We all know that Gross Domestic Product (GDP) is a measure of the complete activity in the Indian economy. Yet is there some indicator that explicitly reflects the industrial activities in the Indian economy? The answer is Yes and this is known as Index of Industrial Production (IIP).

What is Index of Industrial Production (IIP)?

The Index of Industrial Production(IIP) is a combined indicator.

It is expressed in the form of an index number. This measures the short-term variations in the production volume of a basket of industrial goods during a particular time period with reference to a base time period.

Thus, IIP is a short-term measure of industrial growth till the outcomes from Annual Survey of Industries (ASI) and National Accounts Statistics such as GDP are available.

Base Year Value in IIP:

- The base year for IIP is always given a value of 100.

- The base year of IIP has been revised to 2011-2012 (in the month of May)

- This has been done in order to bring the IIP data at par with GDP data(GDP base year has been revised to 2011-2012).

For Example:

Suppose the value of IIP in 2016 was 140.

This means that there has been a 40%(140-100) increase in the industrial activities in India as compared to the industrial activities in 2011-2012.

Classification of Index of Industrial Production (IIP):

Sector-wise classification of IIP:

As per United Nations Statistics Division: the scope of IIP should include

1. Mining

2. Manufacturing

3. Electricity

4. Gas Steam

5. Air Conditioning Supply

6. Water Supply

7. Waste Management, Sewerage, and Remediation Activities

But due to data availability constraints for items (4) to (7), they are not included in the Indian IIP. Thus sector-wise Indian IIP comprises the following three broad sectors:

1. Mining

2. Manufacturing

3. Electricity

Use-Based classification of Index of Industrial Production (IIP)

The use-based classification of IIP comprises of the following categories of representative goods:

1. Primary Goods:

2. Capital Goods

3. Intermediate Goods

4. Infrastructure/Construction Goods

5. Consumer Durables

6. Non-Consumer Durables

Item-wise classification of IIP:

IIP with the base year 2011-2012 comprises of 839 items and 407 items groups.

Of the 407 item groups: 405 item groups pertain to the manufacturing sector.

While mining and electricity, sector comprise of a single item group each.

- Manufacturing Sector comprises of 809 items

- Mining Sector comprises of 29 items

- Electricity Sector comprises of 1 item.

IIP Weightage of the different sectors:

Mining sector items comprise of 14.37% of the weight of all the items included in IIP.

While the manufacturing sector comprises of 77.6% by weight of all the items of IIP.

Finally, the electricity sector comprises of 7.9% by weight of all the items of IIP.

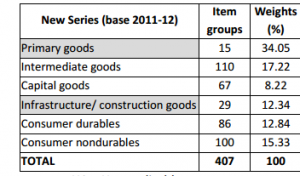

Weightage as per Use-based classification in IIP:

Who publishes IIP data?

IIP is compiled and published on a monthly basis by Central Statistics Office (CSO) of the Ministry of Statistics and Programme Implementation.

It is published with a lag period of 6 weeks from the end of the Reference Month.

Reference Month can be defined as the month for which the IIP data is being released.

IIP data release comprises of quick estimates of the IIP for the relevant month as well as revised and final indices.

The revised indices are the first revision of the quick estimates of the month prior to the reference month.

While the final indices are the final revised quick estimates of two months prior to the reference month.

Sources of Data Collection:

The data required for the compilation of IIP is sourced from 14 agencies:

1. Indian Bureau of Mines

2. Directorate of Sugar and Vegetable Oils

3. Tea Board

4. Coffee Board

5. Office of the Textile Commissioner

6. Office of the Jute Commissioner

7. Office of the Coal Controller

8. Ministry of Petroleum and Natural Gas

9. Joint Plant Committee(Iron and Steel)

10. Railway Board

11. Department of Industrial Policy and Promotion(DIPP)

12. Department of Chemicals and Petrochemicals

13. Department of Fertilizers

14. Central Electricity Authority

Calculation of IIP:

- The compilation of IIP is carried out in multiple stages.

Initially for the items.

Then for the sub-groups groups and major groups.

Finally for all the sectors combined. - The items included in IIP are selected from the results of 3-digit level National Industrial Classification(NIC)-2008.

- The selection is done in such a way so as to ensure that all the selected items contribute to at least 80% of the output of each 3 digit group.

- Each item is given a relevant weight.

- Weights at the sectoral levels are computed by using the sectoral Gross Value Added(GVA) , the GVA figures are obtained from National Accounts Statistics with the base year 2011-2012.

IIP is calculated as a simple weighted arithmetic mean of production relatives by using Laspreye’s Formula:

IIP=Summation(Wi.Ri)/Summation(Wi)

Where : Ri= Production Relative of the i th item for the relevant month

Wi= Weight allotted to the ith itemProduction Relative is calculated as:

Ri= Qi/Qo

Where: Qi= Quantity produced in the current year in the reference month

Qo= Quantity produced in the base year in the reference month

Impact of IIP on the economy:

A low IIP implies a lower production in the industrial sector.

This, in turn, can be detrimental to the growth of the economy and vice-versa.

Also Read: A quick introduction to the term index and its concepts

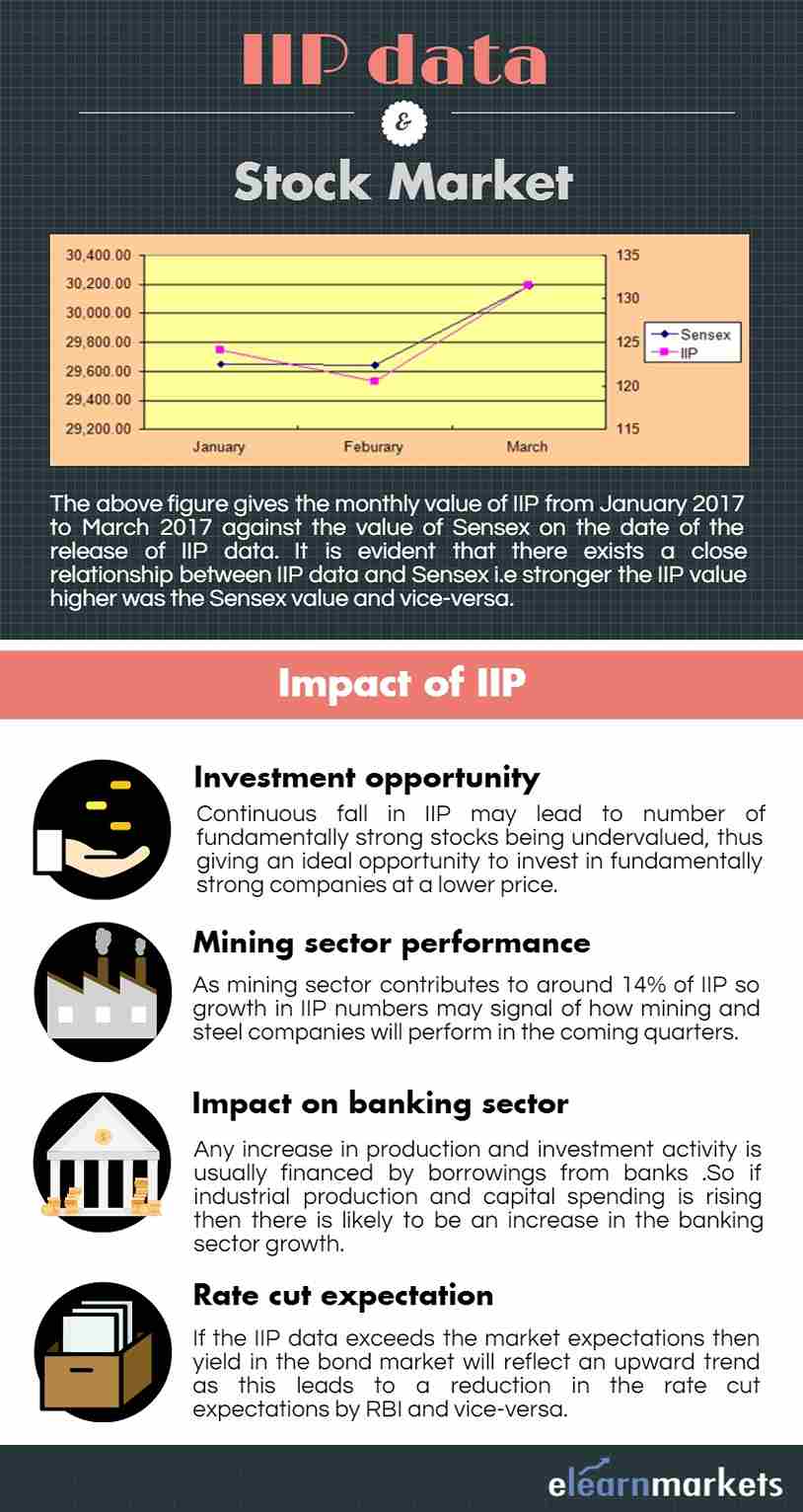

IIP Data and Stock Market:

- Decreased Consumer Spending will lead to lower demand.

The producers will respond to this low demand situation by reducing their production.

A low industrial production will result in lower corporate sales and profits.

Thus a direct impact of weak IIP data is a sudden fall in stock prices. - On the other hand, a strong IIP data will imply higher industrial production.

This, in turn, will imply higher demand, which in turn will lead to higher corporate sales and to greater profits.

Hence a direct impact of a strong IIP data will be a rise in the stock prices. - A continuous fall in IIP may lead to many strong stocks being undervalued.

This gives an individual an ideal opportunity to invest in strong companies at a lower price. - As mining sector contributes to around 14% of IIP so growth in IIP numbers can give a signal of how mining and steel companies will perform in the coming quarters.

- Any increase in production and investment activity is usually financed by borrowings from banks.

So if industrial production and capital spending are rising it then there is likely to be an increase in the banking sector growth. - Similarly a weak IIP data can have an adverse impact on the banking sector.

- If the IIP data exceeds the market expectations then yield in the bond market will reflect an upward trend as this leads to a reduction in the rate cut expectations by RBI and vise-versa.

IIP and Sensex:

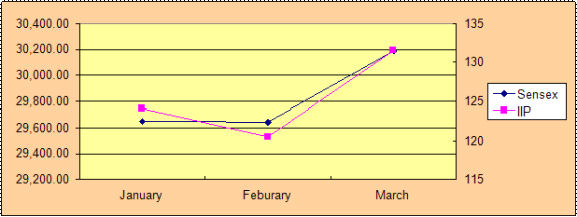

- Source: http://www.bseindia.com/ and http://mospi.nic.in/

The above figure gives the monthly value of IIP for the three month period starting from January 2017 to March 2017 against the value of Sensex on the date of the release of IIP data(usually the 12 th of the month).

As it is clear from the above figure there exists a close relationship between IIP data and Sensex i.e stronger the IIP value higher was the Sensex value and vice-versa.

Example of the impact of IIP data on stock prices:

The February 2017 IIP of 120.5 (released on 12th April) registered a fall of 2.9 as compared to the previous month IIP.

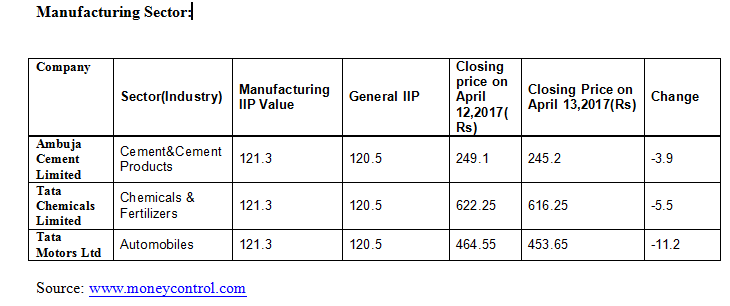

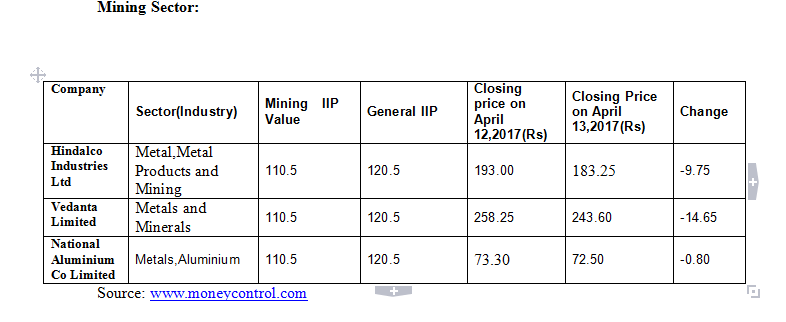

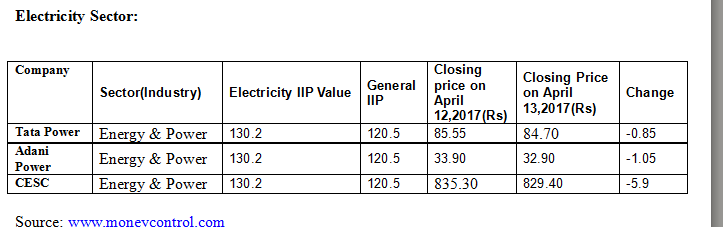

The overall weak IIP data lead to a fall in the stock prices as shown in the tables below.

For representative purposes: three companies have been selected from three broad sectors viz Manufacturing sector, Mining sector and Electricity Sector, which comprises the IIP.

Thus it can be seen from the tables above that weak IIP data leads to a fall in the stock prices.

Bottomline:

Index of Industrial Production (IIP), in essence, gives a measure of the performance of the industries. However, some sectors may outperform other sectors on account of a variety of reasons, such as growth prospects, position in the business cycle, government policy, international factors, etc.

For example, The passage of GST Bill is likely to have a positive impact on the consumer durables sector which is likely to perform better as compared to other.

But, as IIP does not reflect the reason behind the better/worse performance of a sector, therefore, it should not form the sole basis for investments in the stock markets.

It is essential to know the reason for the better/worse performance of a sector before investing.

Feel free to write back to us in the comment box below.