In an interesting session as a part of the highly popular Face2Face series, conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Manu Rishi Guptha, a successful stock market trader with many years of experience, to decode How Big People make Big Money in Stock Market?

Manu has a full-time Master’s in Business Administration from Warwick Business School, UK. He has a distinguished track record of close to 3 decades in Equity Investments. His last stint was with a Bangalore-based private equity fund, managing assets for close to 9 years, taking business from Rs 60 Crs to Rs 300 Crs. Manu has managed funds across Large Cap/ Mid Cap/ Small Cap with a stellar track record of performance across funds.

In this blog, our experts will be talking about investing as well as trading strategy.

Table of Contents

Investment Philosophy for Investing in the Stock Market

According to Mr Manu Rishi Guptha, if any company come on his radar that has the potential to grow around 14%, he tries to make a position in it after checking its fundamental parameters and listening to corporate announcements. Corporate Announcements help the investors to know about the image of the company.

He gives an example of Infosys Ltd., according to him if any investor had invested in it whenever it fell 2% then would have made a good return. He strongly believes in generating stable returns while minimizing the risk rather than extraordinary chase, unstable returns with high risk.

Everyone talks about following the rules of Warren Buffet but they ultimately invest in stocks with a 100 Price to Earnings ratio. But he says that one should never invest when the price of that stock is too high as one day the price will fall. According to Mr. Manu, we say and profess something else and do something else as we all want to grow money at a superfast rate.

According to Mr. Manu, one should never chase momentum, let the stock’s price fall and then invest in it. Investors should Invest in a stable stock rather than follow the herd. One should never invest in FOMO. Investors should higher allocation or around 40% allocation in their top 3 conviction stocks.

He gives another example of the Indian Banking Sector and says that everyone likes to invest in banking stocks. But the nature and working of the banks will never change according to the speaker.

According to Mr. Manu, one should keep investment limited to 30-40 stocks. It is not possible to do a fundamental analysis of all the stocks present in the Stock Market Indexes. So one should try to trade as well as invest in the 30-40 stocks that have been fundamentally analysed by the investor.

In this way, investors will be able to screen well the stocks and will be able to understand what reports will come, what bad news will come and so on.

Now let us discuss his trading strategy:

Trading with Options Strategies

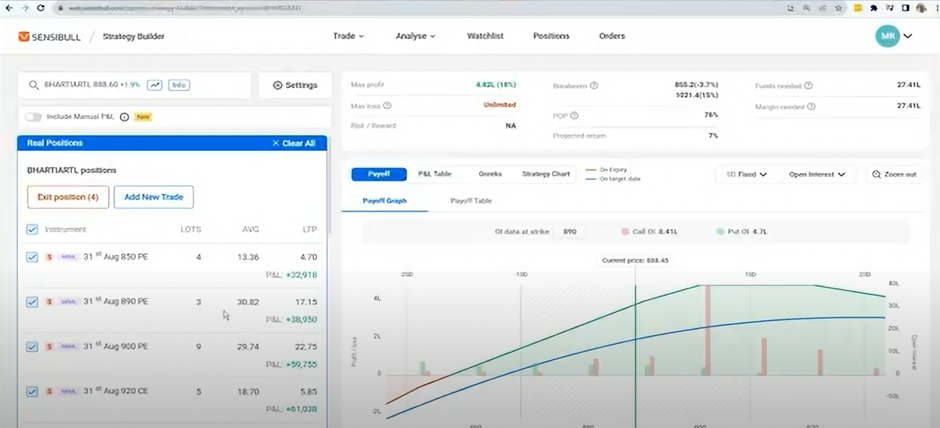

Mr. Manu uses a stringent rule-based approach to identify the stock and the option when selling deep out-of-the-money naked stock options. Less time is spent on entering and managing a position when using a rules-based approach. enables us to devote more time to stock research.

The basic idea is to preserve the obtained premium with Theta decay while collecting the most premium on volatile days (Short Gamma).

A greater emphasis on managing cash flows ensures that a loss position eventually becomes profitable. Hedging when necessary (when a deep OTM option becomes an ATM or ITM) by selling ITM options or using futures. Knowledge obtained from trading options on a particular stock counter makes rolling over holdings over several months more efficient.

According to him, one should choose OTM options that accumulated some Delta and Gamma on a day of strong underlying volatility and sell them. On a big-up day, far calls are sold, and on a big-down day, distant puts.

You can learn more about options stratgies through our course on Options Trading Made Easy

Options are traded 45 days in advance; options for the following month are traded after the 15th of the current month to earn considerable theta, and they are typically covered by the second week of the contract month.

Target yields of approximately 4% to 5% on the necessary margin amount and selling the option. Multiple option shorts on many underlying stocks provide a good level of risk diversification. One or two positions almost always fail, but the remaining ones more than make up for them and provide a minimum monthly return of 3–4%.

You can watch the full Face2Face Video here-

Bottomline

According to Mr. Manu, every stock has its life cycle so one should fundamentally research that stock well. The investors should know when to enter as well as exit that stock in time.