outstanding under ₹3 lakhs.

- Pay down 70%+ of your balance at least 5–10 days before statement cut‑off so the ratio “resets.”

2. Checking Your Score Too Often via Loan Apps

There are two enquiry types:

- Soft Checks (you logging in): Zero impact. Do these monthly on CIBIL’s official site or partnered apps.

- Hard Checks (lenders evaluating you): Each one can dip your score by a few points if they cluster in a short span.

Reserve hard pulls for when you’re serious about a new personal loan and space them out.

3. Only Paying the Minimum Due

Covering only the minimum due may preserve cash flow but racks up interest and signals repayment strain. TransUnion CIBIL data shows that cardholders who revolve balances only have scores on average 42 points lower than those who clear full dues. Whenever possible:

- Set up auto‑debit for full or high‑value payments.

- Treat minimum payments as the floor, not the ceiling.

4. Closing Old Credit Cards Prematurely

Your length of credit history contributes roughly 15–25% of your score. Shuttering a decade‑old card might feel responsible but it can shorten your average account age. Instead:

- Keep “no‑fee” starter cards active with a small monthly spend (₹500–₹1,000).

- Use them for subscriptions and clear the balance immediately.

5. Co‑signing or Being a Joint Applicant on Risky Loans

When you co‑sign, you assume full liability. A default by the primary borrower lands on your report, too. Only co‑sign or joint‑apply if you have absolute confidence in the other party’s repayment discipline.

Practical Steps to Boost Your CIBIL Score

- Soft Check Your Report Monthly: Spot errors or identity friction using CIBIL’s portal, no score hit.

- Keep Utilisation Under 30%: Spread balances across cards and pay down ahead of statements.

- Pay EMIs and Bills on Time: Even a single missed EMI stays on your report for years.

- Avoid Multiple Loan Applications: Space out credit needs by at least 3–6 months.

Bottomline

Your CIBIL score is a snapshot of your financial trustworthiness. By addressing these five habits and following the practical tips, you’ll be well on your way to surpassing the 750 mark and unlocking better loan deals, lower rates, and greater peace of mind.

Read here if you want to know more about CIBIL Score

Frequently Asked Questions (FAQs)

1. What Is the Full Form of CIBIL Score?

CIBIL stands for Credit Information Bureau (India) Limited.

2. How Do I Check My CIBIL Score?

Use the official CIBIL website or partner apps like Paytm, Google Pay, and PhonePe for a free monthly soft pull.

3. What’s Considered a Good CIBIL Score?

A score of 750 and above is widely regarded as excellent for most consumer loans.

4. How Is My CIBIL Score Calculated?

It’s based on payment history (30%), credit exposure (25%), credit mix & duration (25%), and other factors (20%).

5. Can I Get a Personal Loan with a Low CIBIL Score?

Yes, but expect higher interest rates, stricter terms, and possibly lower loan amounts. Raising your score first can save you a bundle in interest.