Have you ever had a thought about what could smart investment choice? And how to get a better ROI on your invested money? So here is the answer, The REIT.

We the people of India are always interested to invest either in Real Estate or Gold. People having more land are looked upon by the society as rich people and gold would remain an investment destination to help during hard times.

Now people with land would either construct it or rent out, both of which was always a real headache with a lot of time, money and regulatory approvals that too only in their known area. Next when you want to sell the constructed land, it would also be a very tedious effort. People could not buy faraway land as looking after them was again a huge painstaking task.

People buying land in faraway destinations always had to deal with either land mafias or acquisition by the local sharks. Thus, people refrained and bought land in their own vicinity. Many who wanted to purchase some cheap land could never fulfill their dreams.

What is REIT?

Thus, a new alternative Investment tool came up known as Real Estate Investment Trust or REITs. Now the REIT lets you purchase land in and around India with an investment as low as Rs. 50,000.

This is a bouquet of real estate managed by a Trust around India. Thus, this may have properties from different states and you as a holder of its units, will get dividends on it derived from the Rent Income that it gets as its business Income.

Thus, it functions with an investment value derived from a group of people who want to invest into the growth of real estate. You can invest into REITs whenever you wish to.

How does it function?

Now, this trust buys either land or finished projects and derives rental income out of it. The investment is managed by professionals in the field. 80% of their investments are into commercial spaces. 90% of rent income collected by them has to be distributed to the holders of the REITs after paying for all the expenses of the Trust. Thus, all these real estate managers do proper research before venturing out to buy any projects from the Trusts funds.

How is a REIT different from Mutual Funds or stocks?

REITs , just like mutual funds, are managed by professionals in the Real estate and are a group of land banks or buildings in different states. Thus as M-F checks the financials on the company before taking any investment decision, similarly the REITs also checks out the financial viability of any project before investing into it. Thus, selling or buying of Real Estate takes more time than shares.

Secondly, when you buy shares of a real estate company it may or may not outperform based on the management’s business outlook over the years and thus, you may or may not derive capital appreciation on it. On the other hand, REITs normally give dividends twice a year to its investors thus, your chance of reaping capital appreciation on the price of REIT and increase in rental income becomes a regular process. The prices of land normally increase by 4%-5% based on Inflation every year and normally REITs have given dividends close to 5%-6%. Thus, you gain both on your investments and dividends by 10%-12%.

What is the Tax structure of REITs?

You can sell a REIT just like any share or Mutual fund in the exchanges. Today there are very few REITs in India which are listed. So if you sell the REITs before 3 years then your tax outgo or short term capital gains tax is 15% and if you sell them after 3 years then a long term capital gain tax of 10% is charged. Whereas if you sell a real estate bought individually, then either you need to keep that money locked in for 3 years or invest in another real estate to save tax.

What should you check before investing into REIT’S?

Before investment into any REITs an Investor should check out few things like :

What is the soft portfolio of the REIT?

How much rent does it receive?

What percentage of its acquired space is rented out and what percentage is vacant?

What is the area of its property i.e., is it in the business hub or in some faraway place?

What can be the future growth prospect for this REIT as an investment bet?

What are the benefits of Investing into REITs?

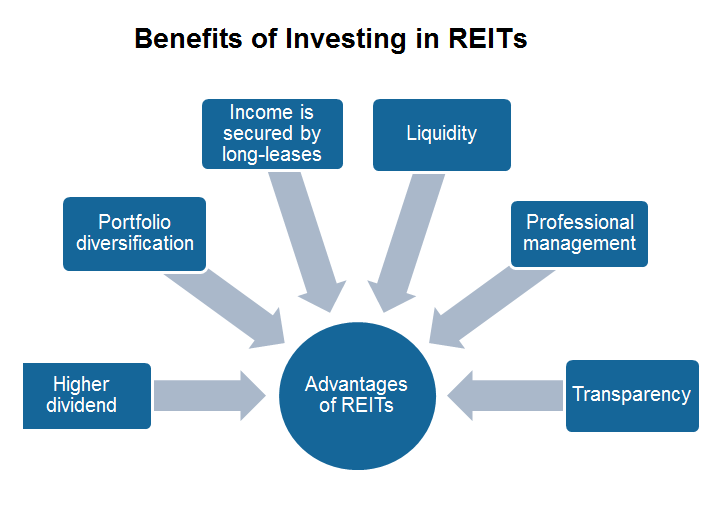

If one wants to benefit from the growth in Real Estate all over India, and wants to be a part of this growth story, then he can invest in REIT and be the owner of various properties invested on by the REIT. It will save him the hassle of individual buying, paperwork and maintenance and will also keep him away from the hassle of collecting rents from the tenants. Thus, he can be an owner of multiple real estates and can collect rents as dividend being a passive Investor.

Thus’ not only will he be able to collect dividends and have capital appreciation but will also have the opportunity to sell it whenever he decides for it.

Thus, risk averse investors who cannot do fundamental analysis of stocks and track them on a real time basis can stay invested in REITs to generate a return better than FDs and Bonds. Thus it’s also a good investment bet for people looking out for retirement Income.

To read more you can also visit web.stockedge.com.

Happy Investing !