The Futures market forms an important part of the Derivatives world.

This underlying asset can be a stock, commodity, or currency, etc.

Derivatives are financial contracts whose value is derived from other financial entity also referred to as Underlying Asset.

It is a form of derivative.

Traders still use the forward contracts but are now limited to a few participants like the industries and banks.

In this blog we will discuss the details of the forward contract, how it differentiates from the futures contract and the risk involved while trading in it.

What is a Forward Contract?

It is a contract agreement for buying or selling an underlying asset at a particular price on a specified date in the future.

In this, a buyer takes a long position whereas the seller takes a short position.

The parties involved can use this contract for managing the volatility through locking in pricing for the underlying assets.

These contracts are traded over the counter and they are not regulated by exchanges.

In simple words, it is mainly used for hedging against market uncertainty.

Example of a Forward Contract

Now, let us take an example to furthermore explain this:

Suppose you are a farmer and you want to sell wheat at the current rate of Rs.18, but you know that wheat prices will fall in the coming months ahead.

In this case, you enter a contract with a grocery for selling them a particular amount of wheat at Rs.18 in three months.

Now, if the price of wheat falls to Rs.16, then you are protected. But if the price of wheat rises, then you will get the price as mentioned in the contract.

How does it work?

If the forward contract reaches its expiration date and the spot price have increased, then the seller has to pay the buyer the difference between the forward price and the spot price.

Whereas, if the spot price has reduced more than the forward price, then the buyer has to pay the difference to the seller.

Learn basics of financial markets with Financial Market Expert course

When the contract ends, it is settled on certain terms, and every contract is settled on different terms.

There are two ways for a settlement: delivery or cash basis settlement.

If the contract is settled on a delivery basis, then the seller has to transfer the underlying asset to the buyer.

When a contract is settled on a cash basis, then the buyer has to make the payment on the settlement date and no underling assets are exchanged.

This amount is the difference between the current spot price and the forward price.

Basic terms used in Forward Contracts:

Here are a few terms, that a trader should be knowing before trading in forwards:

- Underlying Asset: This is the underlying asset that is mentioned in the contract. This underlying asset can be commodity, currency, stock, and so on.

- Quantity: This mainly refers to the size of the contract, in units of the asset that is being bought and sold.

- Price: This is the price that will be paid on the expiration date must also be specified.

- Expiration Date: This is the date when the agreement is settled and the asset is delivered and paid.

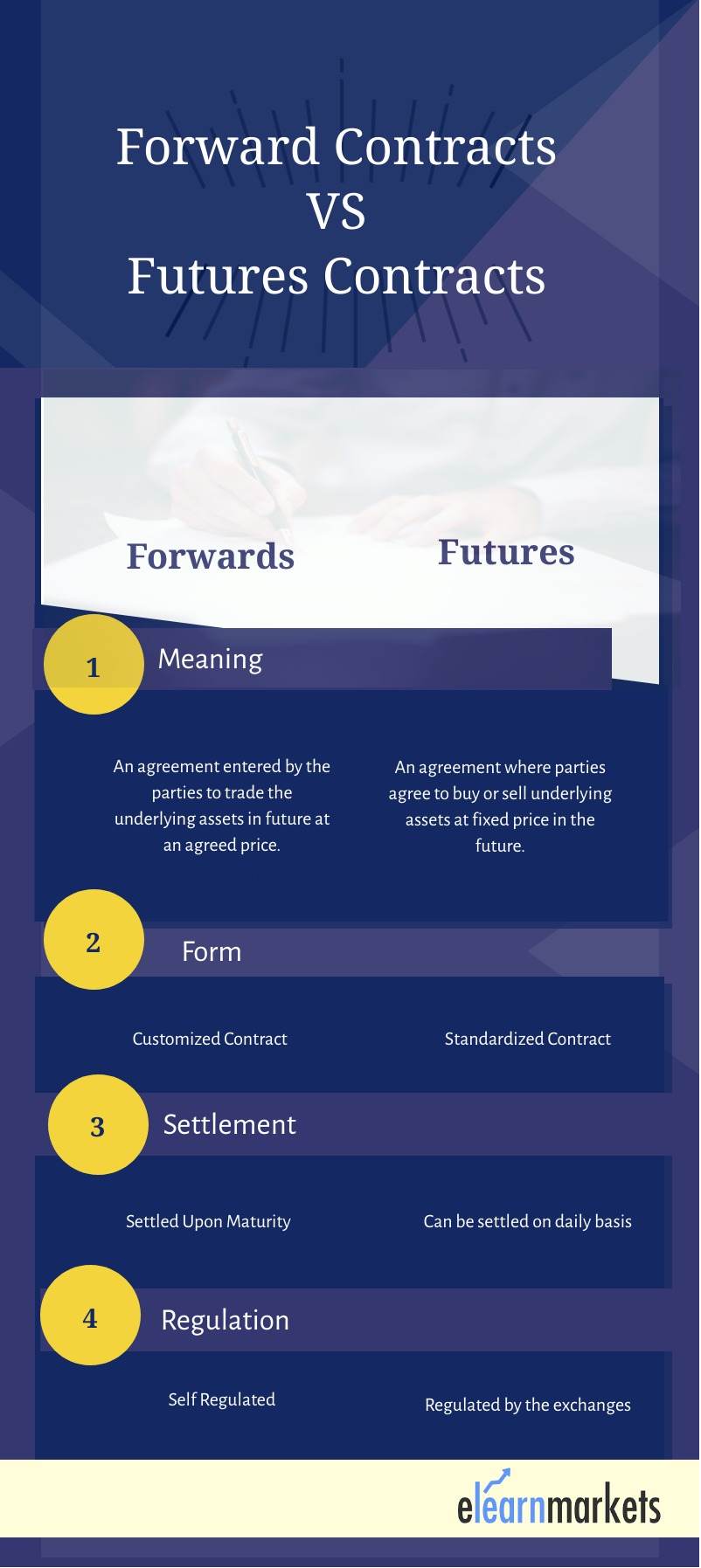

Forward Contract Vs Futures Contract:

Both forward & futures contracts are related to each other, but there are some differences between these two.

Below are the main differences:

Firstly, the futures contracts are standardized for enabling trading on a futures exchange, whereas forward one are private agreements and they are not traded on the exchanges.

Secondly, in futures contracts, the exchange clearinghouse acts as the counterparty to both sides whereas in the forward contracts, as there is no exchange involved, they are exposed to credit risk.

Finally, because futures contracts are squared off before maturity, delivery never takes place whereas the forward one is mainly used by hedgers to protect themselves against price volatility in market, so cash settlement usually takes place.

Risks involved in Forward Contract:

Following are the risks involved while trading in the Forwards:

1. Regulatory Risks:

As we have discussed above, the Forwards contract there is no regulatory authority that governs the agreement.

It is executed by the mutual consent of both the parties involved in this contract.

As there is no regulatory authority, it increases the risk ability of either of the parties defaulting.

2. Liquidity Risks:

As there is low liquidity in the forward contract, it may impact the decision of trading or not.

Even if a trader has a strong trading view, he may not be able to execute the strategy because of liquidity.

3. Default Risks:

The financial institution that drafted the forward contract is exposed to a high level of risk in the event of default or non-settlement by the client.

Forward contracts mainly serve a purpose for buyers and sellers to manage the volatility that is associated with commodities and other financial investments.

They are riskier for both parties involved as they are over-the-counter investments.

Traders who want to look beyond stocks and bonds for building a portfolio diversification can trade-in forward contracts.

Key Takeaways:

- A forward contract is an agreement for buying or selling an underlying asset at a particular price on a specified date in the future.

- There are two ways for settlement that is delivery or cash basis.

- There are differences between Forward and futures contracts.

- Trading in these contracts involves certain risks

- The main purpose of forward contracts mainly is to help the buyers and sellers to manage the volatility that is associated with commodities and other financial investments.

Happy Learning!