Asset allocation was also called diversification in olden days and after 1960 only this term started gaining some prominence. In fact, the concept of asset allocation came afterward with the growth of modern finance.

| Table of Contents |

|---|

| What is Asset Allocation ? |

| Asset Allocation & Diversification |

| Why Asset Allocation is required? |

| Bottomline |

What is Asset Allocation ?

Diversification is an old concept and in history, we find many instances when the principal of diversification has been used. One of the earlier users of this principal was Talmud whose exact life years are not known but is thought to have lived somewhere between 1200 BC to 500 AD.

He said, “ let very man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserves”.

So around 2000 years ago to the principal of diversification had prominence. We also find instances from Hindu Scriptures where man is advised to keep a part of savings in gold and land. So diversification is just an old nomenclature for a new concept – Asset Allocation.

Do you think what was in history, is still relevant today? Would you still invest in the 3 ways as suggested by Talmud or by Hindu Scriptures? Probably yes, with some changes in the assets. But you will not like to concentrate as it increases risk.

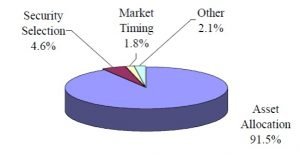

The seminal research work entitled ” Determinants of Portfolio Performance ” published by Messrs. Brinson, Flood and Beebower in the Financial Analysts Journal in 1986 that studied the investment performance of US pension plans and other related research studies have highlighted that asset allocation is the key driver of long-term investment performance. Other aspects of investing such as market timing and security selection have a much lower contribution to long-term investment performance. There finding can be summarised as.

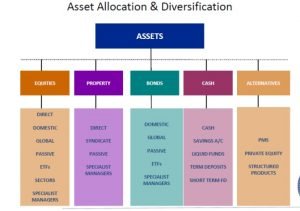

In today’s world, if you see investor spread across their investments in Equity, Debt, Gold, Real Estate & Art. They use different assets to build a their portfolio.

Learn more about diversification with Diversification – Variety is spice of Life in just 2 hours by Experts

Asset Allocation & Diversification

Each asset class has distinguished characteristics and a separate movement track. They compliment or sometimes hedge each other. It all about using the strength of one asset class and balancing the weakness of that asset class with the strength of another asset class.

So when a person buys or diversify his portfolio in another asset, he expects minimum 2 things:

- The existing assets volatility can be traded off with the introduction of the new asset.

- The combined returns are above the risk-adjusted returns before the new asset is included.

Now, look at what Talmud suggested. He said if you follow his advice, you will have equal purchase value of land, business & cash. So in case:

- There is a flood and you cannot sow a crop, cash and business will helo you and family survive.

- If there is economic downturn the business may not flourish but have land to feed family and cash to run business till you make a profit.

- If there is a war and king imposes a tax or impounds your cash, you have land to plough and a business to earn to replenish what you have lost.

The mix of different factors is helping a full life to survive.

Hence diversification and asset allocation are required.

Why Asset Allocation is required?

I am just putting simple questions and if the answer is affirmation, everyone requires asset allocation

- Do you want high returns and do not want to incur risk in attaining those returns?

There are 2 important players in the process of investments. Mr. Market as the term coined by Ben Graham and Mr. Investor.

Markets have huge positives that they are connected by technology, they are transparent as they are in researchers focus all time and regulated by central agencies. But they are also very volatile because millions of people demand or supply securities based on their view, which they form on certain information received from channels they think trustworthy. So in actually, if you see the processes are regulated or controlled but information is free to flow with distortions.

Further, successful investment outcomes also depend on a lot of individual investor behaviors. A typical investor is confronted by questions such as, Where do I invest? When do I invest? How much do I invest? What should be the investment mix? Which instruments do I consider? When should I exit my holdings? etc.

On the other hand investor face, more than 20 identified biases and act like they know everything. They dream of returns and are scared of risk involved. They don’t understand that these two things, risk and returns come hand in hand. No one is willing to pay you if you do not have a view whether correct or right. And having a view about performance and future returns is the basic step of risk as your assessment can be opposite of reality or an underestimation. An investor may love Mr. Market but does not like a lot of phases which market depicts. The basic emotions of fear and greed may override the reasons and logical thinking.

So, on one hand, is Mr. Market you think you cannot control but you know is long term in nature. On the other hand, it is you yourself, who you think to know but gets easily impacted in short term.

Bottomline

In trying to address these questions, investors often succumb to their behavioral biases and a certain lack of investment discipline with regards to the right choice of asset classes and a sound portfolio implementation. This makes asset allocation rather difficult in practice for many investors who try to do it on their own. Hence it is imperative for investors to arrive at suitable asset allocations after a careful consideration of their investment goals, risk tolerance, time horizon and unique circumstances and with guidance from a qualified financial advisor.

In order to get the latest updates on Financial Markets visit Stockedge

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.