Futures and options are among the most widely used derivatives in the financial markets. With the rise of financial literacy in India, they have gained popularity as tools to optimise profits, manage risk, and enable strategic trading.

Knowing the differences between Futures vs Options can help you make informed and secure financial choices, helping to grow your wealth efficiently.

Let’s break down the intricacies of Futures vs Options, focusing on their unique features, helping you choose the one that best suits your financial goals.

What are Futures?

A futures contract, in simple words, is an agreement to purchase or sell an item at a fixed price on a given future date between the buyer and seller. Since these agreements are legally binding, both the buyer and the seller must fulfill their part of the contract when it expires.

The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) are two of the leading exchanges in India where futures trading takes place. Traders use futures to speculate and protect themselves from price swings, allowing them to profit from precise forecasts while avoiding losses.

There are several reasons behind the increasing popularity of futures trading. Here are some of them:

- Protecting Against Price Volatility: Futures are commonly used to lock in prices and mitigate the risk of unfavourable market fluctuations.

- Speculation: To profit from upward and downward trends, traders utilise futures to capitalise on price swings.

- Leverage: Futures allow you to trade large quantities for a little initial outlay of funds.

What are the Options?

Option contracts provide the buyer the right, without any obligation, to buy or sell any asset on or before the expiry date at a predetermined price (the striking price). Options are attractive to traders who wish to minimise their losses while retaining the possibility of significant gains because of their flexibility.

There are generally two types of options: put and call. A call option gives you the right to buy, while a put option gives you the right to sell the asset.

Now, let us look at the reasons why options are appealing to traders.

- Flexibility: Options, as opposed to futures, provide you the option and not the obligation to carry out the terms of the contract.

- Control on Risk: It is easier to control risk since buyers’ losses are limited to the price they pay while entering into an options contract.

- Versatility: Options can be employed for many purposes, including income generation, hedging, and pure speculation.

Example of Futures and Options

To understand them better, let’s compare Futures vs Options trading with a practical example.

Let us consider a company, “X”, whose stock is currently trading at ₹2,500 to explain how Futures vs Options generally work in the stock market.

Scenario-1: Futures Trading:

Let’s say you believe that company X’s stock price will increase within the next two months. With delivery in two months, you sign a futures contract to purchase 100 shares of firm X for ₹2,500 each.

- You profit ₹200 per share if the stock price increases to ₹2,700 in future, which comes to ₹20,000

- You will lose ₹200 for each share, or ₹20,000 overall if the stock price drops to ₹2,300

In a future trade, you have to commit to buying the stock at the price initially agreed, which in this case is ₹2,500 each, regardless of where the market shifts.

Scenario-2: Options Trading:

Rather than committing, you now pay a premium of ₹100 per share to purchase a call option on firm X’s shares with a strike price of ₹2,500, which expires in 2 months.

- You can use your option to purchase at ₹2,500 and profit by ₹200 per share if the stock price increases to ₹2,700. Your net profit is ₹100 per share, or ₹10,000, after deducting the premium of ₹100 per share.

- You decide not to execute the call option if the stock price drops below ₹2,500. The most amount you may lose is the ₹100 premium per share, or ₹10,000 overall.

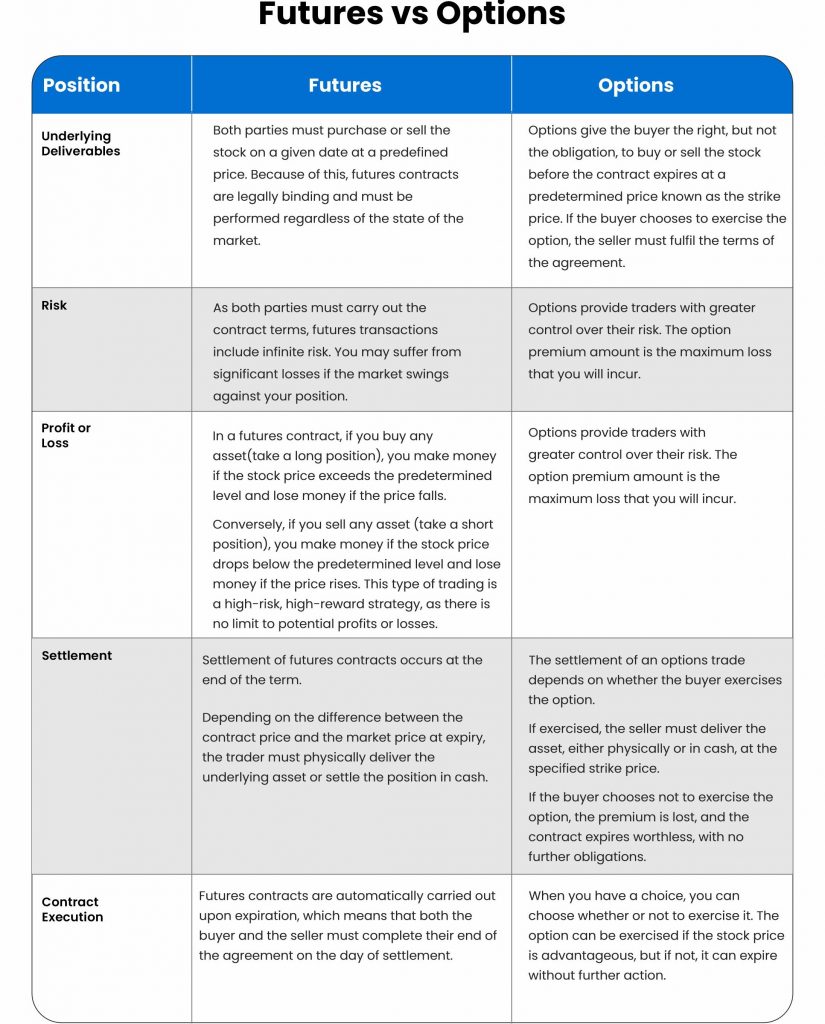

Futures vs Options: Key Differences

Although they are both financial agreements based on underlying assets, Futures vs Options are not the same. Let’s look at the key difference between futures and options.

Takeaway

Making informed decisions in the trading world requires understanding the key differences between futures vs options.

Even though futures include a greater burden and risk, they have the potential to yield substantial profits when market fluctuations are huge. However, options offer flexibility, lower risks, and an earning potential for traders who can predict changes in stock prices. A well-rounded trading portfolio should include futures and options, depending on your trading style, financial objectives, and risk tolerance.

If you are thinking of growing your trading skills, ElearnMarkets is here to help you. We provide the skills you need to succeed with our expert-led courses, practical learning, and up-to-date industry insights. ElearnMarkets offers all the tools you need for futures or options trading, regardless of your experience level. To achieve your maximum trading potential, get started now!

Frequently Asked Questions

- Who should invest in futures and options?

Futures vs. options trading is ideal for those who understand market dynamics and risk management. These tools are well-suited for individuals looking to speculate on price changes or hedge against risks with a relatively small commitment.

- What is safer, futures or options?

If we compare Futures vs Options, Options are generally safer due to their limited risk for buyers. While potentially more profitable, futures expose traders to unlimited risk based on market volatility.

- Are futures and options trading profitable?

Futures vs Options trading can be profitable, but it depends on your strategy and risk management. Futures offer high rewards with greater risk, while options limit risk with more flexible opportunities.